VPBank Reveals Major Shareholders with Over 1% Stake

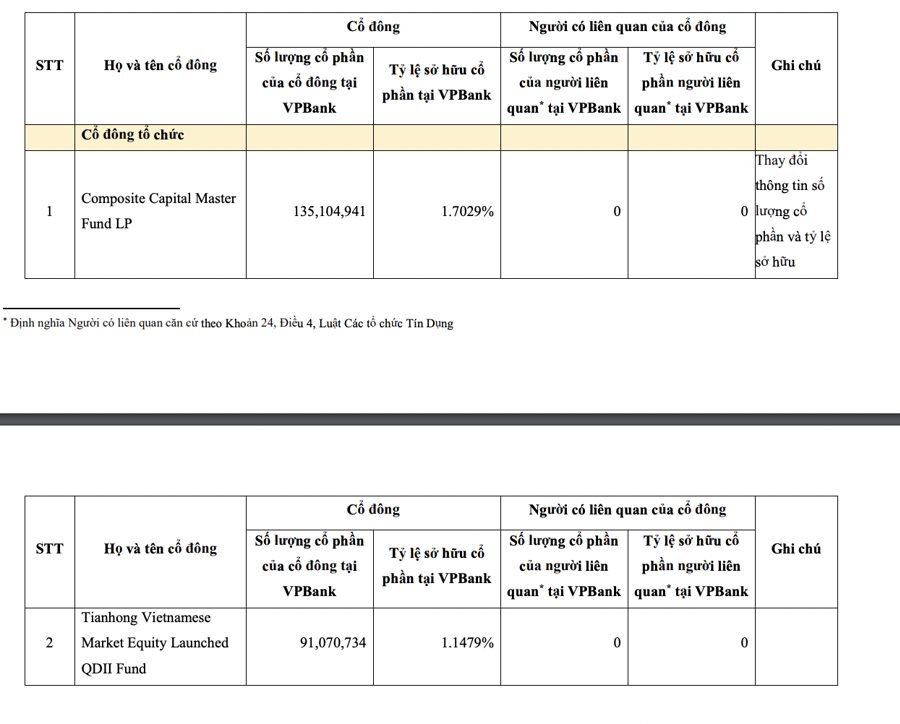

VPB, or Vietnam Prosperity Joint-Stock Commercial Bank, has disclosed information about its shareholders who own over 1% of its charter capital.

This announcement introduces a new shareholder, Tianhong Vietnamese Market Equity Launched QDII Fund, a China-based open-ended fund that invests in the Vietnamese stock market, particularly tracking the VN30 index. The fund currently holds over 91 million VPB shares, representing 1.14% of the bank’s capital.

Meanwhile, Composite Capital Master Fund LP, based in the Cayman Islands, has significantly reduced its ownership in VPBank from 2.7% to 1.7% of the bank’s capital, holding over 135 million VPB shares.

Previously, in late July, VPBank published a list of shareholders owning over 1% of its charter capital. As of July 19, 2024, VPBank had 13 individual and 4 institutional shareholders owning nearly 5.1 billion VPB shares, representing over 64% of its charter capital.

The bank’s Chairman, Ngo Chi Dung, holds 328.5 million shares, or 4.14%, while related parties hold 2.34 billion shares, taking their total ownership to 29.5%. Dung’s related group now holds 33.64% of the bank’s capital.

VPBank’s CEO, Nguyen Duc Vinh, owns over 104.9 million shares, or 1.3%, while related parties hold 1.56%, bringing their total ownership to 2.88%.

Related parties to Vice Chairman Lo Bang Giang include his mother, Ly Thi Thu Ha, who holds nearly 3.6%, or 282.1 million shares, and his wife, Nguyen Thu Thuy, who owns nearly 2.6%, or 203.34 million shares.

Vice Chairman Bui Hai Quan holds 156.3 million shares, or 1.97%, while his wife, Kim Ngoc Cam Ly, owns 286.6 million shares, representing 3.61%. Their related group holds a total of 5.59% of the bank’s capital.

Other individual shareholders include Tran Ngoc Trung, Tran Ngoc Lan, Le Viet Anh, Le Minh Anh, and Nguyen Manh Cuong, holding 3.85%, 3.9%, 3.53%, 2.71%, and 1.45% of the bank’s capital, respectively.

The four institutional shareholders of VPBank are: Sumitomo Mitsui Banking Corporation (SMBC), the bank’s strategic partner, holding 15%; CTCP DIERA, with 4.39%; and two investment funds, Composite Capital Master Fund and Vietnam Enterprise Investments.

In terms of financial performance, VPBank recorded a post-tax profit of VND 3,633 billion in Q2 2024, a 48% increase year-on-year. For the first half of 2024, the bank reported a pre-tax profit of VND 8,665 billion and a post-tax profit of VND 6,775 billion, a 65% surge compared to the same period in 2023.

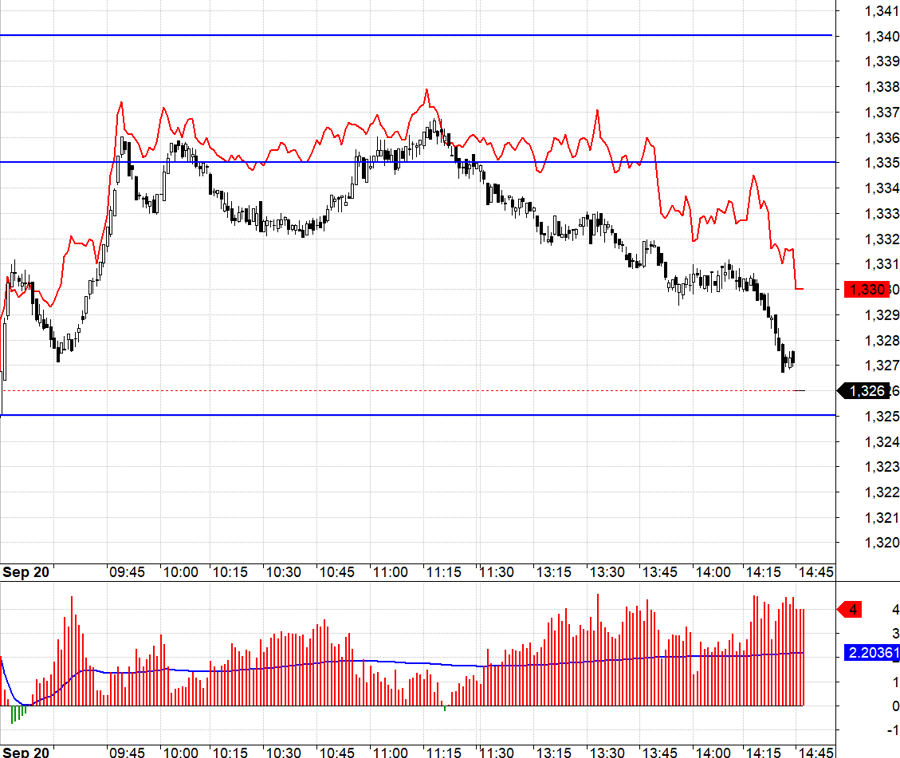

VPB is a bank stock with high potential, as indicated by Mirae Asset’s recommendation, which forecasts a significant price increase of up to 26%. In the first half of 2024, VPB’s credit growth reached nearly 7% year-on-year, totaling VND 647.7 trillion. While there was a quarterly decline, the overall asset quality showed improvement. The non-performing loan ratio increased to 5.08%, a rise of 24 basis points from Q1 but a decrease of 144 basis points year-on-year. The loan loss coverage ratio stood at 48.1%, a reduction of 5.4% from Q1 but an improvement of 5.1% year-on-year.

The expanded non-performing loan ratio witnessed a decrease of 23 basis points from Q1 and 181 basis points year-on-year, settling at 12.9%. A positive aspect of VPB’s Q2 performance was the substantial drop in the sub-standard bond ratio to 17.8% from 27.4% in Q1/2024, reflecting a decline in value of 53.8%.

Although VPB’s profit growth slowed in Q2/2024, its increase surpassed that of most comparable banks in the first half of the year. During this period, consolidated operating income exceeded VND 29,000 billion, a rise of 17.5%, while pre-tax profit climbed by nearly 68% to over VND 8,600 billion. This success is attributed to enhanced operational efficiency across the ecosystem, notably the reduction in losses incurred by subsidiaries (from VND 3,725.7 billion in 6T2023 to VND 707.6 billion in 6T2024)

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.

Novaland reports over VND 1,600 billion in profit for Q4/2023, bond debt reduced by VND 6,000 billion in one year.

In 2023, Novaland achieved a profit of over 800 billion VND, in contrast to the first half of the year when the company incurred a loss of over 1,000 billion VND.