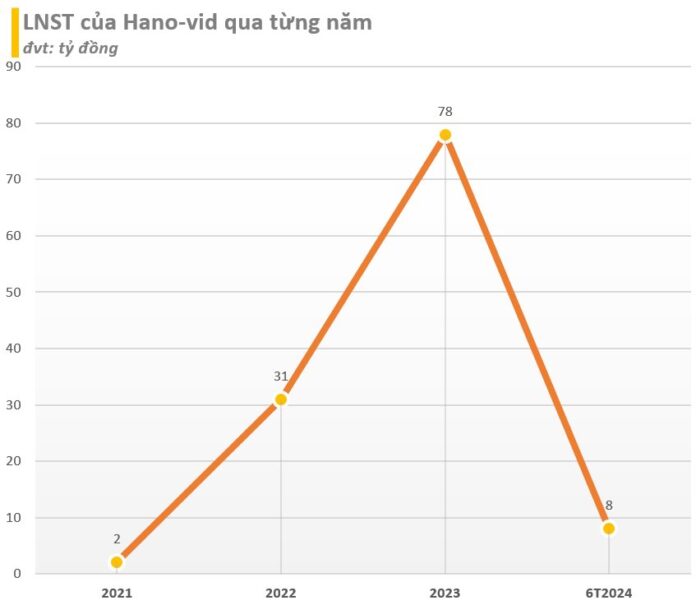

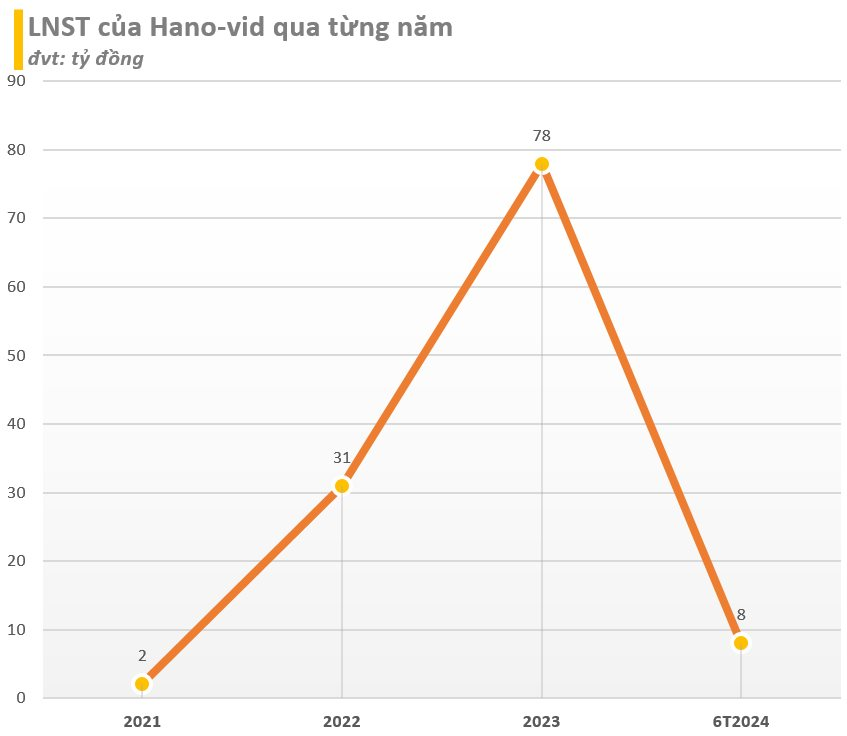

Hanoi-vid Real Estate JSC has released its financial report for the first half of 2024, revealing a 7.8 billion VND post-tax profit, an 80.7% decrease compared to the same period last year. The return on equity (ROE) ratio also witnessed a decline from 0.77% to 0.15%.

As of June 30, 2024, Hanoi-vid’s equity stood at 5,291.6 billion VND. The debt-to-equity ratio was 6.77, indicating payables of over 35,800 billion VND (approximately 1.4 billion USD). The bond debt-to-equity ratio was 1.81, translating to nearly 9,600 billion VND in bond debt. Consequently, the company’s total assets amounted to over 41,000 billion VND.

Notably, the company’s report on bond principal and interest payments for the first half of 2024 revealed that Hanoi-vid is servicing interest on 182 issued bond lots, with a total value of over 9,650 billion VND.

In 2022, Hanoi-vid grabbed attention by issuing two bond lots worth a total of 1,000 billion VND in March 2022. This coincided with a surge in the bond market following the cancellation of nine bond lots issued by Tan Hoang Minh.

From July to November 2020, Hanoi-vid Real Estate also raised a significant amount of bonds through 180 lots, each valued at approximately 50 billion VND, totaling 8,700 billion VND in just a few months.

These bonds had maturities ranging from 5 to 7 years, with the majority lacking collateral, and the Vietnam Maritime Commercial Joint Stock Bank (MSB) serving as the depository institution.

Hanoi-vid Real Estate JSC, established in 2010, primarily operates in the real estate sector. The company has a diverse portfolio of projects across Vietnam, including in Hanoi, Quang Ninh, Thai Binh, Long An, Phu Yen, and Binh Dinh.

Hanoi-vid’s inaugural project was the successful TNR GoldSilk Complex in Ha Dong, Hanoi.

TNR GoldSilk Complex.

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.