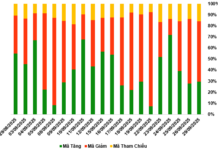

The VN-Index, Vietnam’s benchmark stock index, surged past the MA20 threshold, fueled by a rapid increase in market momentum. This upward trajectory propelled the index towards the historic peak of 1,300 points. However, the market’s cautious sentiment led to a slight slowdown during the last two trading sessions of the week. Overall, the VN-Index concluded the trading week of August 19-23 with a notable gain of +33.09 points (+2.64%), settling at 1,285.32 points.

Looking ahead to the new trading week, experts offer a relatively cautious outlook on the VN-Index’s trajectory leading up to the upcoming holiday break. While a short-term corrective phase is anticipated, there remains a possibility for the market to surpass the 1,300-point milestone post-holiday.

Fed Interest Rate Cut Expectations May Already Be Priced In

Mr. Dinh Quang Hinh, Head of Macroeconomics and Strategy, VNDIRECT, assesses that the market maintained its impressive upward trend last week, with the VN-Index successively breaching the 1,260-point and 1,270-point marks and approaching the strong resistance zone of 1,290-1,300 points. The market exhibited signs of deceleration during the last two sessions ahead of this formidable resistance level, while also awaiting updates from Fed Chair Jerome Powell on monetary policy in the upcoming period, as conveyed at the annual Jacksonville conference held over the weekend.

Although it is almost certain that the Fed will execute an interest rate cut in the September meeting (which has already been priced into the market), the primary focus now is on the magnitude and pace of the Fed’s rate cuts for the remainder of the year. Currently, the market anticipates the Fed to slash approximately 0.75-1 percentage points from the current interest rate by the year’s end. Nonetheless, should the Fed opt for a more cautious approach, it could lead to adjustments in investor expectations and market dynamics.

Given this context, domestic investors are advised to exercise caution as the positive news has been largely reflected in the market’s impressive ascent, and the VN-Index is confronting a formidable resistance zone at 1,290-1,300 points. Investors are recommended to refrain from new investments in stocks that have already witnessed substantial recovery in this region, maintain a moderate portfolio, and avoid excessive leverage to effectively manage risks.

Should the market undergo a corrective phase and retreat to the support zone of 1,255-1,260 points, it will present an opportunity to accumulate more stocks, prioritizing sectors with improved prospects in the latter half of 2024. These sectors include banking, exports (such as textiles, seafood, and wood products), and select real estate businesses that have been deeply discounted recently.

VN-Index May Experience Volatility Before Surpassing 1,300 Points

Mr. Bui Van Huy, Branch Director, DSC Securities, provides a positive outlook on the global context, citing the Fed’s clearer stance on monetary policy following the Jackson Hole symposium. The likelihood of an interest rate reduction at the September meeting (September 18) is high, and the primary focus now is on the number of rate cuts. It is worth recalling that during the pandemic, post-Jackson Hole in 2020, global stock markets experienced a robust upward trend.

With these developments, the overall market conditions are relatively favorable, as evidenced by the strong performance of US stocks, with the Dow Jones approaching its previous peak. Meanwhile, the US Dollar Index (DXY) has dropped to the 100 level, which should ease pressure on the USD/VND exchange rate in the near future.

Assessing the domestic context, Mr. Huy notes that investor sentiment is upbeat, as the market has climbed nearly 100 points without any significant corrective phases. This rapid ascent may induce a sense of discomfort for those who have recently cut losses or missed out on the rally. While it is natural to experience volatility after such a strong surge, it is evident that the VN-Index is robust and faces multiple favorable factors in its attempt to breach the 1,300-point threshold.

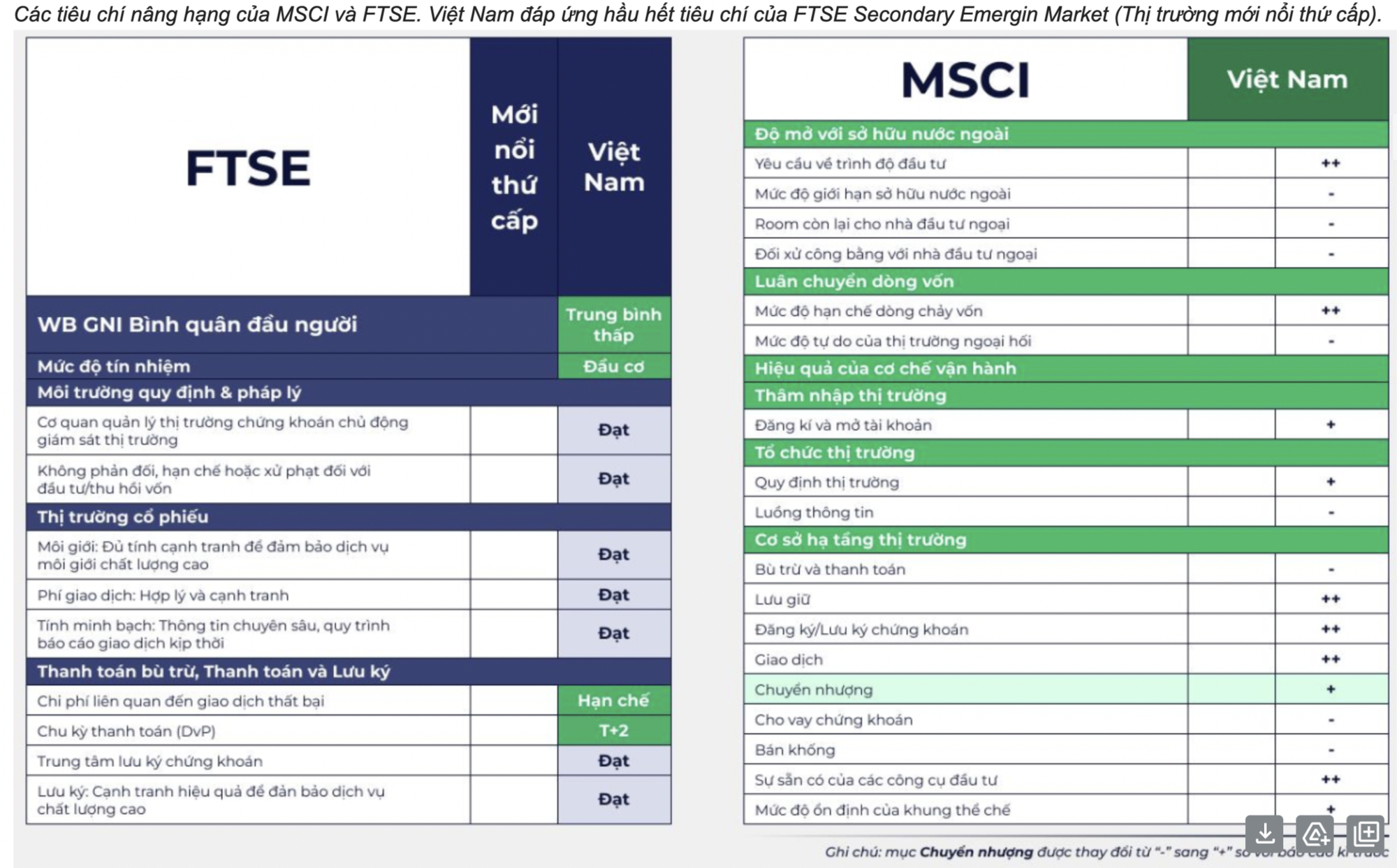

Additionally, there is anticipation surrounding the FTSE’s upcoming announcement regarding country classification at the end of September. The market expects positive evaluations from FTSE regarding Vietnam’s progress in the upgrade process, given the concerted efforts of regulatory authorities.

However, the upcoming four-day holiday for September 2 may influence investor sentiment and result in lower liquidity. Investors may opt to take profits ahead of this extended break, but there is no cause for significant concern.

“Although the market may experience volatility ahead of the holiday, if global conditions remain stable, surpassing the 1,300-point mark is achievable, with short-term support expected around 1,260 points,” asserts the DSC expert.

The VN-Index’s approach to the 1,300-point threshold this time is bolstered by several favorable factors: (1) a relatively positive domestic and international backdrop, (2) reduced foreign net selling, (3) significant upside potential in major stock groups, and (4) generally low margin levels among individual investors.

Regarding investment strategies, the expert suggests that investors should make decisions based on their individual positions, either opting for profit-taking or investing during this period. Many cash-rich investors are seeking opportunities to invest, as the market has not undergone a significant correction. Therefore, maintaining a stock allocation of 60-70% is prudent ahead of the extended holiday and the market’s proximity to the 1,300-point resistance level. This approach ensures investors’ flexibility regardless of market fluctuations.

Currently, investment funds are primarily focused on key sectors that benefit from the economic recovery. Notable sectors include retail, consumer goods, and technology, although attention should be given to their valuations.

State-owned banks are attracting significant interest, and room for foreign ownership in the banking sector may be addressed in the context of upgrade solutions. However, it is crucial to remain vigilant about asset quality, as non-performing loans tend to be high.

The securities sector is in the spotlight due to pre-funding discussions and upgrade efforts. Real estate is also expected to witness positive developments, driven by new policies and a strong rebound following deep corrections. However, it is essential to be selective and focus on companies with substantial improvements in financial performance and stable financial conditions.

Capitalize on Corrective Phases for Medium and Long-Term Investment Goals

Mr. Tran Truong Manh Hieu, Head of Analysis, KIS Securities, states that after the breakthrough session on August 16, 2024, the VN-Index confirmed its upward trajectory, accompanied by a surge in trading volume. The subsequent strong gains prompted many investors to consider profit-taking to safeguard their profits. Additionally, the market lacked positive catalysts to sustain the momentum, leading to cautious trading during the last two sessions of the week.

However, as selling pressure subsides, the market will resume its growth trajectory. While the index may struggle to breach the 1,300-point level in the short term due to cautious sentiment ahead of the holiday, a lack of supportive news, and profit-taking tendencies after a robust market rally, this corrective phase is merely a temporary pause within a broader upward trend.

The medium-term upward trend of the market is evident, underpinned by the robust economic recovery. Consequently, the market is likely to undergo a consolidation phase before resuming its ascent to conquer the 1,300-point milestone.

Regarding investment strategies, long-term investors can capitalize on the current corrective phase to accumulate stocks for medium and long-term positions. Conversely, short-term investors should await bottom-formation signals before re-entering the market.

Several stock groups warrant attention in this phase, including industrial real estate, which stands to benefit from the surge in FDI inflows. Additionally, the land law, which will take effect in 2024, provides a legal framework for companies in this sector to initiate new projects.

In the construction materials sector, experts from KIS foresee benefits stemming from the gradual recovery of the real estate market. Moreover, increased public investment will generate potential demand, positively impacting the revenue and profitability of companies in this sector in the future.