On August 20, as the VND to USD exchange rate at many commercial banks continued its downward trend that had persisted for over a month, concerns about exchange rate pressure seemed to have faded from the minds of stock market participants. The VN-Index rose nearly 11 points on the same day, climbing back to the high of 1,270 for the year, after a period of volatility.

The latest US economic data indirectly freed Vietnamese stocks from the persistent worry about exchange rates over the past two years. As the Fed is now in a position to cut interest rates—thanks to easing inflation and a cooling economy—the world may welcome a weaker USD.

|

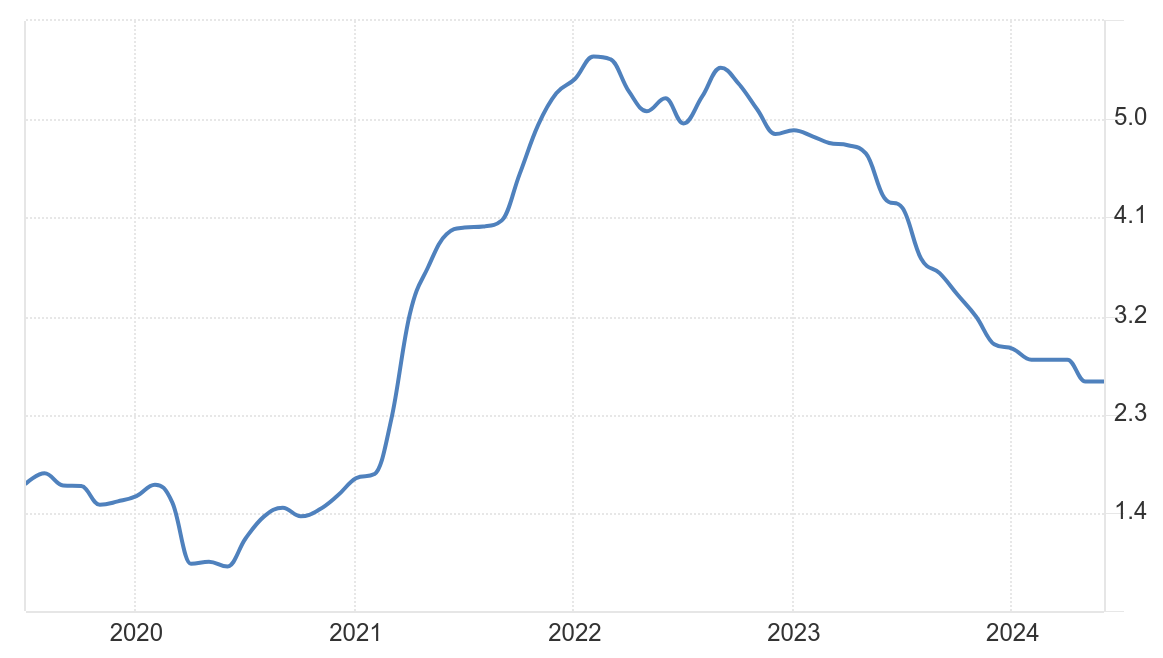

Cooling Prices

US PCE Price Index, year-over-year change (In %)

Latest data as of June 2024. Source: tradingeconomics.com, US Bureau of Economic Analysis

|

Bucking the Headwind

Looking back, after more than half a decade of stability, the USD/VND exchange rate became tense starting in 2022 when the US Federal Reserve (Fed) initiated a strong cycle of interest rate hikes to curb post-pandemic inflation.

As the interest rate gap between the US and other economies widened, and the US economy remained solid while the global economy faltered, the USD became a safe haven for global investors. The US stock market—assets denominated in USD—also became more attractive as the AI boom took off in early 2023.

Amid the strengthening USD, Vietnam was one of the few developing countries that maintained and lowered interest rates, which meant going against the Fed’s direction and that of most central banks worldwide. These opposing monetary policies created pressure on the exchange rate as the VND, with its low-interest rates, became weak compared to a high-yielding USD.

|

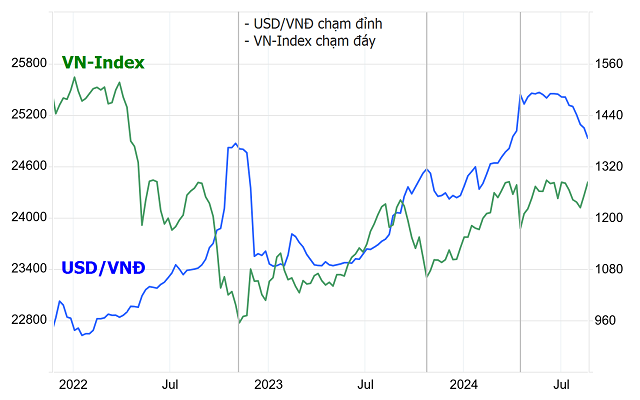

USD/VND Exchange Rate

VND has been depreciating rapidly against USD since 2022 amid the strengthening USD globally

Data as of August 21, 2024. Source: tradingeconomics.com

|

In 2022, the State Bank of Vietnam (SBV) sold $23 billion in foreign exchange reserves to support the exchange rate and even had to abruptly raise operating interest rates in September and October of that year, adding fuel to the fire amid the corporate bond crisis and the scandal involving Van Thinh Phat and SCB Bank.

More recently, in the last two months of the second quarter of 2024, when the USD/VND exchange rate came under significant pressure and consistently approached the 24,450 level, the SBV was again forced to act as an important source of supply for the market, selling about $6 billion in reserves. Open market operations (OMOs)—including the issuance of bills and collateralized securities—were also deployed by the SBV to maintain appropriate liquidity in the interbank market and raise interest rates in this market to narrow the interest rate gap between USD and VND.

During these periods of heightened tension, there was always a risk that the SBV would have to raise operating interest rates to relieve exchange rate pressure. Or, in the event that the SBV did not proactively raise interest rates, the only hope was for the Fed to cut rates soon, leading to a weaker USD, something that few could predict the timing of.

However, the optimistic scenario unfolded. In the past month, from mid-July 2024 to the present, the USD/VND exchange rate has declined amid a weakening USD globally, thanks to US economic data beginning to support the case for a Fed rate cut this year. According to the forecast tool of financial services firm CME Group, the Fed’s first rate cut will likely be at the September 18 meeting.

|

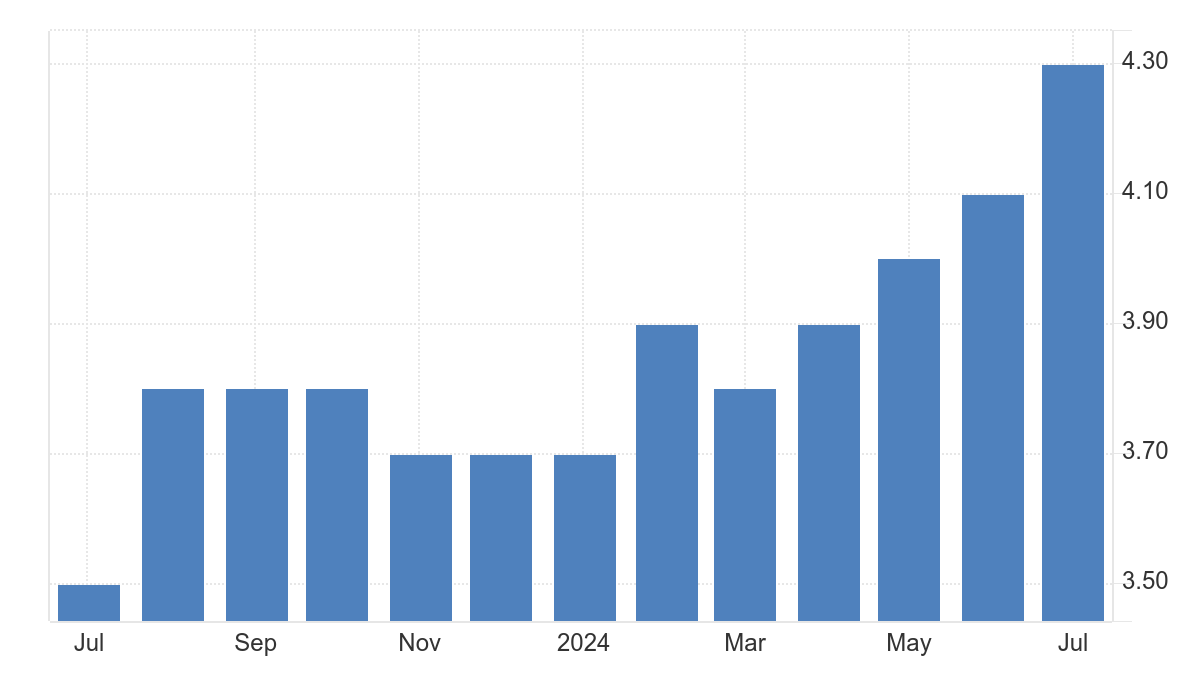

Rising Unemployment

US unemployment rate has been increasing rapidly since the start of 2024 (In %)

Latest data as of July 2024. Source: tradingeconomics.com, US Bureau of Labor Statistics

|

|

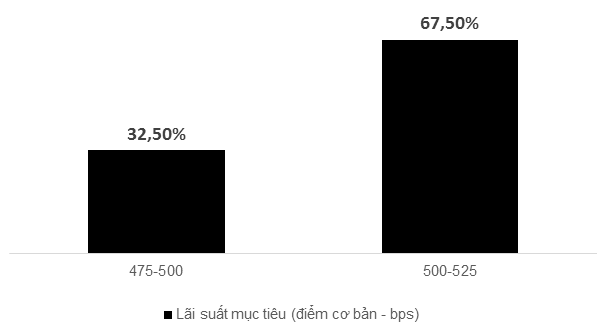

Rate Cut Likely?

– Markets predict a 100% chance of a Fed rate cut at the September 18 meeting – Federal funds rate is at its highest in 23 years: 525-550 bps

The federal funds rate is the target interest rate set by the Fed at which commercial banks lend their excess reserves to each other overnight. Data as of August 21, 2024. Source: CME Group

|

Shifting from overwhelming concerns about persistent high inflation, the US financial markets are now approaching a balance between the risks of inflation and a potential recession.

During his testimony before the Senate Banking Committee on July 9, Fed Governor Jerome Powell stated that the risks of allowing inflation to remain too high and letting the labor market slow down too much “are now roughly balanced.” This implies that a rate cut is only a matter of time, but Powell remains cautious and has not specified a timeline.

In financial markets, participants often anticipate events and make decisions accordingly. Therefore, asset price movements can occur rapidly when they perceive a change in the Fed’s stance.

A Sigh of Relief

A critical macroeconomic variable seems to have been resolved. And a context of reduced uncertainty is good for both the economy and stocks.

The exchange rate is certainly not the only factor influencing the movement of the stock market. But in some periods of high exchange rate volatility—such as in the third and fourth quarters of 2022, the third quarter of 2023, and the second quarter of 2024—its impact has overshadowed the market’s sentiment.

It’s worth noting that the corporate bond crisis and the scandals involving Tan Hoang Minh, Trinh Van Quyet, and Van Thinh Phat dominated the headlines in 2022. Meanwhile, the biggest concern for Vietnamese stocks during the sharp fluctuations in 2023 and 2024 was macroeconomic instability due to exchange rate tension.

|

Haunted by Exchange Rates

In the last two years, notable lows in stocks have often coincided with peaks in the exchange rate after tense periods

Data as of August 21, 2024. Source: Tradingeconomics, VietstockFinance

|

“The exchange rate is an important macroeconomic indicator that affects the purchasing power of the Vietnamese dong, as well as other economic policies,” said Dao Minh Tu, Deputy Governor of the State Bank of Vietnam, at a government press conference on April 3, when the exchange rate was under significant pressure.

The monetary policy of the SBV is directed towards multiple goals, including exchange rate stability, inflation control, financial system safety, money market stability, and promoting economic growth through lower interest rates.

The interconnection between these macroeconomic balances is why sharp fluctuations in the USD/VND exchange rate naturally become a dominant factor influencing the stock market’s sentiment. A highly tense exchange rate situation can lead to inflation exceeding manageable levels, prompting the SBV to raise interest rates as a stabilizing solution.

Higher interest rates could hinder the economy’s recovery and unsettle the stock market. Moreover, the appeal of the stock channel in a low-interest-rate environment would also take a significant hit.

Fed Chair: “It’s Time to Adjust Monetary Policy”

Global Turning Point: Major Central Banks Move Towards Cutting Interest Rates