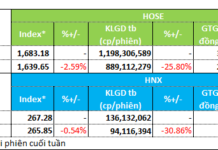

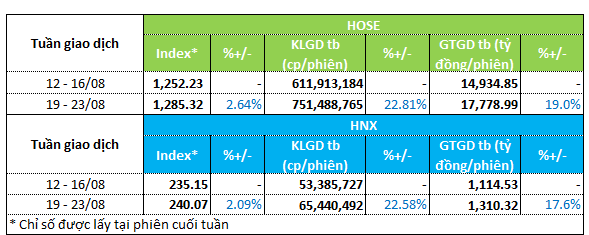

Week of August 19-23 saw a promising rise in the stock market, with both scores and liquidity higher than the previous week. The VN-Index rose 2.6% to 1,285.3, while the HNX-Index increased by 2% to 240.

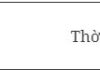

Trading volume and value rose on both exchanges. On the HOSE exchange, trading volume rose 23% to 751.5 million units per session, while trading value increased by nearly 20% to VND 17.8 trillion per session.

Meanwhile, the HNX exchange recorded a 22.5% increase in volume, reaching 65.4 million units per session, with a 17% rise in trading value to VND 1.3 trillion per session.

|

Market Liquidity Overview for Week of August 19-23

|

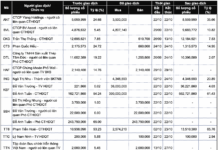

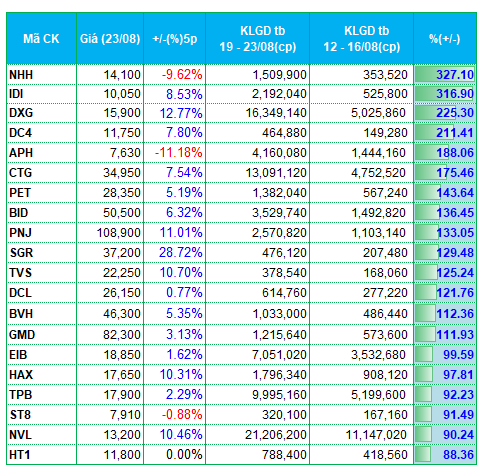

Real estate stocks showed strong attraction for investors this week. A series of codes entered the top gainers in liquidity on both listed exchanges. DXG saw its average volume increase by more than 225% over the previous week, reaching over 16.3 million units per session. The stock rose nearly 13% to VND 15,900 per share.

Many other real estate codes such as SGR, NVL, IDJ, API, CEO, AAV, NDN, and IDC also made it into the group of strong money attractors. On the downside, not many real estate stocks saw significant outflows.

The energy sector also performed well last week, with PVB, PVC, and PVS all among the top gainers in liquidity on the HNX exchange.

The financial sector also had a good week in terms of liquidity. Bank codes (CTG, BID, EIB, TPB), securities (TVS, APS, HBS, VFS), and insurance (BVH) all saw healthy inflows.

Despite the overall improvement in liquidity, some sectors weakened in terms of money flow. In the construction sector, codes such as DLG, KPF, HBC, S99, CMS, and C69 saw declines in liquidity compared to the previous week.

In the transportation sector, SKG, PVP, and VOS saw trading volumes drop by 30-40%. The textile sector also saw reduced liquidity in some of its representatives, including ADS and TNG.

|

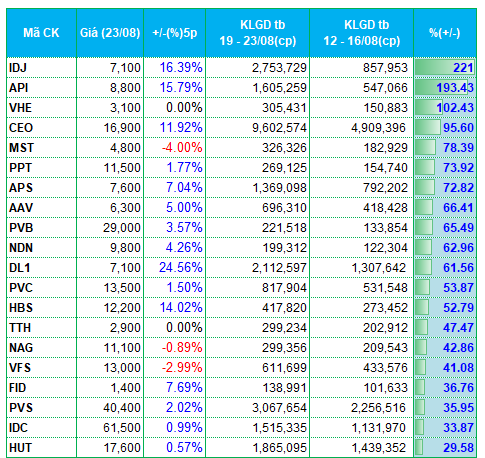

Top 20 Codes with Highest Liquidity Increase/Decrease on the HOSE Exchange

|

|

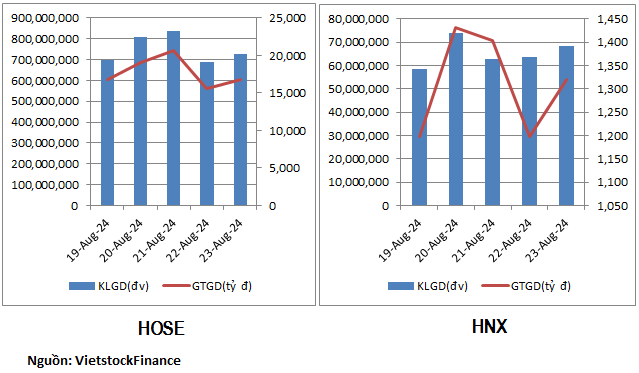

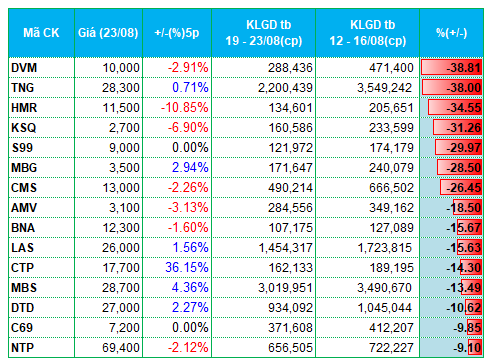

Codes with the Highest Liquidity Increase/Decrease on the HNX Exchange

|

The list of codes with the highest increases and decreases in liquidity is based on a minimum average trading volume of 100,000 units per session.