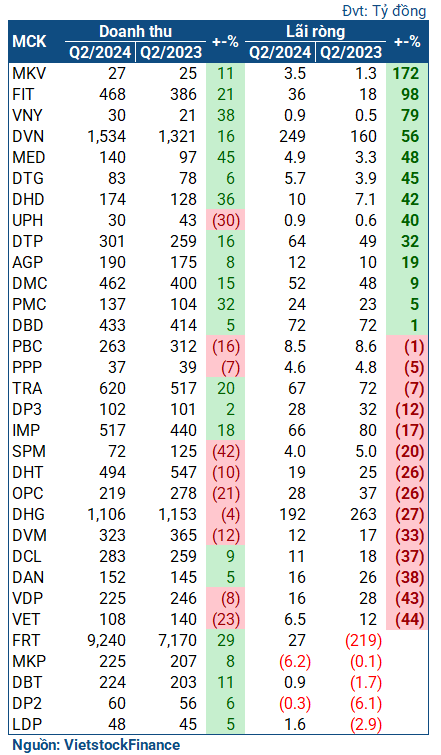

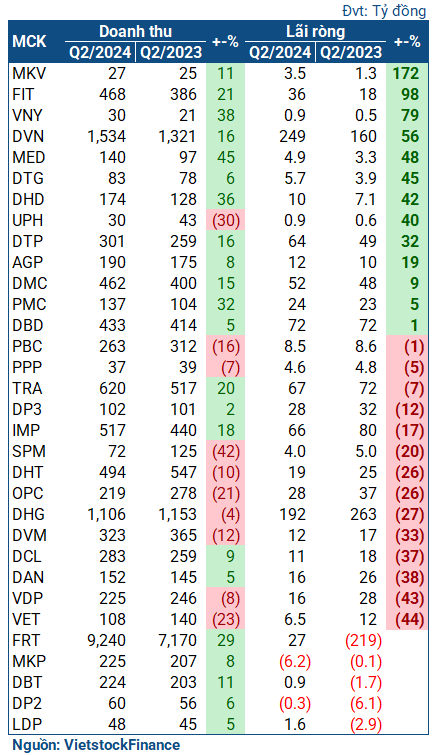

According to statistics from VietstockFinance, out of 32 pharmaceutical companies that announced their Q2 2024 results, 16 companies reported profit growth (including 3 that turned losses into profits), 14 companies experienced profit declines, and 2 companies suffered losses.

Struggling to live up to the previous year’s success?

2023 was a favorable year for pharmaceutical businesses, with supportive policies and market conditions contributing to significant growth and even record-breaking profits for many companies. However, this success has inadvertently cast a large shadow, causing challenges for several companies in the current year.

|

Q2 2024 Financial Results of Pharmaceutical Companies

|

For instance, Duoc Hau Giang (HOSE: DHG) reported a net profit of 192 billion VND in Q2 2024, a 27% decrease compared to the same period last year, which was the second-highest quarterly profit in its history. In their explanation, DHG attributed the decline to a significant reduction in consumer spending as people tightened their budgets, along with a drop in financial revenue due to lower deposit interest rates. Additionally, the operation of the new Betalactam factory since May 2024 has resulted in increased immediate expenses and costs associated with upgrading the Nonbetalactam factory to meet EU-GMP standards.

Similarly, Imexpharm (HOSE: IMP), which achieved a record profit in Q2 2023 (nearly 80 billion VND), reported a profit of 66 billion VND in the same quarter this year, a 17% decrease. The company attributed the profit decline to an increase in cost of goods sold as IMP proactively adjusted its inventory to align with the sluggish OTC (over-the-counter) market. Additionally, the depreciation of the IMP4 factory as per plan and rising active ingredient prices also contributed to the decline.

| IMP faces challenges due to high base from the previous year |

Traphaco (HOSE: TRA) also experienced a slight decline in its quarterly performance, with a profit of 67 billion VND, a 7% decrease compared to the same period last year. However, this result is actually higher than the previous two quarters. Additionally, the high base from 2023, where TRA recorded the second-highest profit in its history, only surpassed by 2022, should be taken into consideration.

Another example is Vidipha (HOSE: VDP). Compared to the record profit in the same period last year, the company concluded Q2 2024 with a profit of only 16 billion VND, a significant drop of 44%.

Nevertheless, several companies shone brightly in Q2, reporting substantial profits. For instance, Duoc Viet Nam (Vinapharm, UPCoM: DVN) achieved a new milestone with a profit of 249 billion VND, a 56% increase compared to the record profit in the same period last year. This improvement can be attributed to enhanced gross profit, increased financial revenue, cost-cutting measures across various segments, and additional profits from associated companies.

| DVN surpasses previous record profit |

DTP also recorded the second-highest quarterly profit in its history, amounting to 64 billion VND, a 32% increase. According to the company, the introduction of new products and enhanced sales through various channels contributed to their robust revenue growth. Moreover, DTP effectively managed their sales process and transportation, resulting in a slight increase in sales expenses, and they also reduced interest expenses by efficiently controlling cash flow and lowering loan interest rates.

F.I.T Group (HOSE: FIT) was among the companies that witnessed a significant profit increase, reporting a profit of 36 billion VND, nearly double that of the same period last year. Their pharmaceutical and medical equipment business contributed almost 300 billion VND in revenue during the quarter, representing a 16% increase compared to the previous year.

FRT is another notable company. They reported a net profit of 27 billion VND, a remarkable recovery from a loss of 219 billion VND in the same quarter last year. This improvement can be attributed to the expansion of the Long Chau pharmacy chain, with 463 more pharmacies compared to the end of Q2 2023, resulting in a 67% increase in revenue compared to the previous year.

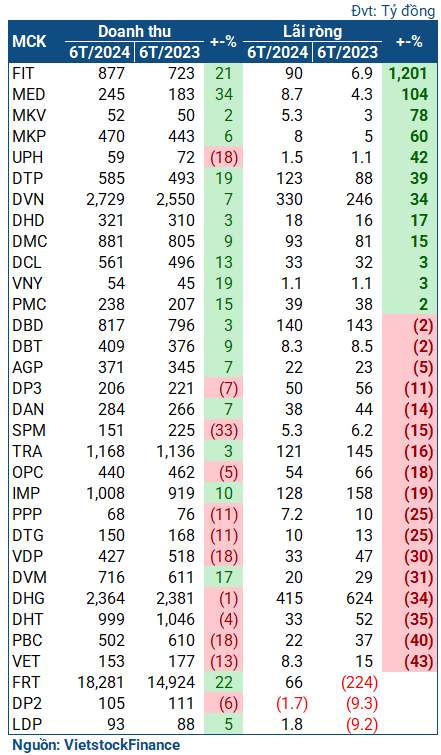

In terms of cumulative results, there weren’t many changes from Q2. DVN and DTP continued to lead with substantial profits, earning 330 billion VND and 123 billion VND, respectively, representing growth of 34% and 39%. FRT reported a profit of 66 billion VND (compared to a loss of 224 billion VND in the same period last year) with a significant contribution from Long Chau. On the other hand, companies that experienced profit declines in Q2, such as IMP, TRA, and DHG, continued on this downward trajectory.

|

Financial Results for the First Half of 2024 for Pharmaceutical Companies

|

Remaining Growth Drivers

Although most of the pharmaceutical industry’s advantages materialized in 2023, experts predict that there are still many positive prospects. IQVIA, one of the world’s leading providers of pharmaceutical data and insights, forecasts a CAGR of 6-8% for the industry during the period of 2023-2028.

This growth is driven by three main factors. Firstly, there is a rising demand for pharmaceuticals and healthcare products in Vietnam due to its large population and aging demographics, leading to increased need for pharmaceutical care and treatment. Secondly, the Vietnamese government has been highly supportive of the pharmaceutical industry, as evidenced by the recently approved National Strategy for the Development of the Vietnamese Pharmaceutical Industry until 2030, with a vision towards 2045. This strategy provides a clear direction for the industry’s growth in the coming years. Lastly, international integration is creating opportunities for pharmaceutical companies to expand into foreign markets. The FTA agreements are facilitating the expansion of distribution networks, enhancing brand presence, and fostering international collaboration.

In February 2024, the Vietnamese government announced the Plan for Implementing the National Strategy for the Development of the Pharmaceutical Industry, with the goal of meeting 80% of the domestic demand for pharmaceuticals with locally produced drugs and capturing 70% of the total market value by 2030. This plan presents opportunities for manufacturing companies such as IMP, DBD, TRA, and DHG. Therefore, despite the large shadow cast by the past, there are still growth drivers for the upcoming quarters.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Accelerating disbursement of the 120 trillion VND credit package for social housing

Deputy Prime Minister Trần Hồng Hà has recently issued directives regarding the implementation of the 120,000 billion VND credit package for investors and buyers of social housing, workers’ housing, and projects for the renovation and construction of apartment buildings.

Vietnam’s Irresistible ‘Specialty’ That China Desperately Wants to Revive: Highly Popular from the US to Asia, Bringing in Millions of Dollars

Vietnam is one of the largest exporting countries in the world, along with China and the Philippines.