At the latest closing session on August 23, the price of CLX shares stood at 15,900 VND per share. With this price, the value of the TMS-registered shares for sale is nearly 8 billion VND.

According to TMS, the sale of shares aims to realize profits and supplement capital for the company’s portfolio of potential investment projects.

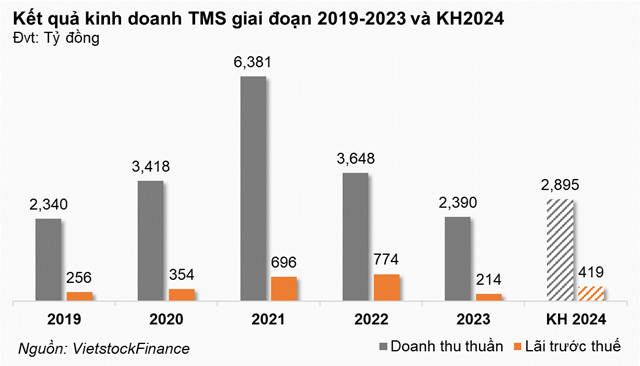

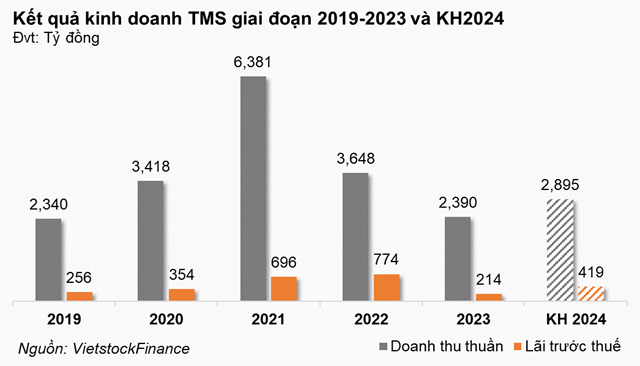

Looking back at the 2024 Annual General Meeting of Shareholders, TMS set its business plan for 2024 with a revenue target of over 2,895 billion VND and a pre-tax profit of nearly 419 billion VND, up 21% and 95%, respectively, compared to the previous year’s performance.

TMS plans to focus on business development and service restructuring, as well as organizational changes at other companies where TMS is a majority shareholder, including northern-based parent companies such as Mipec Port, Foreign Trade Transport, and Transport and Trade Services. Additionally, they intend to negotiate and divest their investment in Nippon Express (Vietnam).

Furthermore, TMS will invest in phase 2 of the Thang Long logistics centers, accelerate the progress of the Vinh Loc logistics center project, phase 2 of the cold storage warehouses in Ben Luc district, Long An province, and prepare to commence operations.

Regarding CLX, TMS Chairman Bui Tuan Ngoc stated: “TMS has incurred costs for a project that has been pending for 3-4 years without implementation, such as the Vinh Loc Logistics Center on a 5-hectare land area, in collaboration with strategic partner CLX. The TMS Chairman expects that in 2024, TMS and CLX will expedite the progress of this project.”

This is the seventh time in 2024 that TMS has registered to sell CLX shares. In the previous six transactions, TMS registered to sell 500,000 shares each time but never sold them all.

Previously, in 2022, the TMS Board of Directors decided to transfer 15% of its capital, equivalent to 13 million CLX shares, but only partially succeeded. Specifically, since the beginning of 2022, TMS registered to sell 7.6 million shares but only sold about 1.3 million. Subsequent registrations to sell large quantities resulted in partial or failed sales.

Over the past two years, TMS has registered to sell a total of 11 times and only reduced its holdings by approximately 5.7%, mainly due to unfavorable market conditions.

TMS began accounting for its capital contribution of over 300 billion VND in CLX from 2016 in exchange for a 35% stake, thereby becoming CLX’s strategic shareholder.

|

Recent TMS transactions involving CLX shares

Source: VietstockFinance

|

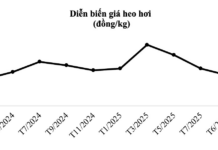

In reality, the price of CLX shares has not shown much improvement in recent years. From a level of around 30,000 VND per share at the beginning of 2022, the price of CLX shares continuously declined to around 11,000 VND per share in October of the same year. Despite subsequent recovery attempts, CLX currently fluctuates around 16,000 VND per share.

| CLX Share Price Movement in the Past 2 Years |

The connection between TMS and CLX is quite close. Specifically, TMS Chairman Bui Tuan Ngoc is the Vice Chairman of CLX’s Board of Directors; TMS General Director Le Duy Hiep is a member of CLX’s Board of Directors; TMS Board member Bui Minh Tuan is also a member of CLX’s Board; Independent Board member of TMS, Huynh An Trung, serves as CLX’s General Director; and TMS’s Chief Financial Officer, Le Van Hung, is a member of CLX’s Supervisory Board.

Also related to CLX shares, as of the end of 2023, TMS held 17.3 million CLX shares, along with 16.5 million shares of Vinafreight Joint Stock Company (HNX: VNF) and 300,000 shares of Dong Nai Port Joint Stock Company (HOSE: PDN) as collateral for a bond lot.

The bonds were issued on August 13, 2021, with a term of 5 years until August 13, 2026. The bonds were valued at 300 billion VND at the end of 2023, with an interest rate of 8.3% per annum.

Ho Chi Minh City Tops the Nation in New FDI Projects in the First Month of 2024.

With a vibrant start in early 2024, the attraction of FDI capital is expected to continue achieving impressive results in the near future.