At the workshop “Promoting and Enhancing the Efficiency of Financial Resources for Socio-Economic Development in the New Context,” directed by the Central Economic Committee and co-organized by the Vietnam Economic Magazine/VnEconomy in collaboration with the Department of General Economics (Central Economic Committee), Dr. Can Van Luc provided an overview of the process of mobilizing resources for Vietnam’s socio-economic development during the 2019-2024 period, in alignment with Resolution 39-NQ/TW issued by the Politburo on January 15, 2019.

Dr. Can Van Luc mentioned that over the past five years, all countries worldwide have intensified their efforts to inject money into their economies to withstand and recover from a series of shocks, including pandemics, wars, and escalating political conflicts.

According to the IMF, during 2020-2021, fiscal support measures (for healthcare and other sectors) amounted to 10.2% of global GDP in 2020, accounting for 62.2% of total support packages. Monetary and other support measures (capital injection, concessional loans, guarantees, asset purchases, etc.) were equivalent to 6.2% of global GDP in 2020, making up 37.8% of the total support packages.

In Vietnam, for the period of 2020-2021, the National Assembly and the Government approved fiscal support packages equivalent to 1.8% of 2020 GDP (accounting for 64.3%), while monetary and other measures accounted for 1% of 2020 GDP (35.7%). For the period of 2022-2024, the Socio-Economic Recovery and Development Program for 2022-2023, with a total value of about VND 342 trillion, has been approved.

“As a result, the economy recovered quite quickly. After two years of slow growth during the peak pandemic years of 2020-2021, Vietnam has regained its stable growth trajectory and is among the top performers in the region,” the expert emphasized.

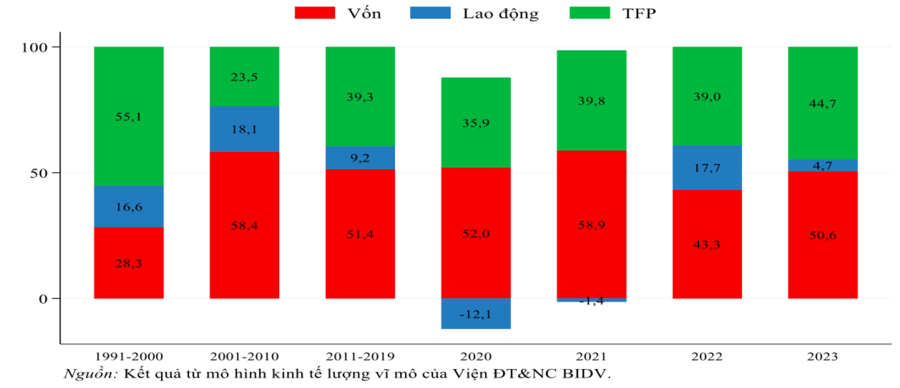

However, Dr. Luc also pointed out weaknesses in the economy, including low-quality growth that remains heavily reliant on capital.

“The role of capital in growth has decreased but remains the most critical factor, contributing 50.6% in 2023. In contrast, the contribution of TFP (Total Factor Productivity) was 44.7%,” said Dr. Luc.

According to the expert, the slow restructuring of the economy has led to inefficient resource allocation, and labor productivity remains low and slow to improve (with a growth rate of about 5.5% during 2019-2023, falling short of the 6.5% target for the 2021-2025 period). These factors are the main reasons for the decline in growth quality.

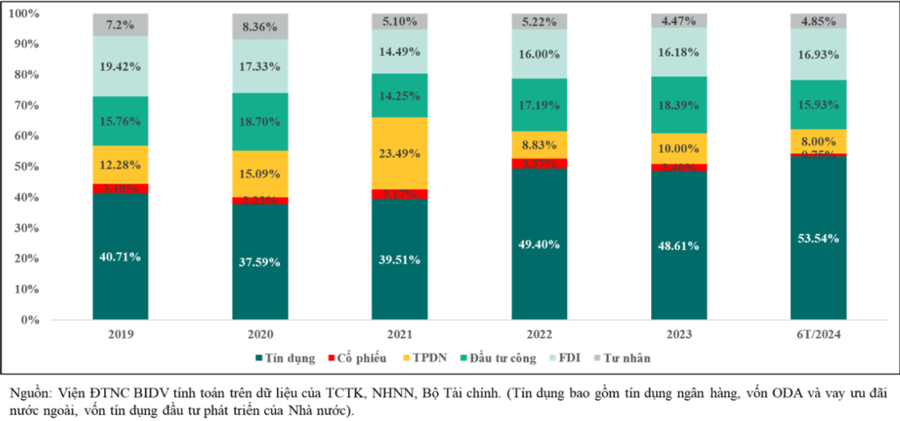

At the workshop, Dr. Can Van Luc also pointed out the imbalance in the structure of capital sources for the economy.

According to the BIDV Training and Research Institute, the total social investment capital for the 2019-2024 period is calculated based on a classification by capital sources, including: state budget capital (public investment); ODA and concessional foreign loans; state investment development credit (through the Vietnam Development Bank); bank credit capital; capital mobilized from the securities market (bonds, stocks, equitization…); self-financing and other sources.

According to the research results, credit remains the main channel of capital supply to the economy, with a ratio of up to 53.54% in the first six months of 2024, while the stock channel accounts for only 0.75%, and the corporate bond channel accounts for 8%…

“Bank credit capital accounts for half of the total capital supply to the economy, while capital mobilization through the stock channel is extremely small, reaching only about VND 120 trillion per year, equivalent to the mobilization capacity of a medium-sized bank. Therefore, it is necessary to further promote the role of capital mobilization in the stock market,” said Dr. Luc.

Corporate bonds, a medium to long-term capital source for the economy, reached a record issuance volume in 2021, with more than VND 740 trillion. However, serious violations in 2022 slowed down this growth trend.

“The corporate bond market performed exceptionally well in 2021, providing 23.49% of the economy’s capital needs. Still, from 2022 to the first six months of 2024, it declined sharply after several violations, contributing only about 8% of the total capital to the economy. Private investment has continuously decreased since 2020, contributing only about 4-5% of the total capital to the economy,” said Dr. Luc.

According to Dr. Can Van Luc, surveys by the BIDV Research Institute show that the actual capital contribution of enterprises is typically only 10-15% of the registered capital with the business registration agency. Therefore, the research group estimates private capital annually as 10% of the newly established enterprises’ registered capital (based on data published by the General Statistics Office).

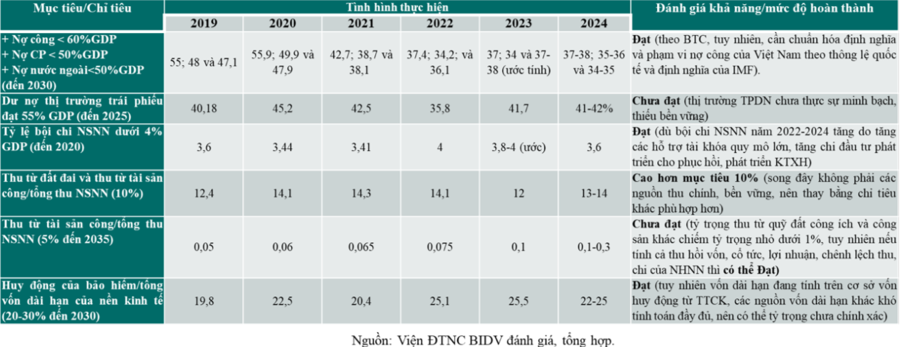

Providing an overview of the implementation of resource mobilization targets according to Resolution 39-NQ/TW issued by the Politburo on January 15, 2019, Dr. Can Van Luc stated that during the 2019-2024 period, the Government has controlled public debt and budget deficits in line with set targets. International financial institutions and credit rating agencies have assessed Vietnam’s economy’s risks as moderate. The ratio of insurance companies’ mobilization to the total long-term capital of the economy has also recorded positive growth.

However, Dr. Can Van Luc assessed that the development of the corporate bond market has not met the set targets. The outstanding balance of the corporate bond market decreased to 9.64% (as of June 2024), far from the targets set by the 2022 Finance Strategy and the 2023 Securities Market Development Strategy, aiming for 20% of GDP by 2025. In general, the corporate bond market lacks transparency, efficiency, and sustainability. Additionally, capital mobilization through the stock market (stocks) has been modest, and equitization and state-owned enterprise divestment have been slow.

The expert also emphasized that land-related revenue and revenue from state assets as a proportion of total state budget revenue are currently unsustainable and prone to waste and loss.

Dr. Can Van Luc recommended that, in the coming time, relevant agencies should strengthen the work of inventory and statistics of resources in a fundamental and scientific manner to formulate optimal management, allocation, and utilization plans.

First, build a database and apply international statistical standards to relevant statistical indicators related to human resources, financial resources, and physical resources.

Second, pay attention to the statistics of the unobserved economy.

Third, strengthen international cooperation and share experiences in this field.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Mobile World achieves revenue of VND118,000 trillion: TVs, tablets, and phones all decrease by 10% – 50%, while one product grows in both quantity and revenue.

Mobile World Investment Corporation (MWG) has recently announced its 2023 business results. According to the report, the company’s consolidated revenue reached over 118 trillion Vietnamese dong, equivalent to 89% of the revenue in 2022.