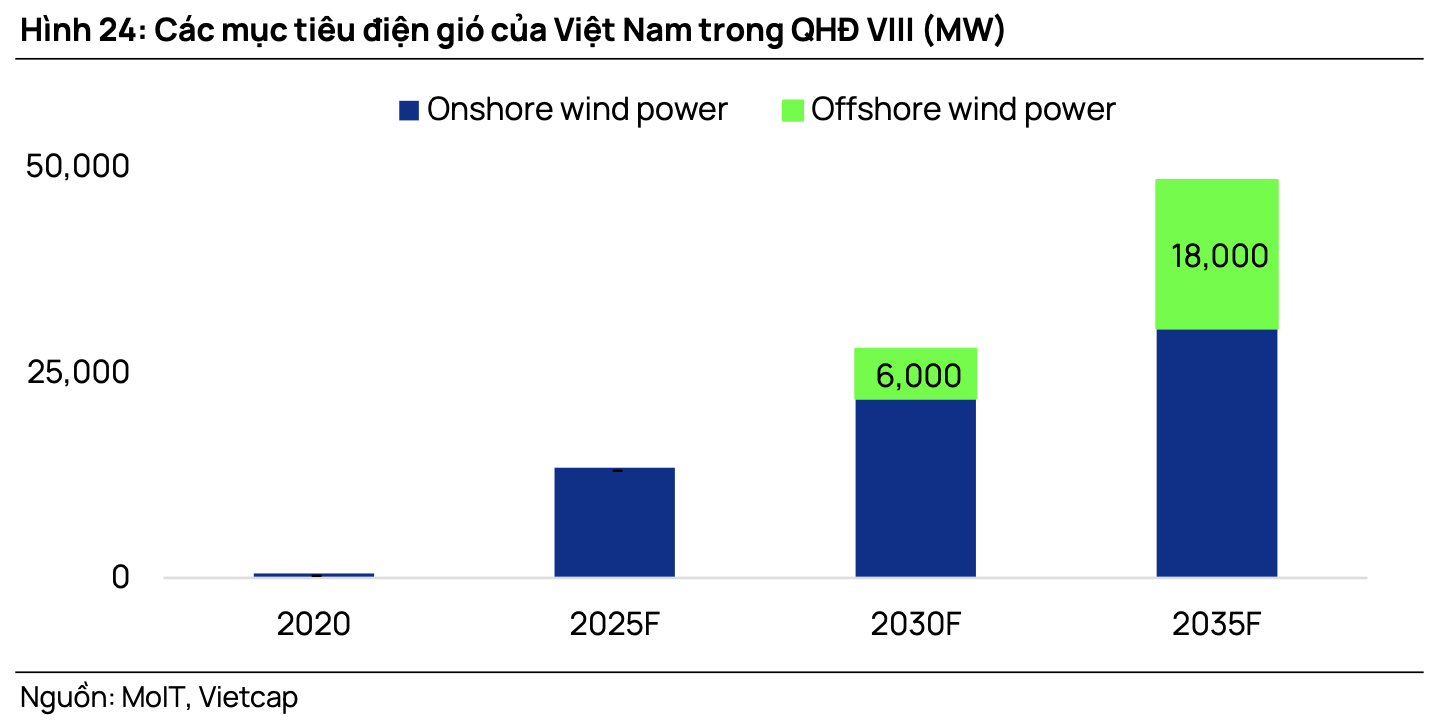

Offshore wind power is gaining traction as a global investment theme. Governments in the Asia-Pacific region have taken unprecedented steps to accelerate the development of this sector, and Vietnam is no exception. According to the Power Development Plan VIII, Vietnam aims to achieve 6 GW of offshore wind power capacity by 2030 and 70-91 GW by 2050.

Vietcap assesses that Vietnam Technical Services Corporation (PTSC – code PVS) will significantly benefit from the growth of the offshore wind power industry. This is because there are many similarities between the processes of M&C infrastructure construction for offshore oil and gas projects and offshore wind power projects, making it easier for oil and gas companies to transition into offshore wind developers.

Key areas where synergies can be achieved between the installation of offshore wind and oil and gas projects include the fabrication and installation of towers, as well as foundations/jackets, due to the linkage of established facilities and the necessary knowledge for both industries. Moreover, M&C contractors can leverage their best practices and skills from the offshore oil and gas sector and apply them to offshore wind power.

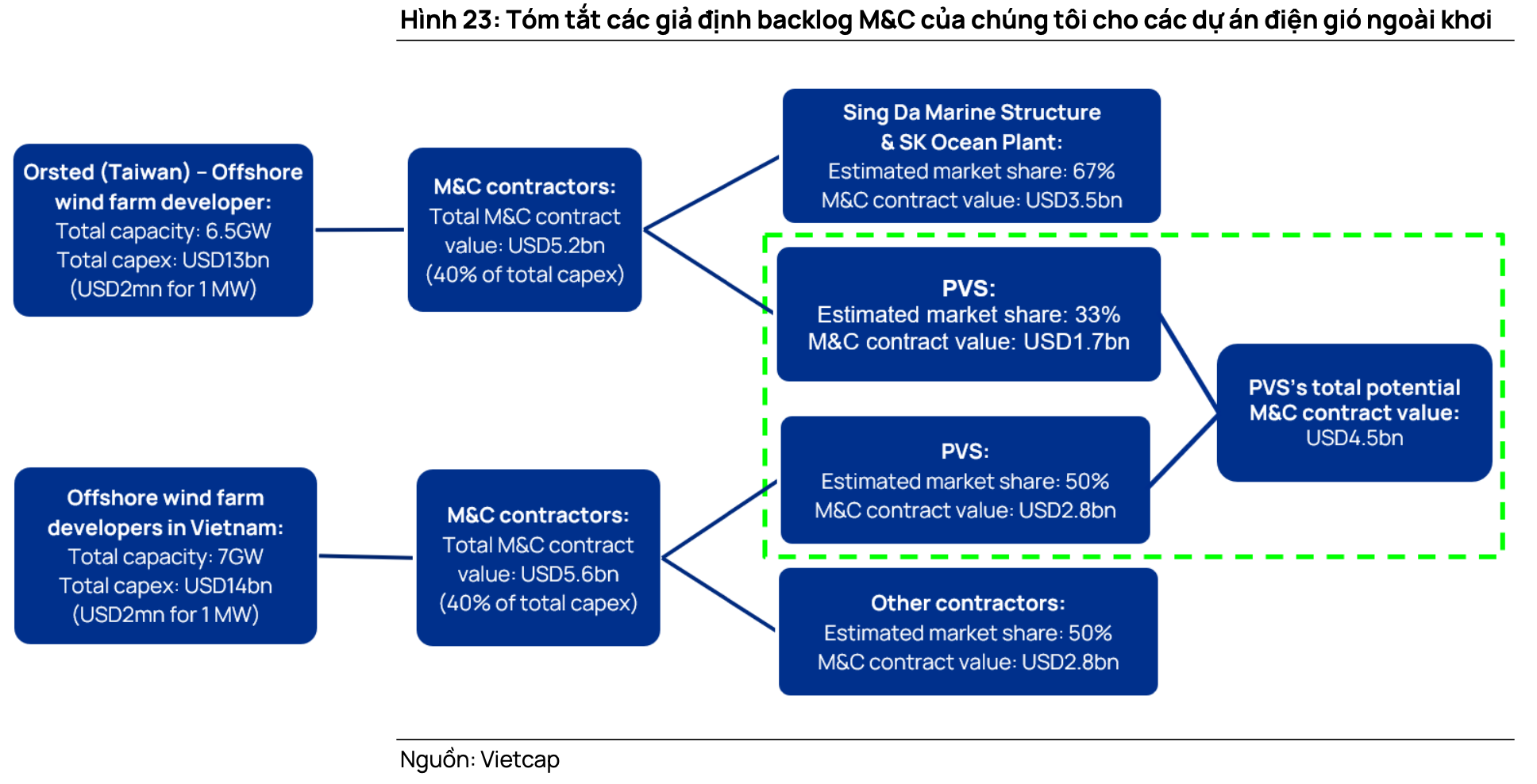

Currently, PVS, SK Ocean Plant, and Sing Da Marine Structure are the M&C contractors for Orsted’s offshore wind farms in Taiwan. While SK Ocean Plant and Sing Da Marine Structure entered the offshore wind power sector earlier than PVS, PVS boasts the largest production facility among the three contractors.

In addition, PVS offers comprehensive M&C services and has strong fabrication capabilities in offshore construction. Vietcap believes that PVS has significant potential to become one of the strongest players in this field in Asia, thanks to its experience in building offshore wind farms.

Vietcap estimates the total contract value of M&C for Orsted’s wind farms in Taiwan (China) to be around $5.2 billion. As offshore wind projects typically involve multiple contractors, the potential contract value for PVS is estimated to be approximately $1.7 billion (assuming a 33% market share in a competitive context).

Additionally, PVS will continue to benefit from the offshore wind power capacity that the company will co-develop with Singapore’s Sembcorp. On February 10, 2023, PVS signed a cooperation agreement with Sembcorp to jointly develop offshore wind projects (with an initial capacity of 2,300 MW and a capital investment of about $5 billion) and export electricity from these wind farms to Singapore via high-voltage underground cables, starting in 2030.

According to Vietcap, PVS can achieve an offshore wind power contract value of $2.8 billion — capturing 50% of Vietnam’s offshore wind power market. Thus, PVS is expected to attain a total contract value of $4.5 billion for offshore wind farms during 2023-2030 in the Vietnamese and Taiwanese markets.

Benefiting from the Super Project Lot B

Vietcap expects the Lot B project to commence construction by the end of 2024, delayed from the previous expectation of mid-2024. The main reason for the delay is that the EPCI#1 contract (worth $1.1 billion) requires some adjustments and needs to be approved by the State Capital Management Committee (CMSC) in the first half of 2024.

According to PVS, the contract for the onshore gas pipeline is valued at $257 million for the company. For the offshore pipeline, Vietcap has lowered the estimated contract value to $310 million for PVS (previously $400 million), according to the SWPOC’s plan for contractor selection.

Vietcap assesses that PVS will benefit from leasing FSO to the Lac Da Vang and Lot B projects. PVS has planned an investment of $400 million for these projects, demonstrating their confidence in winning the bid. These FSO are expected to contribute from 2027 onwards, at a level of about 8% to PVS’s annual net profit.

According to Vietcap’s report, during 2024-2030, PVS requires large capital expenditures totaling VND 70,600 billion, including spending on M&C, expansion of the base port system capacity, investment in floating oil storage for the Lac Da Vang and Lot B projects (~VND 10,000 billion), as well as offshore wind farms (~VND 60,000 billion).

To meet this requirement, PVS may increase its charter capital to VND 17,000 billion by 2030. However, Vietcap also emphasizes that this plan is still in its early stages, as PVS needs approval from various levels, including the Vietnam Oil and Gas Group (PVN) and the State Capital Management Committee, before proceeding. Therefore, detailed information is not yet available. Currently, PVS has a charter capital of VND 4,800 billion and is the second-largest capitalized company on the HNX exchange, with a value of over VND 19,000 billion.

Total assets of commercial banks reach 20 quadrillion VND for the first time, how much do Agribank, BIDV, VietinBank, and Vietcombank account for?

As of the end of 2023, the total assets of the State Commercial Bank Group amounted to over 8,326 trillion VND, while the Joint Stock Commercial Bank Group reached nearly 8,987 trillion VND.