Novagroup JSC, the largest shareholder of Novaland Group (stock code: NVL), has registered to sell 3 million NVL shares. The transaction will be carried out through order matching or agreement, expected from August 27 to September 6. It is estimated that Novagroup will earn approximately VND 39 billion from this deal.

If the transaction is successful, Novagroup’s ownership in Novaland will decrease from over 346.88 million shares (equivalent to 17.78% of charter capital) to 343.88 million NVL shares (equivalent to 17.63% of charter capital).

Previously, Novagroup repeatedly registered to sell large quantities of NVL shares to reduce its ownership in Novaland. In July, the organization twice registered to sell 2 million shares each time. However, from June 27 to July 12, Novagroup only sold 34,701 shares, and from July 18 to 26, they successfully sold 2 million NVL shares.

Novagroup is currently the largest shareholder of Novaland and is also an organization related to Mr. Bui Thanh Nhon, Chairman of Novaland’s Board of Directors. Mr. Nhon currently holds nearly 96.8 million NVL shares (equivalent to 4.96% of charter capital).

The ownership ratio of Mr. Bui Thanh Nhon and related parties in Novaland has decreased to 38.8% of NVL’s charter capital.

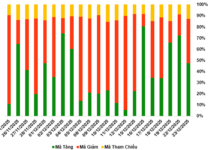

Currently, the ownership ratio of Mr. Bui Thanh Nhon and related parties in Novaland stands at 38.8% of NVL’s charter capital. Notably, in October 2022, the shareholder group related to Mr. Bui Thanh Nhon still held nearly 1.19 billion NVL shares, equivalent to 60.85% of Novaland’s charter capital.

Thus, over the past two years, the ownership ratio of Novaland by the shareholder group related to Mr. Bui Thanh Nhon has decreased by approximately 410 million NVL shares.

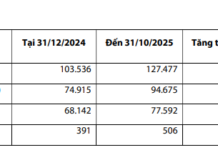

In the second quarter of this year, Novaland recorded net revenue of VND 1,549 billion, up 47% over the same period last year. Novaland reported a net profit of VND 941 billion, a significant increase compared to the loss of VND 634 billion in the previous year. This is also the highest profit in the past nine quarters.

The main reason for Novaland’s substantial profit in the second quarter was the financial revenue. Specifically, NVL’s financial revenue reached VND 3,951 billion, more than five times higher than the same period last year.

For the first six months, Novaland recorded revenue of VND 2,246 billion and after-tax profit of VND 374 billion, a significant increase compared to the loss of over VND 1,000 billion in the previous year.

As of June 30, Novaland’s total assets amounted to VND 240,178 billion, a decrease of VND 1,300 billion from the beginning of the year. The largest item was inventory, at VND 142,025 billion, an increase of VND 3,000 billion from the beginning of the year. Payable debt stood at VND 194,531 billion.

Transfer of 12.5 million NVL shares to “small shareholders”, related shareholder group of Mr. Bui Thanh Nhon holds less than 41% of Novaland’s capital

In the past year, the overall ownership percentage of the shareholder group connected to Mr. Bui Thanh Nhon at Novaland has decreased by approximately 11%, which is equivalent to 208 million NVL shares.