“An obese body needs to lose weight and exercise” is perhaps the most fitting description of how Mr. Nguyen Duc Tai is restructuring Mobile World Investment Corporation (MWG). With its massive scale, MWG has been making aggressive moves to streamline its underperforming stores.

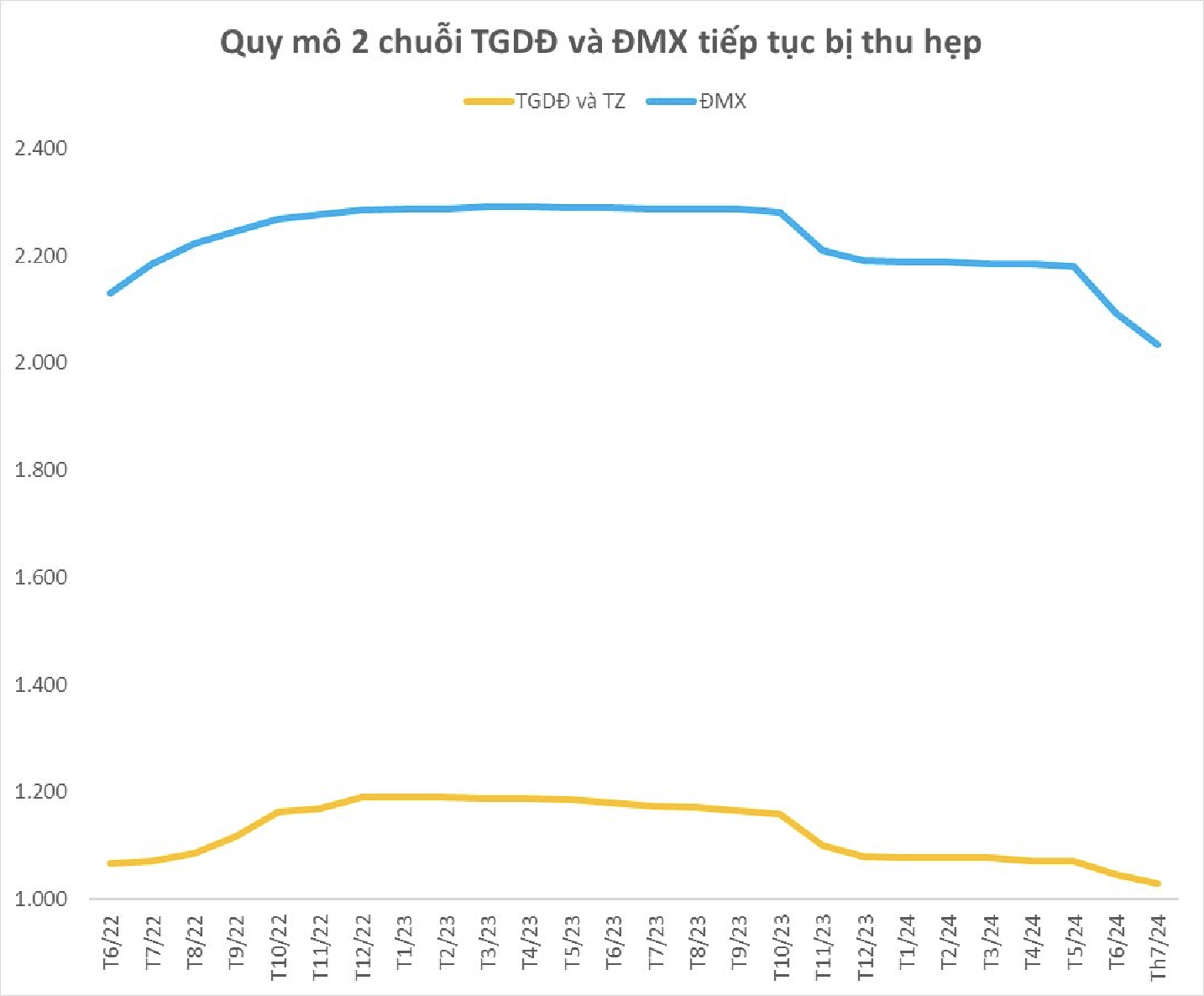

Just in July, MWG closed 18 The Gioi Di Dong (including Topzone) stores, 59 Dien May Xanh outlets, and notably, 94 An Khang pharmacies. Overall, in the first seven months, The Gioi Di Dong closed 43 stores, Dien May Xanh closed 150, and An Khang shuttered 140.

During the Q2 2024 investor meeting, MWG leaders shared that they had essentially finished closing The Gioi Di Dong and Dien May Xanh stores. However, the An Khang pharmacy chain is still in the process of streamlining and is expected to close nearly 200 more stores, maintaining approximately 300 operational outlets.

“The number of stores will be adjusted depending on the situation. If the market grows robustly and opportunities abound, we will focus on expanding our scale to increase revenue and capture a larger market share. However, in the current challenging market context, MWG is more focused on the “quality” of each store”, said MWG leaders.

Why is the closure of stores good news?

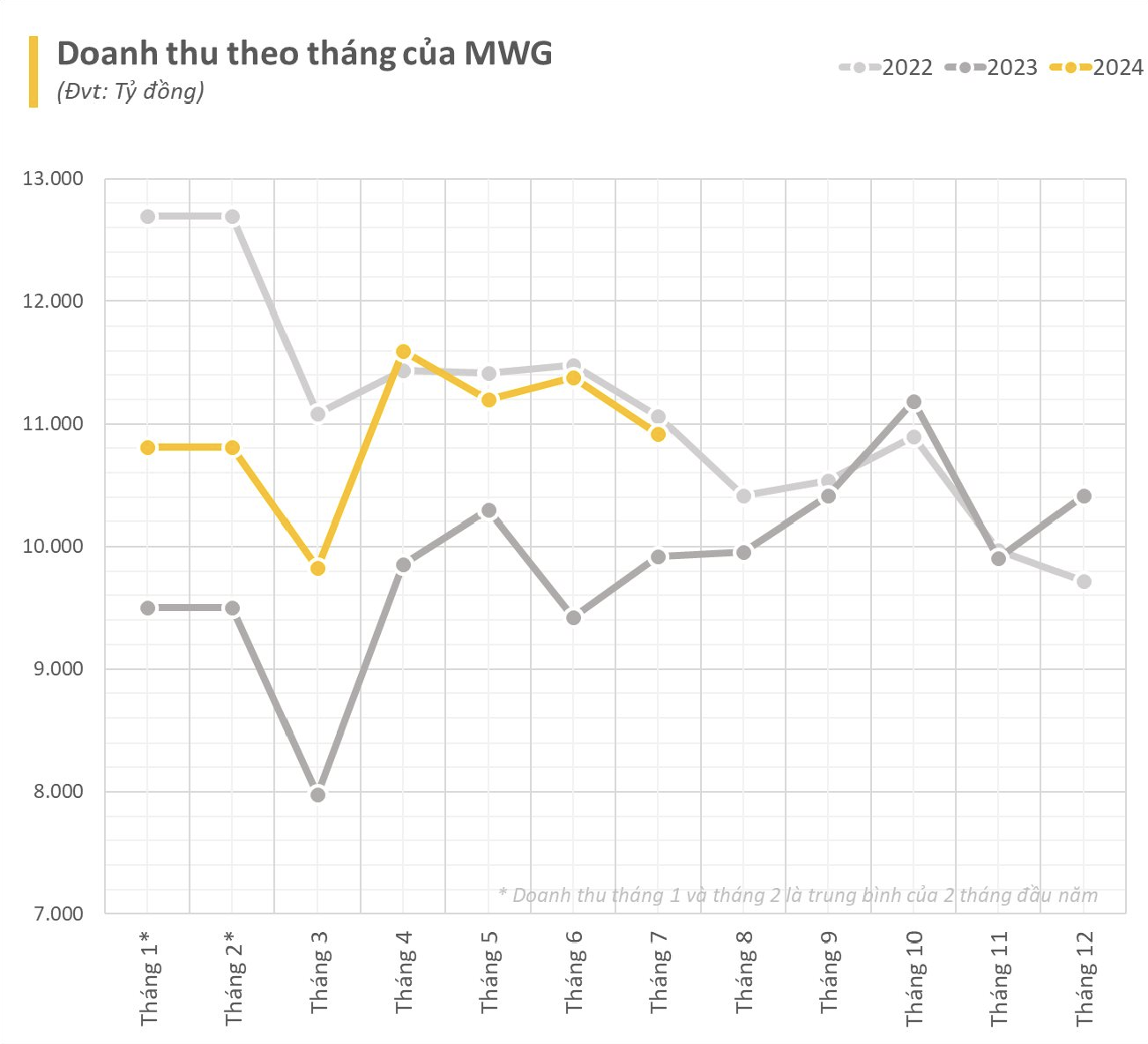

The biggest risk in closing a series of stores is a potential drop in revenue. However, this has not been the case for MWG, as its revenue for the first seven months of 2024 still grew by 15% year-on-year, reaching more than VND 76.5 trillion. In July alone, MWG’s revenue was close to VND 11 trillion, a 10% increase compared to the previous year.

Looking at each business segment, The Gioi Di Dong/Dien May Xanh generated a total revenue of VND 51.3 trillion in the first seven months, up over 6% from the same period in 2023. In July alone, MWG earned about VND 7.2 trillion from the sale of electronics, appliances, and refrigeration equipment. These results further reinforce the argument put forth by MWG’s leadership for this campaign.

Recalling the end of last year, at the Q4 investor meeting, Mr. Nguyen Duc Tai confidently asserted that closing some stores would not significantly impact MWG’s revenue thanks to the shift to nearby stores. Instead, this move would help MWG significantly reduce costs and optimize operations.

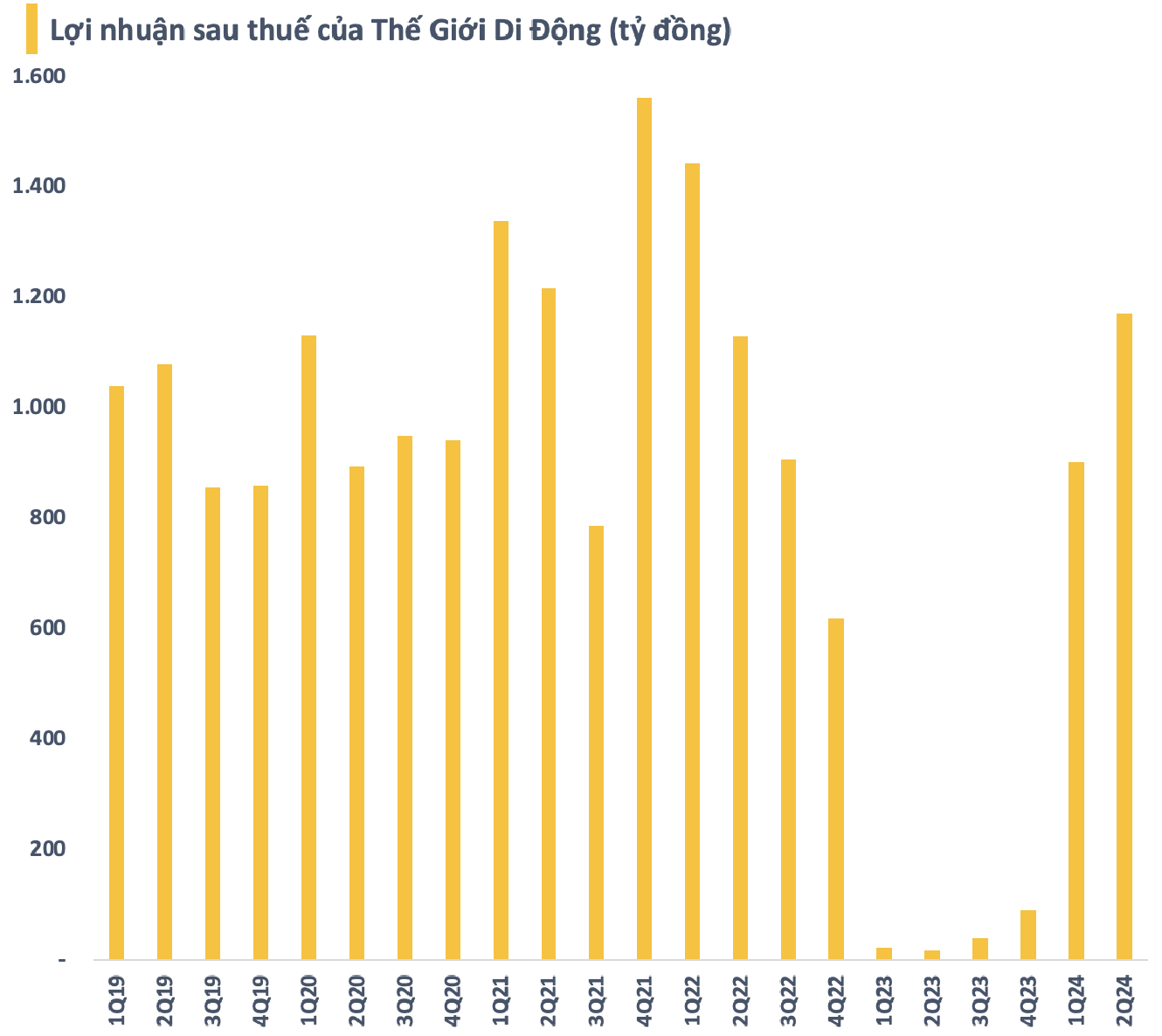

In reality, MWG’s profits have rebounded strongly since the beginning of the year. This retail business has had two consecutive quarters of exceptional growth compared to the low base in the same period last year. The net profit for the first six months reached VND 2,075 billion, a more than 5200% increase over the first half of last year, thus completing nearly 87% of the plan.

As for the An Khang pharmacy chain, MWG seems to be “copying” the successful path of Bach Hoa Xanh. According to MWG representatives, An Khang’s primary goals are to ensure sufficient medicine supply and improve the qualifications of pharmacists. In terms of orientation, the first step is to reduce the number of stores to operate at the lowest cost, then perfect the business model to break even before accelerating expansion.

Currently, the revenue per operating store of the An Khang pharmacy chain has exceeded VND 500 million per month, an improvement from VND 450 million at the end of 2023. However, the breakeven point for the pharmacy chain is a revenue of over VND 550 million per store per month. This is a challenging goal that is not easily achievable in the short term.

Contract to Expand

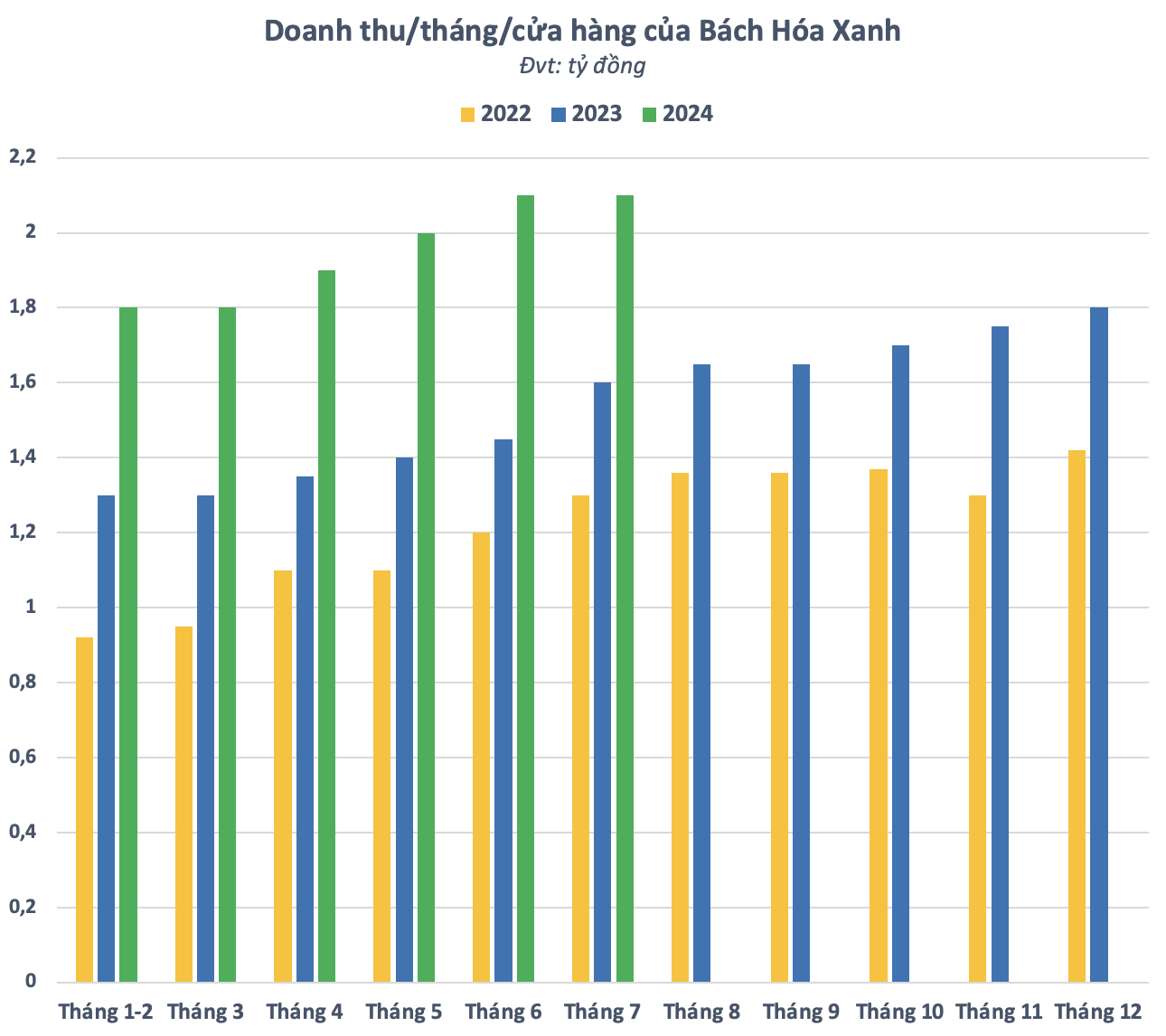

“Hide the ugly, show the beautiful.” After officially turning a profit in Q2, Bach Hoa Xanh is not hiding its ambition to continue expanding its system after a period of stagnation. MWG’s grocery chain plans to open seven new stores in four provinces and cities: Ho Chi Minh City (3 stores), Long An (1 store), Binh Duong (1 store), and Dong Nai (2 stores) in the near future.

In the first seven months, Bach Hoa Xanh brought in VND 23 trillion in revenue for MWG, a 40% increase over the same period in 2023. In July alone, revenue exceeded VND 3.6 trillion, a nearly 28% increase over the previous year, with both fresh produce and FMCG maintaining double-digit growth. The average revenue in July reached VND 2.1 billion per store. By the end of July, the chain had 1,704 stores, an increase of three stores compared to the end of June.

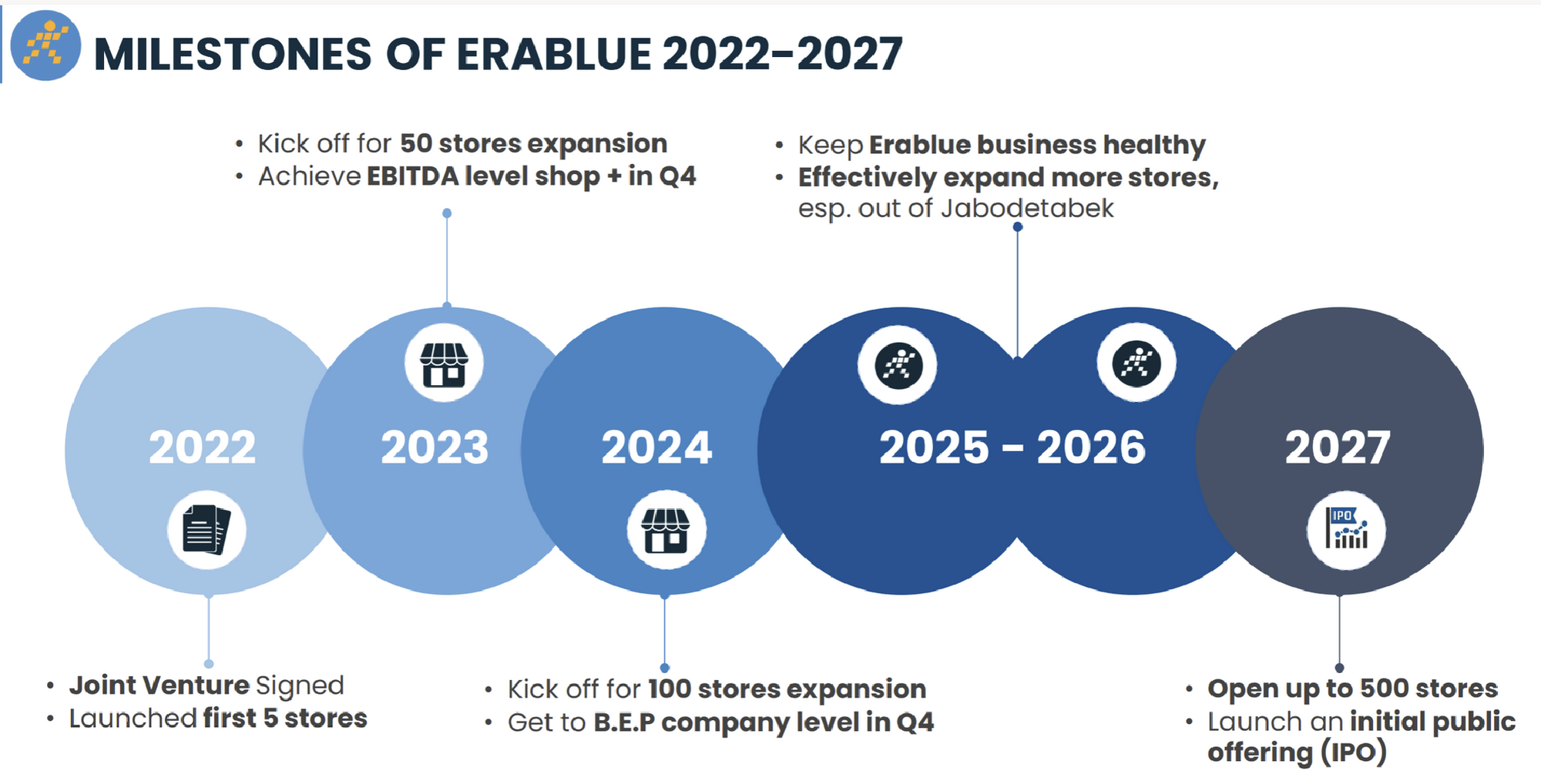

Similarly, the EraBlue electronics and appliance chain in Indonesia is also getting the “green light” from MWG to expand its system, even though it has not yet reached the company-level breakeven point. As of July 2024, the chain had 65 stores in satellite areas of Jakarta, including 37 mini-size stores (size M, approximately 280-320m2) and 28 supermini-size stores (size S, 180-220m2). Notably, EraBlue stores’ revenue (VND 4 billion per month for size M and VND 2.2 billion per month for size S) is nearly double that of a Dien May Xanh store of the same size in Vietnam.