The World Bank’s latest report, Taking Stock, released on August 26, 2024, forecasts an improved economic growth outlook for Vietnam in 2024, attributing it to the recovery in exports of manufactured goods, tourism, consumption, and investment.

World Bank Senior Financial Sector Specialist, Ketut Ariadi Kusuma: “Billions of dollars from global investment funds will flow into capital markets if Vietnam is upgraded to an emerging market”. Screenshot

Vietnam’s economy is projected to grow by 6.1% in 2024 and accelerate to 6.5% in 2025 and 2026, outpacing the 5% growth recorded in 2023, according to Taking Stock. The report highlights the resilience of the Vietnamese economy amid mounting global challenges.

While acknowledging that the economy has not yet returned to its pre-pandemic growth trajectory, the report, titled “Reaching New Heights in Capital Markets,” suggests boosting public investment to stimulate short-term demand and address infrastructure gaps, particularly in energy, transportation, and logistics, which are currently constraining growth. It also emphasizes the need to closely monitor the asset quality of banks due to rising non-performing loans.

“In the first half of this year, the Vietnamese economy benefited from the recovery in export demand,” said Sebastian Eckardt, World Bank’s Lead Economist for East Asia and the Pacific. “To sustain growth through the end of the year and beyond, authorities should continue with institutional reforms, boost public investment, and manage risks in the financial market.”

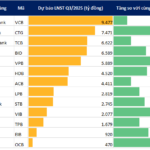

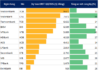

The report’s special focus on capital markets development underscores the importance of this sector in providing long-term capital for the economy and supporting Vietnam’s ambition to become a high-income country by 2045. It identifies key challenges, including the low proportion of institutional investors and the underutilized potential of investments from the Vietnam Social Security (VSS) fund.

The report recommends a stronger policy framework, with VSS playing a pivotal role in fostering capital market development. Policies aimed at upgrading Vietnam’s stock market from frontier to emerging market status, coupled with reforms to enhance market transparency and protect investors, will help attract more foreign investment. Effective coordination among financial sector regulators is crucial to achieving these goals.

“Billions of dollars from global investment funds will flow into capital markets if Vietnam is upgraded to an emerging market,” said Ketut Ariadi Kusuma, World Bank Senior Financial Sector Specialist. “At the same time, there is a need to gradually diversify VSS fund investment channels to improve long-term returns and increase resources for economic growth through investment in the enterprise sector,” he added.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

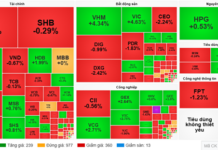

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.