Petrolimex Joint Stock Company (PLX) primarily engages in the import, export, and trading of petroleum products. With a distribution network of over 4,790 retail stations and agents nationwide, PLX is currently the largest supplier of petroleum products in the domestic market, accounting for 47% of the domestic petroleum market share.

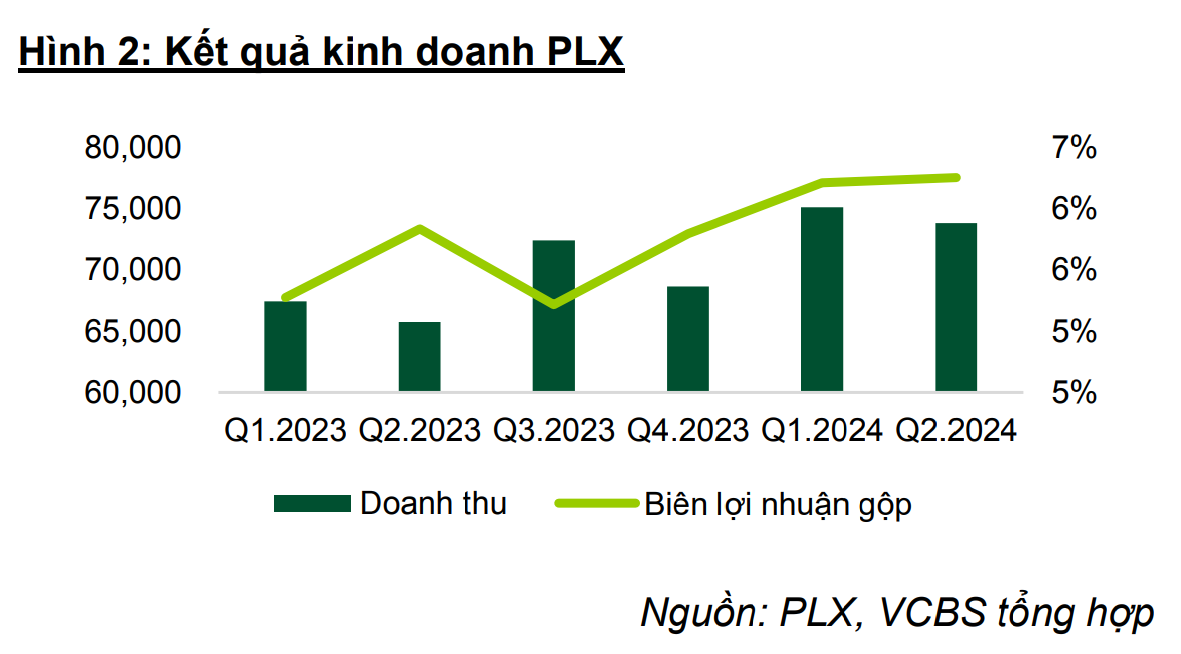

According to the financial report for the second quarter of 2024, PLX’s estimated sales volume remained unchanged from the previous year. However, revenue increased by 12.3% to VND 73,837 billion. Net profit in the second quarter also increased by 47.5% compared to the previous year and by 11.8% compared to the previous quarter. Net profit reached VND 1,275 billion, a 43% increase compared to the same period last year.

The strong business results were mainly driven by an average increase of 8% in petroleum product selling prices compared to the previous year, following the upward trend in global oil prices (up 14%), and a higher proportion of diesel oil consumption in the sales volume mix, as the selling price of diesel oil experienced the highest increase (up 10%) among the products. Gross profit margin improved from 5.9% to 6.3%, and other income amounted to VND 121 billion.

For the first half of 2024, PLX’s revenue grew by 11.8% year-on-year, with a gross profit margin improvement of 0.6 percentage points, and net profit increased positively by 58.6% compared to the previous year.

Figure 1: PLX’s Financial Highlights for Q2 2024 (VND billion)

Figure 2: PLX’s Sales Volume and Product Mix for Q2 2024 (thousand m3)

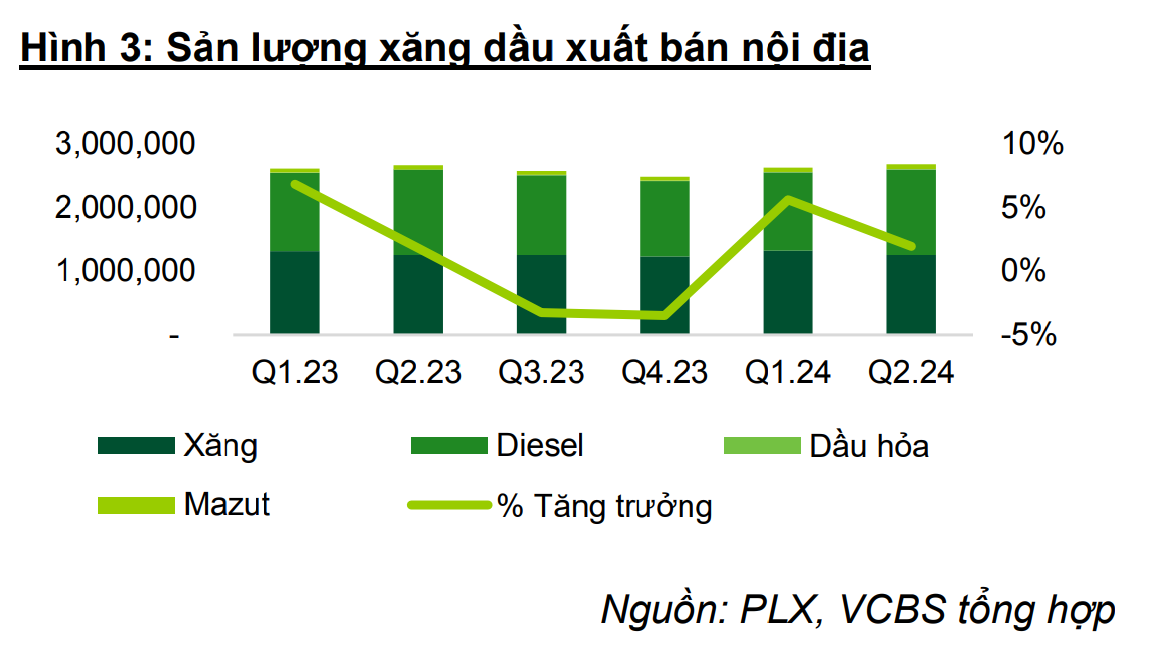

Regarding PLX’s economic outlook, MBS Securities Joint Stock Company (MBS) expects PLX’s sales volume to remain stable at a high level due to increased market share from several traders who had their licenses revoked, despite the possibility of a slow recovery in domestic fuel consumption.

In addition to the previously revoked licenses of Hai Ha Petro and Xuyen Viet Oil, the Ministry of Industry and Trade has also directed penalties and inspections of 20 distributors showing signs of violations in the first seven months of 2024.

MBS forecasts PLX’s domestic and re-export sales volume to reach 10.94 million metric tons in 2024 and 11.15 million metric tons in 2025 (estimated sales volume for the first half of 2024 was 5.27 million metric tons).

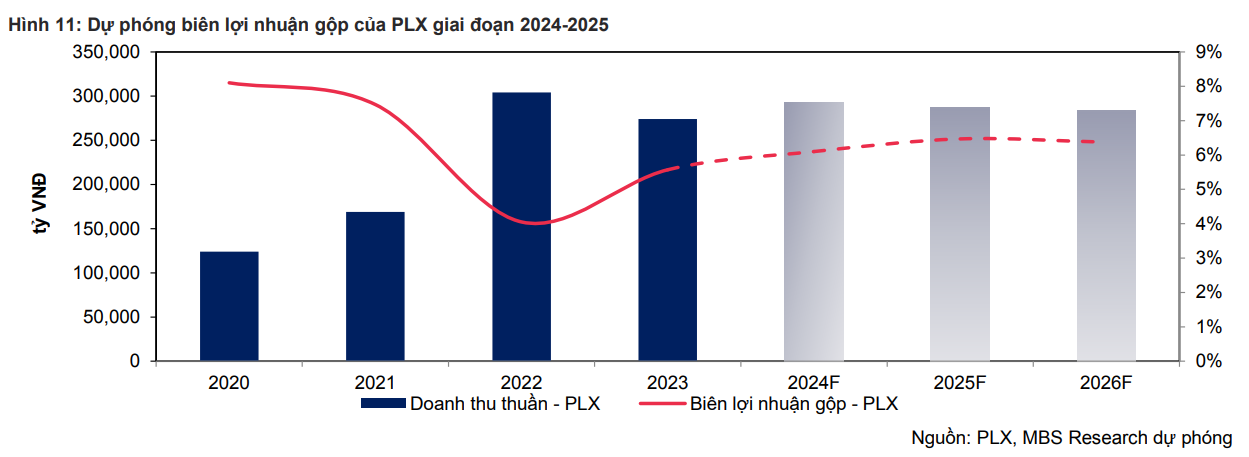

“We expect PLX’s fuel sales volume in the 2024-2025 period to increase by 3.3% and 1.8% year-over-year, respectively. The gross profit margin may improve from 2025 as the business cost factor in the base selling price formula has increased since July 2024. We anticipate PLX’s gross profit margin for 2024-2025 to reach 6.1% (up 0.5 percentage points year-over-year) and 6.5% (up 0.4 percentage points year-over-year), respectively.”

Legal changes are expected to provide petroleum traders like PLX with more autonomy in price decision-making, thereby supporting better profit margin maintenance even in the face of significant fluctuations in actual business costs, according to MBS’s analysis.

Figure 3: PLX’s Sales Volume and Product Mix for H1 2024 (thousand m3)

Sharing a similar viewpoint, Vietcombank Securities Company (VCBS) also assumes a 5% annual increase in consumption volume for 2024-2025, reflecting PLX’s growing sales volume due to increased market share from revoked competitors and the long-term increasing demand for petroleum products.

“We forecast revenue for 2024 and 2025 to increase by 6% and 7% year-over-year, respectively, mainly due to expected oil price increases as per EIA forecasts and volume growth driven by rising consumption and market share gains from revoked competitors,” VCBS said.

Alongside positive growth factors, VCBS also highlights challenges for PLX, including the pressure on maintaining inventory, which may lead to higher provisions for petroleum business enterprises amid volatile oil prices.

Additionally, the growing popularity of electric vehicles in many countries is significantly impacting the demand for petroleum products. This trend is also emerging in Vietnam, although the shift towards electric vehicles will likely be gradual due to the significant costs and time required to build the necessary infrastructure.

To stay aligned with this global shift, PLX and VinFast have signed a cooperation agreement to install electric vehicle charging stations at PLX’s nationwide network of gas stations, providing both electricity for electric vehicles and traditional petroleum products.

Pha Le