Large construction companies were profitable in Q4/2023: Do we see light at the end of the tunnel? Dinh Thơm • 02/02/2024 09:54

In Q4 2023, Hoa Binh Construction reported a profit after tax of over 100 billion VND, breaking the chain of losses for 4 consecutive quarters. Similarly, Vinaconex, Coteccons, and Hung Thinh Incons also reported after-tax profits of 132 billion VND, 69 billion VND, and 33 billion VND respectively.

In 2023, amid difficulties in the real estate market, the business activities of leading construction companies have not yet shown signs of improvement. However, the business performance of some companies in the industry has gradually improved, especially in the last quarter of the year.

Along with the positive business results, the debt repayment of most construction companies has reduced compared to the beginning of the year, and the cash flow has been maintained at a positive level instead of being heavily negative as in the same period.

Hoa Binh Construction ends the loss, Coteccons’ profits soar

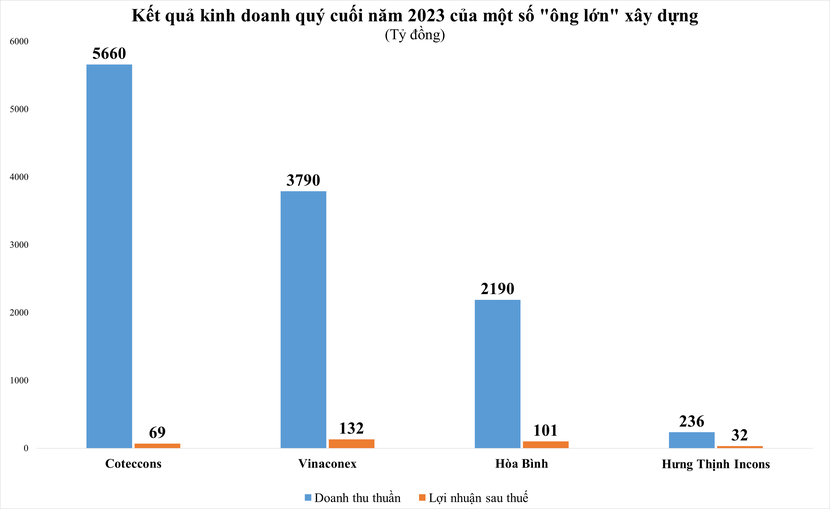

According to the recently published financial report for Q4/2023, Hoa Binh Construction Corporation (code: HBC) recorded a net revenue of 2,190 billion VND, a decrease of 32% compared to the same period last year. However, thanks to a sharp decrease in costs, the company achieved a gross profit of 53 billion VND, while in the same period of the previous year it suffered a loss of over 462 billion VND.

During the quarter, the company generated an additional financial revenue of over 20 billion VND (compared to a negative of nearly 113 billion VND in the same period), and financial expenses were reduced by over 8% to 135 billion VND.

Notably, in Q4, the item of management expenses of Hoa Binh Construction was recognized a reimbursement of 223 billion VND. According to the explanatory notes of the financial report, this is a refund of the provision for difficult collectible receivables amounting to 310 billion VND.

After deducting expenses, Hoa Binh Construction reported an after-tax profit of over 101 billion VND, a significant improvement compared to the loss of over 1,200 billion VND in the same period last year, thereby ending 4 consecutive quarters of losses.

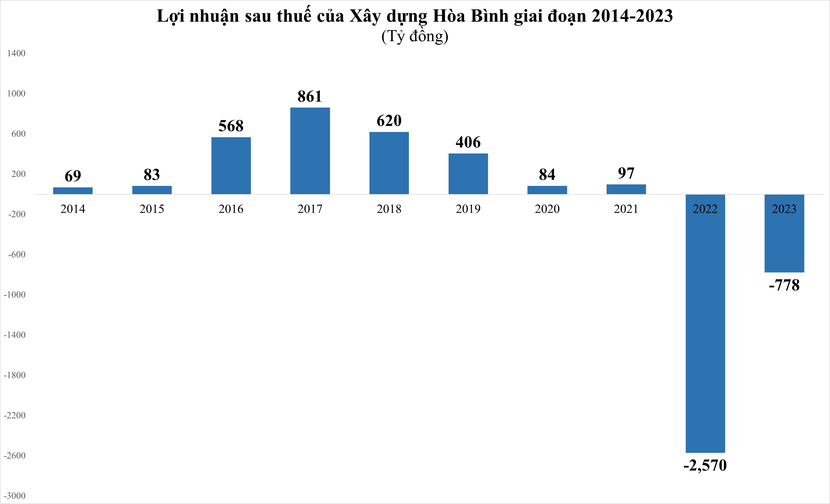

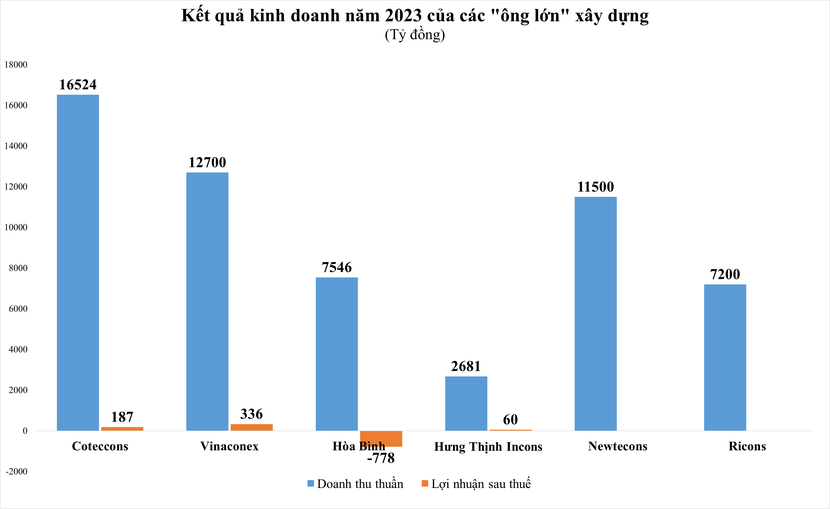

For the whole year of 2023, Hoa Binh Construction recorded a net revenue of 7,546 billion VND, a decrease of nearly half compared to 2022, and still a loss of 778 billion VND after tax, whereas in the same period last year the loss was nearly 2,600 billion VND. With these results, the company failed to achieve its targets for 2023, which were a revenue of 12,500 billion VND and an after-tax profit of 125 billion VND.

Furthermore, with an additional loss of 778 billion VND in 2023, the accumulated loss of Hoa Binh Construction as of December 31, 2023, reached nearly 2,900 billion VND. The accumulated losses caused the company’s equity to decrease by 63% compared to the beginning of the year, to 453.6 billion VND. At the same time, the accumulated loss of the company exceeded the charter capital (2,741 billion VND).

Similarly, with improved business results in Q4 compared to the same period last year, Vietnam Construction and Export-Import Joint Stock Corporation (Vinaconex, code: VCG) reported a net revenue of 3,790 billion VND and an after-tax profit of nearly 132 billion VND in Q4/2023, an increase of 116% and a change from a loss of 38.4 billion VND in the same period.

For the whole year of 2023, Vinaconex’s consolidated revenue increased by 50% compared to the same period, reaching over 12,700 billion VND. This is the highest revenue level of the company in 12 years (since 2012). However, the company still fell far short of its revenue target of 16,340 billion VND set for the entire year.

Despite the high net revenue, due to a decrease in financial revenue and additional costs, Vinaconex’s after-tax profit in 2023 was only over 336 billion VND, a decrease of 64% compared to the previous year, and the lowest level since 2013. This result corresponds to 39% of the annual profit target.

It must also be mentioned that 2023 was a successful year for Vinaconex in the construction bidding market, with winning multiple bid packages for the Long Thanh Airport project (packages 5.10, 4.6, 3.4), with a total contract value recorded at nearly 68,000 billion VND. As a result, the construction activities revenue of the company increased by 35.6% compared to the previous year, reaching nearly 8,300 billion VND, accounting for over 65% of the total revenue. In addition, the real estate business revenue also increased by 10.5 times to over 2,300 billion VND.

For Coteccons Joint Stock Company (code: CTD), in Q2 of the fiscal year 2024, which is equivalent to Q4 of 2023, the company’s profit continued to grow strongly by 266% compared to the same period, to 69 billion VND (the highest quarterly revenue since the beginning of 2021) despite a decline in revenue by more than 9%, to 5,660 billion VND.

Accumulated for 12 months in the Gregorian calendar of 2023, Coteccons had a net revenue of 16,524 billion VND, after-tax profit of 187 billion VND – marking the first time after 3 years that the company’s profit returns to a hundred billion VND.

According to the company’s explanation, the 266% increase in after-tax profit in Q2/2024 compared to the same period last year was mainly due to a decrease of 60.2 billion VND in the expenses of business management, equivalent to a 33% decrease compared to the same period, down to 122 billion VND. This decrease was mainly attributed to a 40.5 billion VND reduction in the provision for difficult collectible receivables, equivalent to 45.8% compared to the same period last year. In addition, the company’s restructuring efforts also contributed to optimizing management costs during the period.

Similarly, with Hung Thinh Incons Corporation (HTN), the profit in Q4/2023, although growing, did not come from the core business activities. In the period, the company’s revenue decreased by nearly 81% compared to the same period, to 236 billion VND. However, the after-tax profit still reached 32 billion VND, while in the same period it suffered a loss of nearly 45 billion VND.

In that period, the financial income of the company surged by 367% to over 93 billion VND. At the same time, the cost of sales and business management expenses also decreased by 43.5% to nearly 31 billion VND. This significant contribution helped improve the after-tax profit.

For the whole year 2023, the net revenue of Hung Thinh Incons was 2,681 billion VND, a decrease of 51% compared to 2022, and the after-tax profit reached nearly 60 billion VND, a decrease of 7%. In 2023, Hung Thinh Incons set a revenue target of 4,200 billion VND and an after-tax profit of 50 billion VND. Thus, the company achieved 64% of the revenue target but exceeded the profit target.

Reduced debt repayment, continued improvement of cash flow

Along with the gradual improvement in business results in the last quarter of the year, the financial situation of construction companies has also become less gloomy as their debts have significantly reduced compared to the beginning of the year, and the cash flow has remained positive.

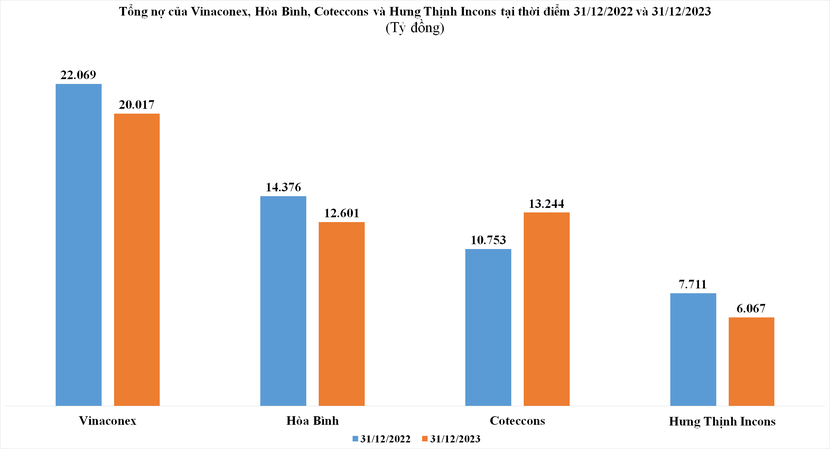

According to the data, Hoa Binh Construction’s total debt as of December 31, 2023, decreased by 1,775 billion VND compared to the beginning of the year, to 12,601 billion VND. In which, trade payables reduced by 370 billion VND (to 4,368 billion VND), short-term borrowings decreased sharply by 1,115 billion VND (to 3,989 billion VND), and long-term borrowings decreased by 298 billion VND (to 729 billion VND). In the past year, the company borrowed nearly 2,535 billion VND and repaid borrowings of 3,948 billion VND.

In addition, the company’s operating cash flow continued to maintain a positive level of 1,393 billion VND (compared to negative 883 billion VND in the same period).

The reduced debt repayment and owner’s equity have caused Hoa Binh Construction’s total capital as of the end of 2023 to decrease by nearly 2,540 billion VND compared to the beginning of the year, to 13,055 billion VND.

Similarly, Hung Thinh Incons’ total outstanding debt also decreased sharply by 1,643 billion VND, accounting for over 21% compared to the beginning of the year, to 6,067 billion VND. In which, short-term borrowings decreased by 1,129 billion VND, mainly due to a reduction in borrowings from banks and a 123 billion VND decrease in bond debt. However, during the period, the company generated additional long-term borrowings of 643 billion VND, compared to none at the beginning of the year.

Hung Thinh Incons’ operating cash flow reached 260 billion VND at the end of Q4/2023, compared to negative 1,019 billion VND at the end of 2022.

By the end of Q4/2023, Vinaconex had also reduced its total outstanding debt by over 2,000 billion VND compared to the beginning of the year, to over 20,000 billion VND. In which, long-term debt decreased by 3,132 billion VND to 5,036 billion VND, while short-term debt increased by 683 billion VND to 6,028 billion VND.

The operating cash flow of the company remained positive at over 3,300 billion VND until the end of Q4/2023, compared to negative 1,767 billion VND in the same period.

In contrast, for Coteccons, the total outstanding debt as of December 31, 2023, slightly increased by 141 billion VND compared to the end of June 2023, to 13,244 billion VND. However, the short-term borrowings of the company decreased by 115 billion VND to 582 billion VND, while long-term borrowings remained nearly unchanged at around 500 billion VND.

The company’s operating cash flow, which returned to positive in the 2023 fiscal year, continued to maintain a positive level in the first two quarters of the 2024 fiscal year, reaching 536 billion VND, compared to negative 329 billion VND in the same period.

It can be seen that the overall business results of the construction industry in 2023 are still facing many difficulties, but there have been more positive signals in the last months of the year, providing a basis for setting better business results in 2024.

Therefore, Hoa Binh Construction Corporation set a target to achieve a revenue of 10,800 billion VND in 2024 (an increase of 43% compared to the result in 2023) and an after-tax profit of 433 billion VND, equivalent to 2019, the year before the COVID-19 pandemic.

Or Coteccons, for the fiscal year 2024 (July 1, 2023 – June 30, 2024), the company set a consolidated revenue target of 17,793 billion VND and a consolidated after-tax profit of 274 billion VND, an increase of 2.6 times and 5 times compared to the fiscal year 2023 (January 1, 2023 – June 30, 2023). After two quarters of the 2024 fiscal year, Coteccons has achieved 55% of the revenue plan and nearly 50% of the profit target for the whole year.