According to the Prosperity Report published by real estate consulting firm Knight Frank in 2024, Vietnam had 752 ultra-high-net-worth individuals in 2023. The report predicts that this number will reach almost 1,000 by 2028, an increase of over 30%.

As a result, priority banking services have become popular in Vietnam in recent years, targeting high-income individuals with specialized and premium needs. While priority customers may not make up the majority of a bank’s clientele, they can bring significant financial value to the institution. However, becoming a VIP customer comes with a set of different criteria.

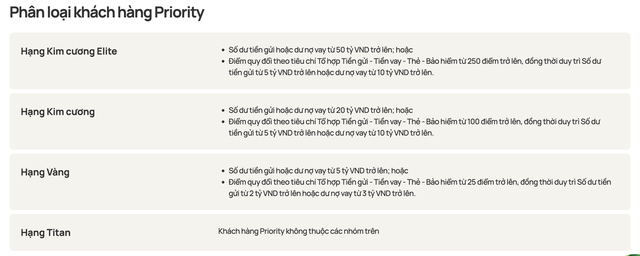

To become a priority customer of Vietcombank, individuals must meet a range of conditions related to deposits, loans, insurance, card spending, income, and more. There are four priority customer tiers with varying criteria.

For the Gold tier, customers need to meet one of two conditions: have deposits or loans of 5 billion VND or more, or achieve a combined score of 25 points or more according to the criteria of the Deposit-Loan-Card-Insurance Composite, while maintaining deposits of 2 billion VND or more or loans of 3 billion VND or more.

The Diamond tier has similar requirements, with customers needing deposits or loans of 20 billion VND or more, or a combined score of 100 points or more, while maintaining deposits of at least 2 billion VND or loans of at least 10 billion VND.

The Diamond Elite tier, on the other hand, requires customers to have deposits or loans of 50 billion VND or more, or a combined score of 250 points or more, along with maintaining deposits of at least 5 billion VND or loans of at least 10 billion VND.

Another major player in the Big 4, VietinBank, categorizes its priority customers into four tiers: Diamond, Platinum, Gold, and Silver. To qualify for these tiers, customers must meet requirements related to deposits, outstanding loans, and card payment turnover.

For the Silver tier, customers need to have deposits ranging from 500 million to 1 billion VND, outstanding loans averaging 1 to 2 billion VND over the previous three months, and a card payment turnover of at least 150 million to 500 million VND. The Gold, Platinum, and Diamond tiers have progressively higher requirements for deposits, outstanding loans, and card payment turnover.

|

Requirement |

Capital Mobilization |

Outstanding Loans |

Card Payment Turnover |

|

3-month average at VietinBank (including term deposits, non-term deposits, and VietinBank bond holdings) |

3-month average at VietinBank |

International credit card payment turnover of customers in the last 12 months |

|

|

1. Silver Tier |

From 500 million VND to under 1 billion VND |

From 1 billion VND to under 2 billion VND |

From 150 million VND to under 500 million VND |

|

2. Gold Tier |

From 1 billion VND to under 3 billion VND |

From 2 billion VND to under 3 billion VND |

From 500 million VND to under 1 billion VND |

|

3. Platinum Tier |

From 3 billion VND to under 5 billion VND |

From 3 billion VND to under 5 billion VND |

From 1 billion VND to under 2 billion VND |

|

4. Diamond Tier |

5 billion VND and above |

5 billion VND and above |

2 billion VND and above |

At BIDV, having a quarterly average balance of 1 billion VND or more is enough to qualify as a VIP customer. However, VIPs are further categorized into three tiers—Diamond, Platinum, and Gold—based on their quarterly average balance.

The Diamond tier requires a balance of 10 billion VND or more, the Platinum tier ranges from 3 billion to under 10 billion VND, and the Gold tier is for balances between 1 billion and under 3 billion VND.

At VPBank, to access priority banking services, customers need to meet basic requirements related to average asset value and account balance.

For the Pre-Diamond tier, customers must have a total average monthly asset value of 500 million to under 1 billion VND, and an average monthly balance on their payment account of 80 million to under 150 million VND.

The Diamond tier requires a total average monthly asset value of 1 billion to under 5 billion VND and an average monthly balance of 150 million to under 500 million VND.

For the highest tier, Diamond Elite, customers must have a total average monthly asset value of at least 5 billion VND, along with an average monthly balance of 500 million VND. VPBank also accepts equivalent amounts in foreign currencies for these requirements.

At Techcombank, becoming a priority customer entails meeting one of two conditions: maintaining an average asset balance of 1 billion VND or more for the last three consecutive months (including payment accounts, savings accounts, bond investments, and fund certificates), or having a total financial relationship value of 2 billion VND or more with Techcombank and meeting the requirements for maintaining an average balance in the payment account.

The total financial relationship value is calculated based on the average asset value over the last three months, including term deposits, non-term deposits in the payment account, bond investments, and fund certificates.

Along with the stringent deposit requirements, being a priority customer at these banks comes with exclusive privileges that are far more attractive than those offered to regular customers.

These privileges focus on priority service, preferential pricing, and dedicated customer care teams. Some banks even offer specialized investment products that provide better returns than traditional options.