The family of Ms. Nguyen Thi Kieu Vy in Kien Hung Ward, Ha Dong District, Hanoi, was delighted to receive a preferential loan of 600 million VND from the Social Policy Bank to purchase social housing. (Photo: Vietnam+)

|

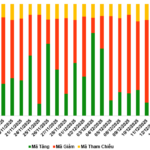

According to Decree No. 100/2024/ND-CP, from August 1, 2024, the Social Policy Bank implemented an interest rate increase for loans to purchase, lease-purchase social housing and housing for the armed forces, and for construction or renovation of houses, from 4.8%/year to 6.6%/year. This adjustment aims to ensure the sustainability of the lending program and reduce the burden on the state budget.

Considering Multiple Perspectives

Decree No. 100/2024/ND-CP, effective from August 1, 2024, details a number of articles in the Housing Law related to the development and management of social housing. It has brought about notable changes regarding social housing loans.

One significant change is the adjustment of the interest rate in line with the lending rate for poor households as stipulated by the Prime Minister for each period. The interest rate for overdue debts is set at 130% of the regular lending rate. This means that with the current lending rate for poor households at 6.6%/year, the interest rate for social housing loans at the Social Policy Bank has increased by 1.8% compared to before.

According to Mr. Huynh Van Thuan, Deputy General Director of the Social Policy Bank, this lending rate has been thoroughly evaluated and calculated by competent authorities during the process of drafting the Decree. The draft Decree was widely consulted with ministries, sectors, localities, and people for completion and appraisal before being submitted to the Government for issuance in accordance with regulations.

Commenting on the new adjustments, Mr. Nguyen Quoc Hung, Secretary-General of the Vietnam Banks Association, stated that the approval of the 6.6%/year interest rate was carefully considered to balance multiple factors. Mr. Hung emphasized that this policy should be viewed from a long-term stability perspective, with a loan term of up to 25 years.

Transaction at the Social Policy Bank. (Photo: Vietnam+)

|

According to a report by the Social Policy Bank as of July 31, 2024, after nearly 10 years of implementing social housing loans under the 2014 Housing Law, Decree No. 100/2015/ND-CP, and Decree No. 49/2021/ND-CP, the bank has disbursed 20,894 billion VND to more than 49,000 customers, with outstanding loans of 17,263 billion VND for nearly 46,000 customers.

The policy credit for social housing has helped over 49,000 low-income people, workers, and their families to own social housing units and contributed to the construction of over 49,000 houses, ensuring “stable residence, successful career,” and peace of mind in labor, production, and economic development.

Considering Adjustments Based on Practicality

Carefully calculated to maintain the sustainability of the program and reduce the burden on the state budget, experts also emphasize the need for a stable long-term policy.

Dr. Nguyen Tri Hieu, an economic expert, assessed that the 6.6%/year interest rate is relatively attractive. He emphasized the need to fix this interest rate for many years to provide stability for borrowers. Dr. Hieu cited the example of the US, where the mortgage interest rate can be as high as 7.5%/year but is fixed for 30 years, allowing borrowers to plan their finances for the long term without worrying about interest rate fluctuations.

A social housing project in District 2, Ho Chi Minh City. (Photo: Vietnam+)

|

Regarding the diverse opinions on the adjustment of the social housing loan interest rate under Decree No. 100/2024/ND-CP, Deputy General Director Huynh Van Thuan affirmed that as the implementing unit for the lending program, the Social Policy Bank would absorb the feedback and report it to the relevant ministries and sectors. Subsequently, a report will be submitted to the Government and the Prime Minister for consideration and decision-making.

The Social Policy Bank also committed to continuing to focus on implementing the social housing lending program, ensuring compliance with the Government’s regulations in Decree No. 100/2024/ND-CP, including the provisions on interest rates./.

|

Subjects eligible for preferential loans to purchase, lease-purchase social housing and housing for the armed forces, and for construction or renovation of houses according to Decree No. 100/2024/ND-CP: – Individuals with meritorious services to the revolution and family members of martyrs who are eligible for support to improve their housing conditions as specified in the Ordinance on Preferential Treatment of Individuals with Meritorious Services to the Revolution. – Poor and near-poor households in rural areas. – Poor and near-poor households in rural areas regularly affected by natural disasters and climate change. – Poor and near-poor households in urban areas. – Low-income individuals in urban areas. – Workers and employees working in enterprises, cooperatives, and cooperative alliances inside and outside industrial parks. – Officers, non-commissioned officers, and other ranks of the armed forces; public security workers, civil servants, and public employees in the defense sector who are currently serving; individuals working in cryptography and other fields within the cryptography organization and receiving salaries from the state budget. – Public officials, civil servants, and public employees as defined by the Law on Public Officials, Civil Servants, and Public Employees. |

Bình Thuận’s Dragon Fruit: A New Path for Sustainable Agriculture and Reduced Emissions

The initial successes in growing dragon fruit and reducing greenhouse gas emissions, as well as carbon footprint tracking in Binh Thuan, are evidence that Vietnam has, is, and will be able to apply innovative approaches to develop sustainable agriculture, adapting to climate change…

Vietnam – One of the five small dragons in Asia ready to take off.

In recent years, Vietnam has gained increasing attention as a destination in the global supply chain strategy “China +1,” along with the four countries Philippines, Indonesia, India, and Thailand.