CASA Improvement Since the Beginning of the Year

According to statistics from the State Bank of Vietnam (SBV), as of May 2024, the total means of payment (excluding the issuance of securities purchased by other domestic credit institutions) exceeded 16 quadrillion dong. Of this, economic organizations’ deposits stood at nearly 6.7 quadrillion dong, a decrease of almost 2% compared to the end of 2023; while household deposits reached nearly 6.7 quadrillion dong, an increase of 2.8% from the previous year.

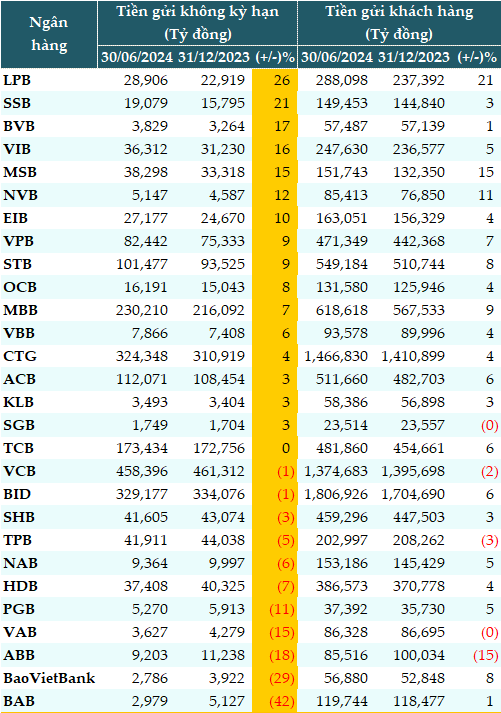

Data from VietstockFinance shows that as of June 30, 2024, the total customer deposits at 29 banks exceeded 10.3 quadrillion dong, a 5% increase from the beginning of the year. Of this, the total non-term deposits (CASA) were nearly 2.2 quadrillion dong, a 2% increase from the start of the year.

Out of the 29 banks, 17 showed an increase in CASA compared to the beginning of the year, with LPB witnessing the highest growth (+26%), followed by SSB (+21%).

On the other hand, banks that recorded a decrease in CASA did so at an average rate of 13%, including BAB (-42%) and BaoVietBank (-29%)…

As expected, state-owned banks led in terms of CASA volume. VCB topped the list with 458,396 billion dong, despite a 1% decrease; followed by BIDV at 329,177 billion dong, also down 1%; and VietinBank, which posted an increase of 4%, reaching 324,348 billion dong.

Among private banks, MBB maintained its leading position with 230,210 billion dong, a 7% increase, followed by TCB at 173,434 billion dong and ACB with 112,071 billion dong, a 3% increase.

|

CASA at banks as of June 30, 2024

Source: VietstockFinance

|

Half of the banks in the system increased their CASA ratio

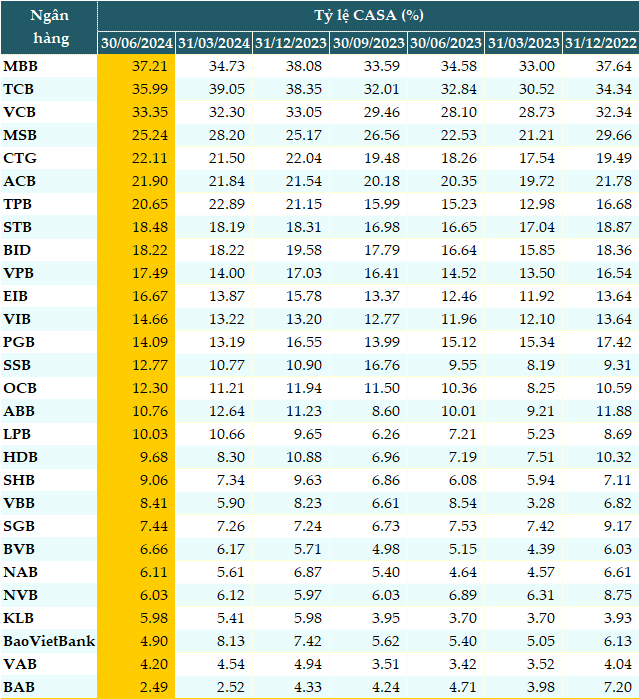

As of the end of the second quarter of 2024, 15 out of 29 banks recorded an increase in their CASA ratio compared to the beginning of the year, and 20 banks showed improvement from the first quarter.

MBB led the industry with a CASA ratio of 37.2%, despite a nearly 1-percentage point decrease from the start of the year. A representative from MB attributed this to their large customer base and digital transaction channels, which helped the bank save on funding costs and significantly enhance its business efficiency.

Following closely behind was TCB with 35.99%, a 2-percentage point decrease. In third place was VCB (33.35%), and in fourth was MSB (25.24%).

|

CASA Ratios at Banks

(Note: The CASA ratio in this article is calculated using the formula: CASA Ratio = Non-term Deposits / Customer Deposits)

Source: VietstockFinance

|

The improvement in CASA ratios at the end of the second quarter compared to the first quarter and the beginning of the year indicates that banks have attracted more non-term deposits. This could reflect several positive factors.

Firstly, it suggests an enhancement in customer confidence. Customers tend to keep more money in their transaction accounts, indicating their trust in the bank’s management and services. This is especially significant following the recent negative events in the banking sector, as it demonstrates the banks’ efforts in consolidating, building, and enhancing public trust.

Secondly, the increased adoption of digital transformation has improved payment, money transfer, and related services, encouraging customers to prioritize keeping their money in transaction accounts. Promotional programs and incentives for transaction accounts may have also played a role in attracting and retaining customers.

However, it’s important to note that the increase in the CASA ratio may not solely reflect improvements in banks’ deposit management. Factors such as changes in customer behavior or temporary market factors (such as low-interest rates on term deposits) could also influence this ratio. Additionally, considering the significant amount of household deposits in the banking system, amounting to 15 quadrillion dong, it appears that people are cautiously considering their options for using idle money for production, business, investment, real estate, securities, gold, etc. As a result, they are temporarily keeping their idle money in banks to ensure capital preservation.

Embracing Personal Financial Management to Boost CASA

Prof. Dr. Nguyen Huu Huan, Senior Lecturer at the University of Economics Ho Chi Minh City, assessed that while the CASA ratio has improved, it hasn’t shown significant strength, indicating that people’s capital usage is still relatively more “relaxed” than before.

To enhance their CASA, banks must focus on improving their services and developing digital banking and automatic payment methods. Currently, banks are leaning towards personal financial management, providing currency and financial management services to their customers. The bank that offers better services will attract more customers to their non-credit services, which will contribute to higher CASA.

Mr. Nguyen Quang Huy, CEO of the Faculty of Finance and Banking at Nguyen Trai University, suggested that banks should focus on the following strategies:

Firstly, banks need to enhance their digital banking services. Digital banks should link with payment services: Increase connections with e-wallets, online payment gateways, and other financial service providers to maximize convenience for customers in their daily transactions.

At the same time, mobile banking and internet banking applications should be improved to offer diverse, convenient, and secure features, enabling customers to easily perform daily transactions. Streamlining the account opening and transaction processes is also crucial. Additionally, it’s essential to link flexible online investment products while strictly adhering to legal regulations.

Most importantly, robust information security management and fraud prevention measures will instill confidence in customers, encouraging them to use and store their money in bank accounts.

Secondly, banks should enhance account benefits. They can offer incentives such as free money transfers and withdrawals or reduced account maintenance fees to encourage customers to use transaction accounts. Developing loyalty programs and offering reward points or cashback on transactions and purchases made through transaction accounts can also be effective.

Thirdly, banks should focus on expanding their financial ecosystem. By partnering with strategic allies and service providers in sectors like telecommunications, insurance, and retail, banks can offer integrated service packages to their customers. This not only creates added value but also helps maintain non-term deposit balances.

Banks need to broaden their personal financial services, offering diverse products and services such as credit cards, consumer loans, and insurance, thus becoming a one-stop shop for all their customers’ financial needs.

Effective marketing and communication strategies can also play a role in improving CASA. Developing financial education programs can help customers understand the benefits of using transaction accounts and electronic banking services. Leveraging big data analytics, in compliance with legal regulations, to study customer behavior and target the right audience for marketing campaigns can further enhance customer attraction and retention.

In conclusion, the increase in the CASA ratio is a positive sign that banks are improving their capital management efficiency, leading to reduced funding costs and increased profits. To continue attracting CASA, banks should focus on enhancing digital banking services, enriching account benefits, expanding their financial ecosystem, and implementing effective marketing strategies. By offering comprehensive financial consulting packages, including personal financial management and asset development advice, banks can not only maintain high CASA ratios but also build a stable and loyal customer base in the long term.

Prof. Dr. Dinh Trong Thinh, Economic Expert, added that improving CASA also depends on production, business, and the individual strategies of banks. When CASA increases, the amount of money deposited in banks also increases during the payment process. If enterprises perform well in production and business, with a good capital turnover, it will result in a positive CASA. Conversely, if enterprises face challenges in capital inflow and outflow, and their goods remain unsold, it will be difficult to achieve an increase in CASA.

Latest Military Bank (MB) interest rates for February 2024: Highest rates for terms of 36 months and above.

The highest deposit interest rate at Military Bank (MB) at the beginning of February 2024 is 6.1% per year.