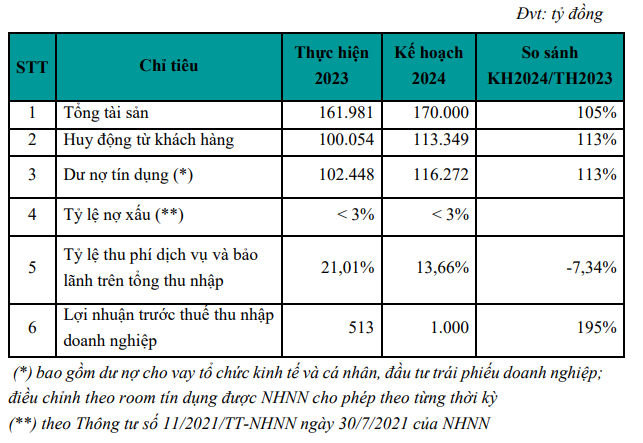

During the General Meeting, ABBank’s Board of Directors will present to shareholders a business plan with a target pre-tax profit of VND 1,000 billion, an increase of 95% compared to 2023. The total assets are expected to increase by 5% compared to 2023, reaching VND 170,000 billion. Customer deposits are projected to increase by 13% to VND 113,349 billion. Credit outstanding is set to increase by 13% to VND 116,272 billion.

In 2023, ABBank failed to achieve its business plan with a pre-tax profit of only VND 513 billion, which is only one-third of the profit in 2022 and only 18% of the plan for 2023.

The bank stated that due to the general difficulties of the economy, ABBank’s profit did not meet the set target. However, the bank had positive results in terms of overall growth, with the safety ratios being well-maintained according to regulations of the State Bank of Vietnam. By the end of 2023, ABBank had over 2.1 million individual and SME customers, an increase of 22% compared to 2023.

Regarding the profit distribution plan, ABBank proposed to leave the entire/undistributed remaining after-tax profit for 2023 after setting up funds to supplement capital for implementing strategic plans, accumulating internal resources to increase charter capital in the future.

Specifically, the after-tax profit of ABBank in 2023 was VND 398 billion. After setting up reserves, the remaining profit for 2023 is VND 298 billion. The undistributed profit from previous years is VND 1,542 billion. Therefore, the total undistributed profit is VND 1,840 billion.

Another topic at the General Meeting is the election of new members of the Board of Controllers. Specifically, at the 2023 General Meeting, the bank approved the number of ABBank’s Board of Controllers for the term 2023 – 2027 as 03 members, and also approved the election of the following individuals: Ms. Nguyen Thi Hanh Tam, Ms. Pham Thi Hang, and Ms. Nguyen Thi Thanh Thai as members of the Board of Controllers. As of January 18, 2024, Ms. Pham Thi Hang has submitted a resignation letter as a member of the Board of Controllers (specialized position) in accordance with her personal wishes, effective from the time of the General Meeting at which the dismissal was approved.

The expected personnel appointment as a member of the Board of Controllers to replace Ms. Nguyen Thi Thanh Thai is Mr. Nguyen Hong Quang, who is currently an advisor to ABBank’s Board of Controllers. Mr. Nguyen Hong Quang has a Master’s degree in Business Administration, a Bachelor’s degree in Monetary Banking and Accounting and Auditing, and has nearly 22 years of working experience at ABBank (from June 2002 until now), including nearly 5 years as the Director of the Small and Medium Enterprise Customers Division and a member of ABBank’s Management Board.