The central exchange rate turned downwards today (August 27) after increasing by four units in the first trading session of the week.

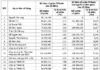

The central exchange rate between the Vietnamese Dong and USD on August 27 stood at 24,224 VND, a decrease of 30 VND compared to the previous day.

With a 5% margin, commercial banks are allowed to trade within a range of 25,435 VND/USD for the ceiling and 23,013 VND/USD for the floor.

Meanwhile, the State Bank of Vietnam’s Trading Centre continues to maintain the buying and selling reference rate at 23,400-25,450 VND/USD.

At commercial banks, the USD/VND exchange rate continued its sharp decline for the second consecutive session. The USD rate at some banks has dropped below the 25,000 VND/USD mark.

A survey at 14:45 today (August 27) revealed that VietinBank set the USD rate at 24,649-24,989 VND/USD (buying-selling), a decrease of 67 VND in both directions compared to the previous day’s opening (August 26).

Bank exchange rates witness a significant drop. Photo: Hoang Ha |

Vietcombank, on the other hand, set the cash buying rate at 24,630 VND/USD and the selling rate at 25,000 VND/USD, a decrease of 70 VND in both buying and selling rates compared to August 26.

Similarly, exchange rates at private joint-stock commercial banks also witnessed a rapid decline, with some banks dropping below the 25,000 VND/USD mark.

This afternoon, ACB’s cash buying rate was 24,630 VND/USD, while the selling rate stood at 24,990 VND/USD, an 80 VND decrease in both buying and selling rates compared to the previous day.

Techcombank’s buying and selling rates were recorded at 24,634 VND/USD and 25,025 VND/USD, respectively, a decrease of 58 VND in both directions compared to August 26.

Sacombank’s buying and selling rates were 24,660-25,000 VND/USD (buying-selling), a decrease of 70 VND in both directions compared to the previous day.

On the previous day, exchange rates at commercial banks dropped by more than 100 VND, with some banks reducing rates by up to 131 VND.

Consequently, from yesterday to today, the USD rate at many banks has decreased by nearly 200 VND.

In the unofficial market, money changers traded USD at a range of 25,150-25,300 VND/USD (buying-selling), a decrease of 50 VND in the buying rate and no change in the selling rate compared to the previous session.

Compared to the rates offered by commercial banks, the buying rate in the unofficial market is currently about 500 VND higher, while the selling rate is 300 VND higher.

In the global market, the USD is showing signs of recovery after a significant drop yesterday.

The US Dollar Index, which measures the strength of the greenback against a basket of major currencies, stood at 100.87 points at 15:25 on August 27 (Vietnam time), an increase of 0.02% from the previous session.

The appreciation of the USD comes amidst rising geopolitical tensions in the Middle East, prompting investors to seek safe-haven assets.

Hanh Nguyen

Declining USD Prices: Banks and Free Market Suffer Declines

Approaching Tet holidays, the USD price in banks and the free market dropped significantly, despite the international USD index maintaining a high level.

Easier mortgage interest rates

Starting from the beginning of the year, banks have been implementing various low-interest credit packages, offering loans to pay off debts from other banks… with the aim of stimulating the demand for home loans.