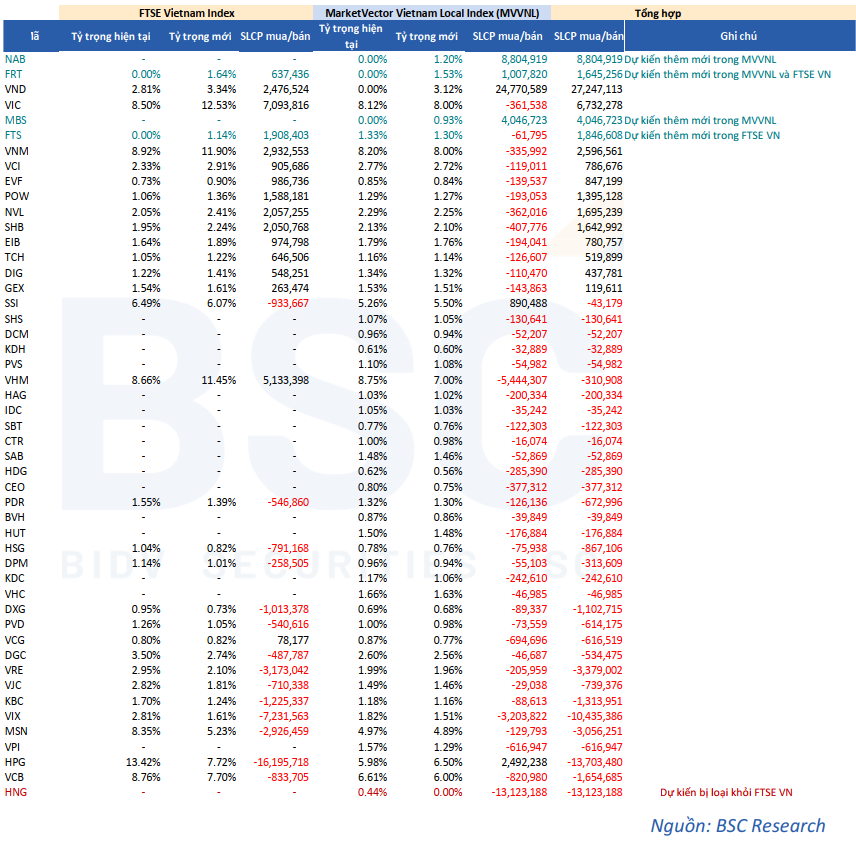

BSC Research forecasts that the FTSE ETF will welcome the “FPT duo,” FRT and FTS, in the Q3 review. Meanwhile, the VNM ETF may add NAB, FRT, and MBS while deleting HNG.

With this forecast, BSC estimates that these two ETFs, worth $790 million, will purchase 8.8 million NAB shares, 1.6 million FRT shares, and 4 million MBS shares. Additionally, VND, VIC, and VNM are also expected to be bought in large quantities by these two ETFs.

On the other hand, HPG and VIX may face significant selling pressure, with an expected 13.7 million and 10 million shares sold, respectively.

However, BSC Research notes that these figures may deviate due to data update timings, free-float ratios, and investment weights.

|

Buy/Sell Forecast for FTSE ETF and VNM ETF

|

|

On September 6, FTSE is expected to announce the constituent stocks of the FTSE Vietnam All-share Index and the FTSE Vietnam Index. On September 13, MarketVector will announce the Marketvector Vietnam Local Index. September 20 is expected to be the final day for the complete restructuring of the portfolios of ETFs referencing these indices. |

World Mobile slashes workforce, FPT Retail takes advantage and hires thousands of salespeople

The year 2023 has been challenging for Thế Giới Di Động and FPT Retail, and they have chosen different ways to regain growth momentum.