VCF shares of Vinacafé Bien Hoa Joint Stock Company (VCF) surged to the maximum daily limit of 233,200 VND per share at the start of Monday’s trading session. This sharp increase pushed the stock out of its recent stagnant state and into the highest peak in the past five months.

Meanwhile, VCF’s rise also solidified its position as the most expensive stock on the HOSE, far surpassing the 189,000 VND of the second-placed stock, FRT. The market capitalization also improved significantly to nearly 6,200 billion VND.

Despite the significant price movement, VCF’s liquidity did not see much improvement. The average matched volume over the last 10 sessions was less than 1,000 units, with 2,300 shares traded in the session on August 26 alone.

The concentrated shareholder structure is the reason behind VCF’s consistently low liquidity. Specifically, 98.79% of the company’s capital is owned by Masan Beverage Company Limited – a subsidiary of the Masan Group (MSN code). Currently, the volume held by small shareholders is only about 320,000 shares.

VCF’s upward momentum was triggered after the company announced the ex-dividend date for the 2023 cash dividend with a ratio of 250%, equivalent to 25,000 VND per share. The ex-dividend date is September 9, with expected payment on September 20.

With nearly 26.6 million shares circulating, Vinacafé Bien Hoa will spend nearly 650 billion VND on dividends. With the holding of more than 26.3 million shares (equivalent to 98.79% ownership), Masan Beverage Company Limited will receive more than 642 billion VND.

Vinacafé Bien Hoa is known for its tradition of consistently paying high cash dividends to shareholders. In recent years, Vinacafé Bien Hoa has consistently paid out cash dividends of 240-250% to its shareholders, and in 2018, the company went big by paying out a massive 660% cash dividend.

Established in 1963 as Bien Hoa Coffee Company, Vinacafé Bien Hoa has become one of the leading manufacturers of instant coffee in Vietnam after more than 60 years of development.

Vinacafé Bien Hoa has a strong brand reputation with well-known coffee products such as Vinacafe and Wake-up. The company also boasts a modern manufacturing facility with an annual production capacity of up to 50,000 tons.

Masan Beverage Company Limited made its presence known in Vinacafé Bien Hoa back in 2011 when Masan implemented a strategy to acquire shares from major shareholders, gradually increasing its ownership to over 50%. By February 2018, Masan Beverage had increased its stake in Vinacafé Bien Hoa to 98.49%. Subsequently, Masan Beverage has made several attempts to purchase the remaining VCF shares to reach 100% ownership but has been unsuccessful.

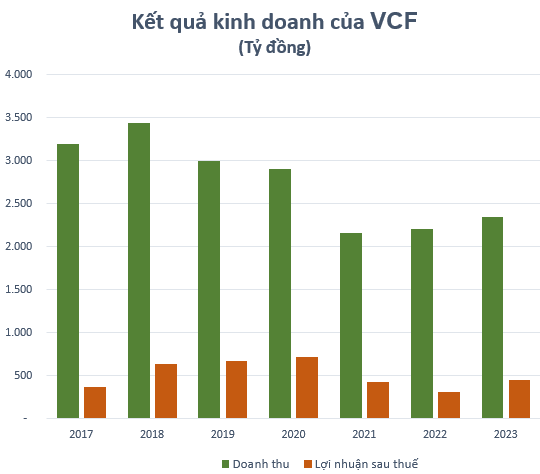

The attractive dividend policy has been consistently maintained thanks to the company’s stable business performance. During the 2018-2020 period, VCF’s annual revenue exceeded 3,000 billion VND, with after-tax profits consistently ranging from 600 to 700 billion VND. From 2021 to the present, revenue has decreased to approximately 2,000 billion VND, while after-tax profits have been steadily maintained at over 300 billion VND per year.

Looking back at 2023, VCF recorded a 7% increase in net revenue to 2,353 billion VND and a 41% jump in after-tax profit to 450 billion VND compared to the previous year.

In the second quarter of 2024, the company reported a slight 4% year-on-year increase in net revenue to 578 billion VND. After expenses, Vinacafé earned 98 billion VND in after-tax profit, a 20% decrease compared to the same period last year. The company attributed the profit decline mainly to higher input material costs, which outpaced revenue growth.

For the first six months of the year, Vinacafé’s net revenue reached 1,062 billion VND, and after-tax profit stood at 186 billion VND. Thus, the company has achieved 42.5% of its revenue target (2,500 billion VND) and nearly 40% of its profit goal (470 billion VND) in the lower-end scenario. In the higher-end scenario, the company has completed approximately 38% (2,800 billion VND) of its revenue target and 37% of its profit plan (500 billion VND).