An uneven pace marked the afternoon session, with the market’s performance hinging on the ability of large-cap stocks to improve their prices. Turnover in the VN30 basket dropped by 32% compared to the morning session, while the HoSE exchange witnessed a 6.3% decline, indicating that bottom-fishing funds remained cautious.

After much volatility, the VN-Index finally closed above the reference level by 0.54 points (+0.04%). The VN30-Index fared slightly better, ending with a gain of 0.28% (+3.68 points), with 11 gainers and 14 losers. This afternoon’s performance was a significant improvement from the morning session, which saw only 6 gainers and 19 losers, resulting in a 0.1% decline for the index.

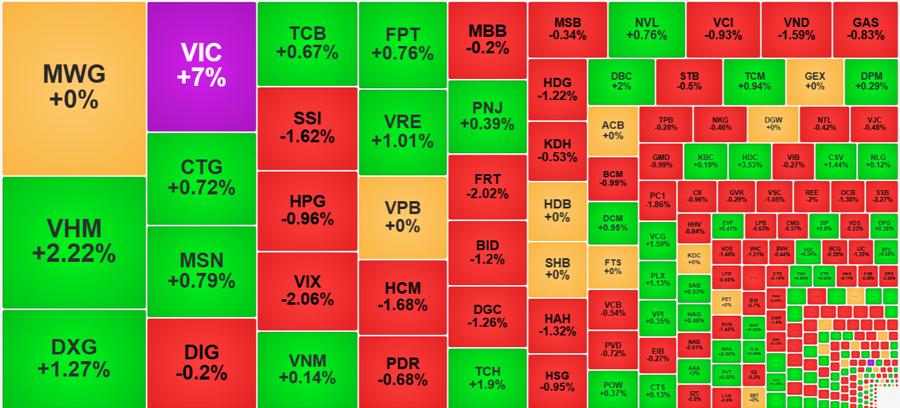

This afternoon, 18 stocks in the VN30 basket advanced, while 8 declined compared to the previous session’s close. VIC, of course, was the most notable stock, finally shaking off its ceiling sell orders and closing at the highest price, up 7%. This was the second time this stock hit the ceiling in 2024, after the session on February 19. VIC traded an additional VND103.4 billion in the afternoon before its liquidity dried up, leaving a buy order of 853,000 units at the ceiling price. For the entire day, VIC matched 12.75 million shares worth VND567 billion, the second-highest figure since the beginning of the year, following the session on February 19. VIC’s ceiling price gain contributed 2.8 points to the VN-Index and nearly 3.4 points to the VN30-Index. In summary, VIC single-handedly supported both indices.

In terms of gainers this afternoon, VIC managed to climb just one more tick at the end of the session. The three stocks that staged the most impressive reversals were MWG, recovering 2.72% to return to the reference price; CTG, up 1.6%, reversing to a 0.72% gain; and MSN, up 1.45%, ending the day with a 0.79% gain. Other stocks generally recovered but with limited margins, preventing the VN-Index from breaking out.

Turnover in the VN30 basket fell sharply by 32% in the afternoon session to VND2,891 billion, the lowest in eight sessions. As a result, the basket’s turnover for the entire session was still about 5% lower than the previous session. Nonetheless, the VN30 basket accounted for 49.4% of the total matched orders on the exchange. Midcap and Smallcap groups saw declines in trading activity of 20% and 18%, respectively.

On the HoSE exchange, turnover in the afternoon session also decreased by 6.3%. Including the HNX exchange, the decline was 5.2%. The decrease in turnover made the late recovery less convincing. Nevertheless, the presence of supporting pillars provided undeniable assurance. Even weak performers like VCB, GAS, BID, and VPB managed to recover slightly from the morning session, with some even reversing to trade above the reference price.

The rest of the market also witnessed slight price recoveries. At the end of the morning session, the VN-Index recorded 91 gainers and 278 losers, but at the close, there were 169 gainers and 235 losers. However, due to limited funds, the recovery margins were not impressive. While there were more green stocks, the gains were modest. Of the 169 stocks mentioned above, only 51 rose more than 1%, with the vast majority trading in small volumes (15 stocks matching VND10 billion or more). In addition to VHM, VIC, and VRE, notable mentions include DXG, up 1.27%; TCH, up 1.9%; DBC, up 2%; HDC, up 2.53%; CSV, up 1.44%; VCG, up 1.59%; and PLX, up 1.13%. These stocks had liquidity of over VND50 billion.

As expected, the losers fared worse. While several stocks managed to reverse course and many others narrowed their losses, 82 stocks still fell by more than 1% (compared to 100 stocks at the end of the morning session). SSI, VIX, HCM, FRT, BID, DGC, VND, and HDG all traded in the billions with significant declines.

Foreign investors net bought this afternoon, although it did not fully offset the morning session’s net selling. Still, it reduced the total trading position for the day to VND259.6 billion. In the afternoon session alone, they net bought VND113.9 billion. Notable stocks that were net bought included FPT (VND121.6 billion), MWG (VND80 billion), VIC (VND64.1 billion), CTG (VND60.1 billion), DXG (VND35.4 billion), and TCH (VND20.7 billion). On the selling side, TLG stood out with VND117.2 billion sold since the morning, followed by HPG (VND83.5 billion), VPB (VND60.7 billion), FRT (VND43.6 billion), KDH (VND32.1 billion), PVD (VND21.6 billion), and HDG (VND30.4 billion).

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.