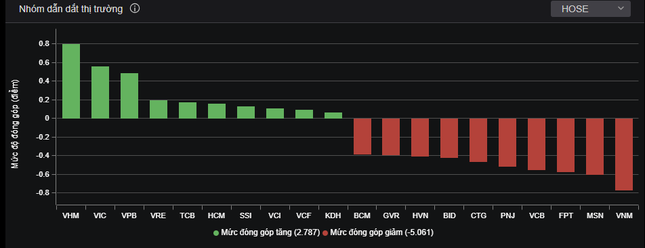

VN-Index closed at the lowest point of the session, with selling pressure on small- and mid-cap stocks, as well as the large-cap VN30. Within the VN30 basket, the representative index only fell by 2.5 points, but 21 out of 30 stocks declined. VNM, MSN, VCB, and PNJ were among the most negatively traded tickers. The banking sector, which usually leads and influences the market, witnessed a unanimous drop in its constituents. On the HoSE, only VPB and TCB ended in positive territory.

Real estate stocks also painted a gloomy picture, with high-liquidity tickers such as DIG, DXG, and HDG all trading in the red. Conversely, the VIC, VHM, and VRE trio remained resilient, playing a pivotal role in market sentiment. However, their gains were modest, hovering around 1%, and thus unable to prevent the VN-Index from undergoing a corrective session.

The Vingroup’s stocks’ effort to prop up prices proved futile against the VN-Index’s downward trajectory.

Stocks in the securities, steel, oil & gas, and construction sectors also exhibited a lack of enthusiasm. The securities sector witnessed rare bright spots in large-cap stocks like HCM, SSI, and VND, while the rest languished in the red.

The Ho Chi Minh Stock Exchange (HoSE) announced that August 22nd marked the effective date for the change in listing status of over 304 million VND shares. Of these, nearly 295 million shares will be credited to investors’ accounts, becoming eligible for trading from September 4th onward. The remaining shares, amounting to over 9.5 million, were unclaimed by shareholders and will be allocated to other investors, subject to a one-year lock-up period. The trading date for these shares is scheduled for July 14, 2025.

Following this issuance, VNDirect has officially surpassed SSI in terms of chartered capital, becoming the securities firm with the largest capital base in the market. However, since the shareholder rights registration deadline, VNĐ shares have declined by 13% in just three months.

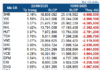

At the close of the trading session, the VN-Index fell by 5.3 points (0.41%) to 1,280.02 points. The HNX-Index dropped by 1.1 points (0.46%) to 238.97 points, while the UPCoM-Index shed 0.25 points (0.26%) to close at 94.16 points. Liquidity climbed, with the HoSE’s matched orders surpassing VND 16,500 billion. Foreign investors net sold over VND 420 billion, focusing on HPG, HSG, VPB, and PVD, among others.

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.