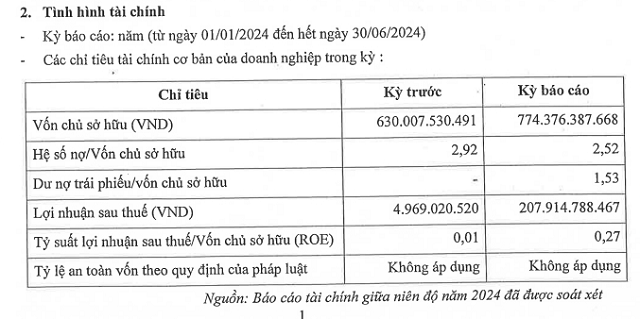

According to the financial report submitted to the Hanoi Stock Exchange (HNX), as of Q2 2024, the equity of BOT Ninh Thuan Company Limited reached VND 774 billion, a 23% increase compared to the same period last year. Its total liabilities exceeded VND 1,900 billion, a slight increase of 6%. Bond debt stood at VND 1,185 billion, while there was none in the previous period. With a post-tax profit of VND 208 billion, the return on equity (ROE) rose from 1% to 27%.

Source: BOT Ninh Thuan

|

Data from HNX also revealed that BOT Ninh Thuan issued a single bond lot with the code BNTCH2433001, raising VND 1,200 billion through a private placement completed on January 29, 2024. The bond has a tenor of 117 months, maturing on October 29, 2033, and carries a fixed interest rate of 10.5% per annum. This unsecured, non-convertible bond, which does not come with warrants, is wholly owned by its parent company, Ho Chi Minh City Infrastructure Investment JSC (HOSE: CII).

On April 15, a subsidiary of CII repurchased VND 15 billion of the bond before its maturity, leaving VND 1,185 billion in circulation.

BOT Ninh Thuan primarily focuses on investing in the BOT project to expand National Highway 1 through Ninh Thuan Province. CII indirectly holds a 54.84% stake in BOT Ninh Thuan through CII Bridge and Road Investment JSC (CII B&R, HOSE: LGC), giving it 100% voting rights.

The positive performance of BOT Ninh Thuan was also reflected in the financial results of its parent company, CII. The latter reported a net profit of VND 265 billion, a sixfold increase year-over-year, despite flat revenue of nearly VND 1,600 billion. The difference in revenue was attributed to toll road operations, which generated VND 1,300 billion, almost double that of the first half of last year.

CII also recognized an additional VND 150 billion in financial income from the BOT project for expanding National Highway 1A through Ninh Thuan Province, specifically the Ca Na toll station project undertaken by its subsidiary, BOT Ninh Thuan. This included profit retention and the interest rate differential between the company’s actual loan interest rate and the packaged loan interest rate specified in the signed BOT contract. As per the contract, the government committed to repaying these amounts to the investor through toll collection for traffic infrastructure projects.

| Net profit and financial revenue of CII for the first half of 2008-2024 |

Another CII subsidiary, Hanoi Highway Investment and Construction Joint Stock Company, recently reported its principal and interest payments for the first half of 2024. The company paid VND 13.7 billion in interest on the single bond issue from February this year. This bond, valued at VND 550 billion, was issued to the parent company, CII, with a maturity date in November 2033 and a fixed interest rate of 10.1% per annum. As per the terms, a minimum of VND 115 billion must be repurchased between the 49th and 60th months from the issuance date.

On July 18, 2024, Hanoi Highway repurchased VND 25 billion of the bond before its maturity, leaving VND 525 billion in circulation.

CII’s subsidiary, Hanoi Highway, issues VND 550 billion in bonds