These pioneering steps also contribute to the comprehensive financial strategy formulated by the Government and the State Bank of Vietnam.

According to statistics from Merchant Machine over two years ago, Vietnam ranked second in the world in terms of the percentage of unbanked population. However, on the digital transformation day in 2023, a representative of the State Bank of Vietnam affirmed that about 74.63% of Vietnamese adults now have a bank account, with more than 70% of new accounts opened in rural and remote areas.

The Importance of Tier-2 Cities for Economic and Social Development

Tier-2 cities are a type of urban classification in Vietnam’s urban classification system. They are medium-sized and small cities that play a crucial role in a country’s economic and social development.

These cities are usually economic, cultural, and administrative centers of provinces and cities, housing a large population and a diverse range of economic activities. The development of Tier-2 cities helps balance regional development, creates job opportunities, and improves the quality of life for residents.

Improving access to banking services, especially in rural areas and Tier-2 cities, has long been a core priority of Vietnam’s financial development policies. In the past, traditional commercial banks often did not expand their networks sufficiently in these areas, mainly due to high investment costs, limited local human resources, and geographical challenges restricting access.

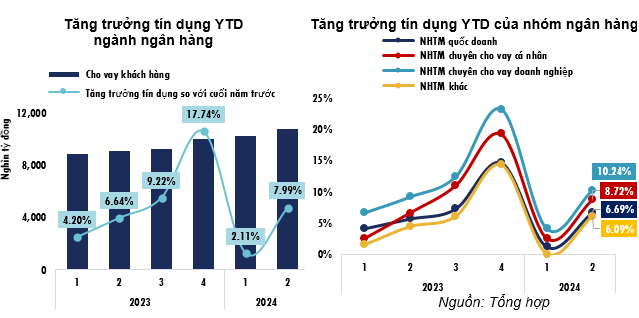

However, in recent years, recognizing the potential of this “fertile ground” and the growing strengths of banks, many financial institutions have actively expanded their customer base into Tier-2 cities. This expansion plays a key role in meeting the financial needs of the people, designing and developing suitable products and services for customers in these areas. Conversely, the robust development of these market areas has further attracted commercial banks.

A Breakthrough Move for Many Banks to Accelerate Customer Acquisition

Over a decade ago, as the banking industry faced a restructuring trend, HDBank and DaiABank voluntarily merged, becoming a successful case study in the industry’s M&A activities.

At that time, HDBank, with its stable customer base in urban areas, and DaiABank, with its strong rural customer base in the Southeast region, joined forces to expand their network and customer reach.

The Southeast region, endowed with favorable conditions for industrial and service sector development, also became one of the first “cradles” for HDBank to grow its agricultural and rural customer base. This region is characterized by abundant land resources suitable for Vietnam’s key crops, such as rubber and coffee. Along with crop cultivation, livestock, poultry, and aquaculture industries, especially shrimp and fish farming in coastal provinces, have presented significant opportunities for HDBank to develop its target customer segments and tailored financial products and services.

By organizing direct marketing campaigns in the region, cultivating a strong network of collaborators, enhancing customer care, and designing specific products and services for these customer segments, HDBank has successfully bridged the gap with agricultural and rural customers.

In 2023, after establishing separate websites for all 63 provinces to cater to the unique needs of each region, the bank launched the HDBank Nông thôn app, exclusively designed for customers in the agricultural and rural sectors. By the end of that year, the number of new digital customers had increased by 58% compared to the previous year, surpassing the number of new customers acquired through traditional channels.

As of now, alongside the “Big 4” state-owned banks—Agribank, Vietcombank, BIDV, and VietinBank—HDBank is one of the few commercial banks with a nationwide presence in all 63 provinces and cities.

Building on its solid foundation, HDBank has continuously expanded its network, particularly targeting rural and Tier-2 city customers with preferential loan packages and customized financial solutions.

Consequently, the agricultural and rural lending market has become a significant part of HDBank’s credit structure, accounting for 33% of its total individual outstanding loans. In terms of credit, agricultural and rural customers make up 42.9%, the largest proportion across all products.

In addition to expanding and maintaining its credit portfolio, developing this customer segment has helped HDBank mitigate risks during economic downturns. The low non-performing loan ratio in agricultural and rural lending is attributed to the small-scale nature of these loans, which diversifies risk and reduces the likelihood of payment defaults.

“Our roots in the agricultural and rural segments date back more than a decade, and this strength has continued to increase HDBank’s market share,” a representative of HDBank once shared.

Alongside HDBank, Agribank remains the traditional “pioneer” in implementing the national comprehensive financial strategy, particularly in these regions and markets. Evidently, Agribank’s outstanding loans for agricultural and rural development consistently account for 70% of its total outstanding loans in the Vietnamese economy, a significant proportion of the nearly VND 2 quadrillion in the agricultural and rural lending market.

Agribank’s role as a “pioneer” has been internationally recognized as an effective poverty reduction model through the implementation of seven policy credit programs and two national target programs on new rural construction and sustainable poverty reduction. This has contributed to Vietnam achieving the Millennium Development Goal on poverty reduction a decade ahead of schedule.

Not only Agribank and HDBank but also LPBank has been one of the banks leading the trend of developing the rural market. LPBank’s leadership shared: “With a presence in every district, LPBank will be well-positioned to capture the rural market trend, a key focus area where we have built a strong advantage over the years.”

LPBank continuously expands its network of traditional transaction offices across all 63 provinces and cities. Their strategy combines online and offline approaches to create a synergistic effect, fostering sustainable development and increasing customer acquisition and cross-selling opportunities.

“The uniqueness of Vietnam’s rural areas lies in their regional characteristics. Therefore, it is crucial to design products that fit the needs of customers in each locality and industry, rather than solely focusing on customer segments. Additionally, we must pay attention to technology application, ensuring simplicity, convenience, and ease of use, along with a personalized experience that caters to the specific needs of these regions,” shared a representative of LPBank.

Choosing the Right VND Bank Partner: A Shift for FDIs

The influx of FDI into Vietnam presents a significant opportunity for the economy as a whole and, more specifically, for the banking sector. With their deep understanding of the local market, culture, and people, domestic banks are ideally positioned to support and facilitate the expansion and growth of FDI enterprises in the region. This unique advantage enables them to foster the development of the local economy and strengthen their own position in the process.