“With sufficient scale, a few trillion in profits will emerge, and that’s when Bach Hoa Xanh (BHX) will be ready to go public,” emphasized Mr. Nguyen Duc Tai, Chairman of the Board of MWG, at the annual general meeting in April this year.

Equally confident, Mr. Pham Van Trong, CEO of BHX, shared his belief that a four-digit profit figure could be achievable within the next one to two years. At that time, BHX had just incurred additional losses in the first quarter of 2024, bringing its cumulative losses to over 8 trillion VND. Despite positive changes, many investors remained skeptical about the management’s confidence.

Four months later, BHX officially turned a profit in the second quarter after raising its average revenue to a record 2.1 billion VND per store per month. Immediately, this MWG-owned chain resumed its expansion plans after a temporary halt. The story became clearer, and the feasibility of the CEO’s statement was highly regarded.

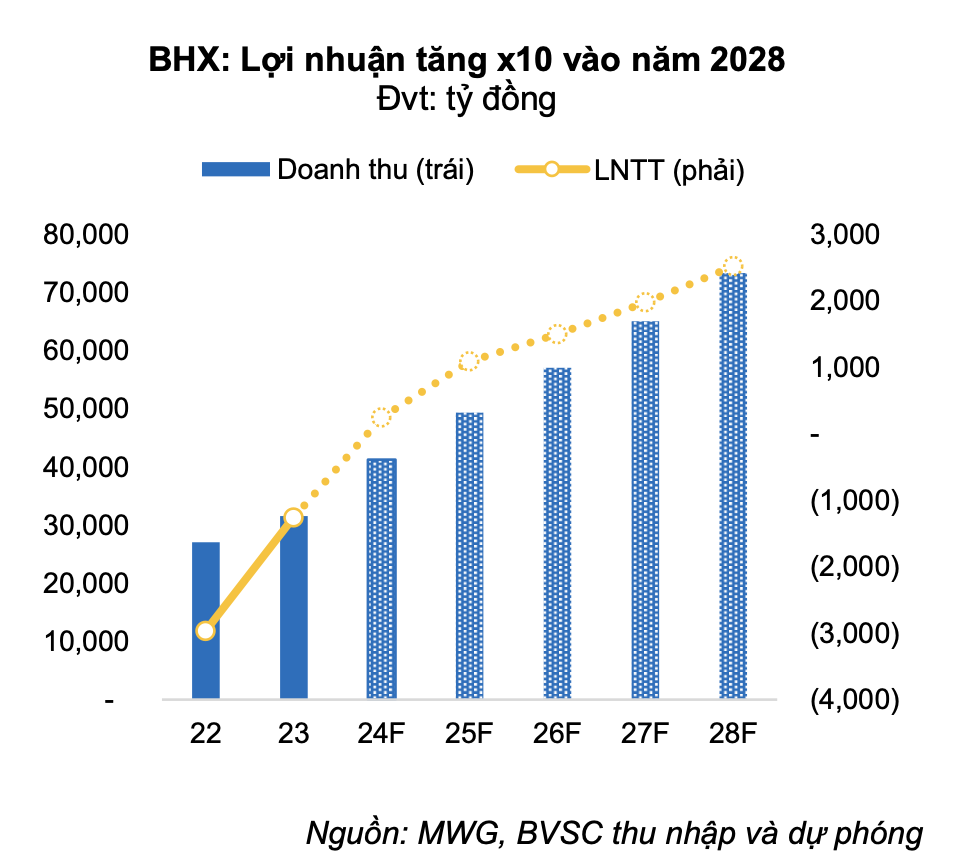

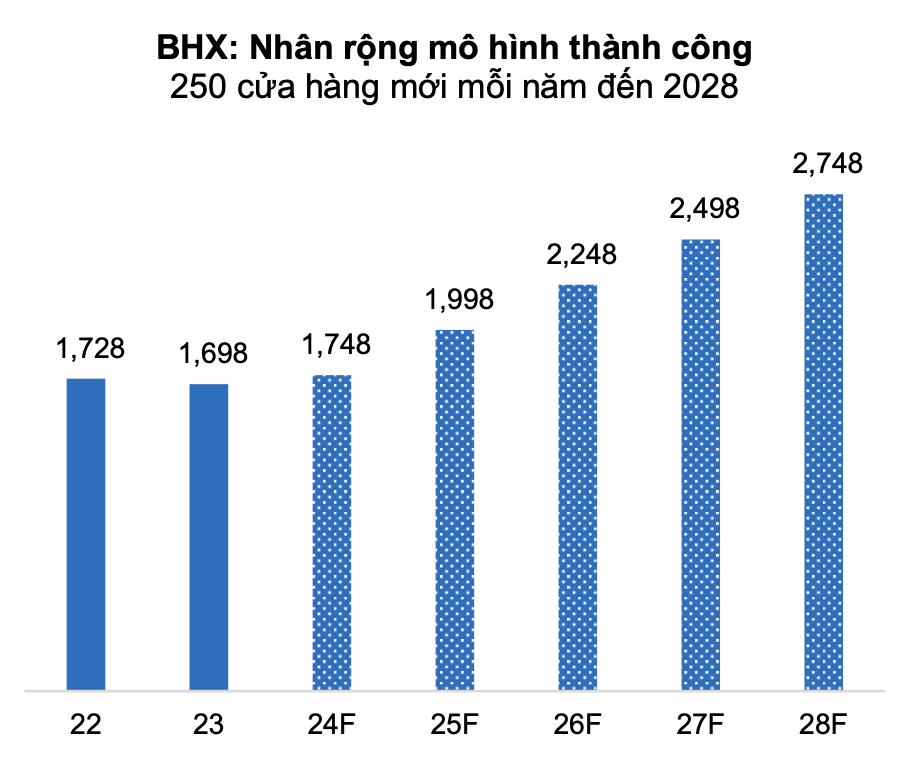

In a recent report, BVSC forecasted that BHX’s profit in 2025 could increase by 4.7 times compared to 2024, surpassing the thousand-billion mark, and is expected to double by 2028. This growth is accompanied by a successful model expansion of approximately 250 new stores per year, bringing the total number of stores to over 2,700 by 2028.

While the forecast will take time to verify, the optimistic outlook for BHX’s business prospects is undeniable. According to BVSC, Vietnam’s modern grocery retail industry has immense potential, with modern channels accounting for only 12% of total grocery retail in 2023, significantly lower than the regional average of 37-38% in Southeast Asia and China.

BVSC argues that there is a strong correlation between the penetration of modern channels and the rate of urbanization and average household income. Vietnam’s modern grocery retail sales are expected to double by 2030, excluding the single-digit natural growth of total grocery retail sales annually. This presents a significant opportunity for leading enterprises like BHX.

Currently, BHX remains on track to achieve its full-year profit plan for 2024. Additionally, the ICT&CE segment has witnessed a stronger-than-expected recovery, supporting MWG’s profits. In the first half of the year, revenue in this segment increased by nearly 7%, and profit estimates rose 2.5 times compared to the same period last year, thanks to a 2.5-2.75 percentage point improvement in gross margin due to cooling price competition in the industry.

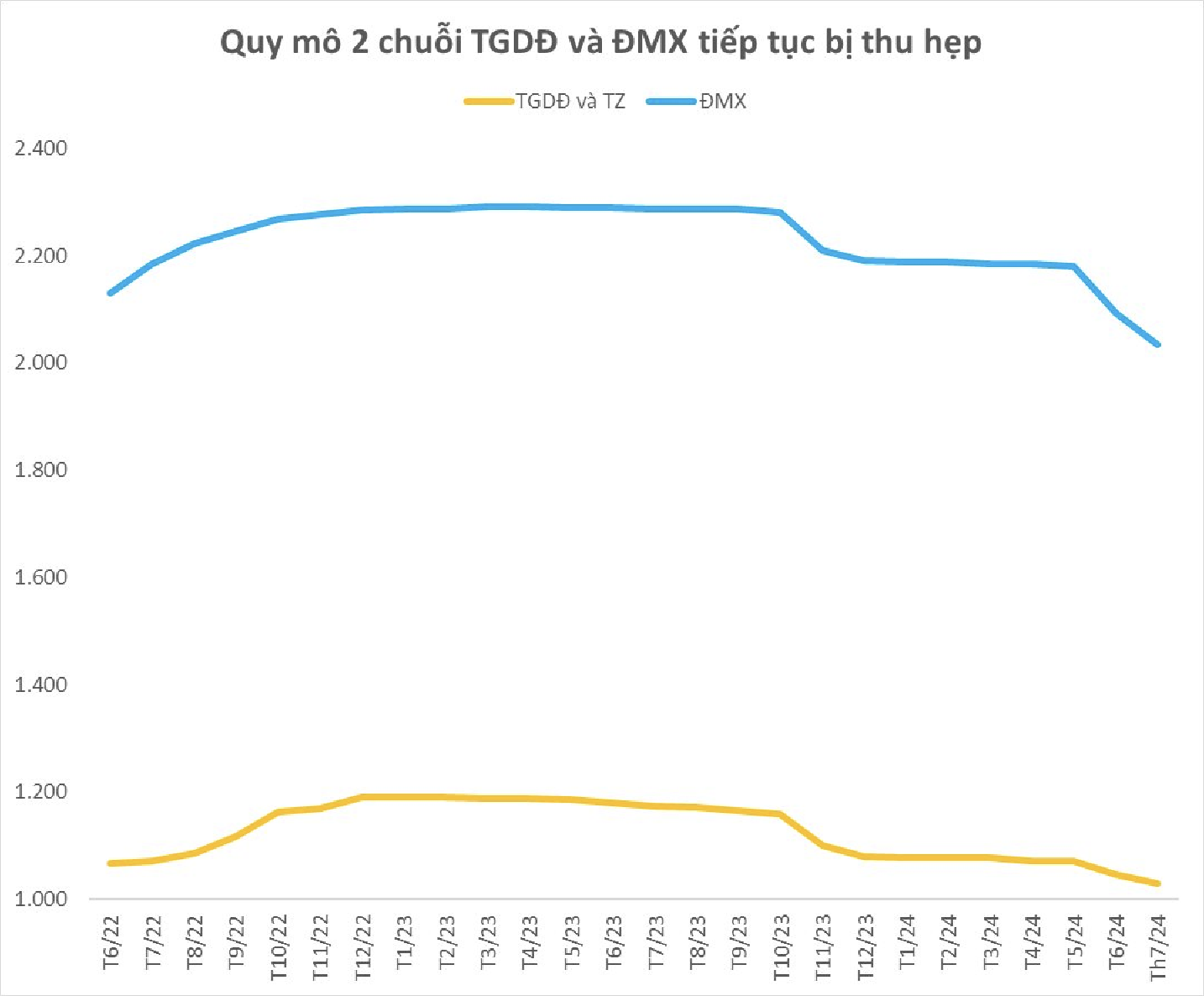

BVSC also highlighted that MWG achieved these figures despite the ICT&CE industry’s demand not fully recovering and a 10% lower number of stores compared to the previous year. The management of MWG stated that, as of now, the company has essentially completed its store closure plan for 2024.

Regarding the 2024 financial results, BVSC forecasts that MWG can achieve a revenue of 133,895 billion VND, an increase of 13.2%, and a net profit of 4,523 billion VND, 34 times higher than the previous year. These figures are much higher than MWG’s initial plans, but they are feasible, given that the company has almost accomplished its yearly goals in the first half.

Looking ahead to 2025, BVSC anticipates that MWG can attain a revenue of 144,922 billion VND and a net profit of 5,954 billion VND, representing an increase of 8.2% and 31.6%, respectively, compared to the projected figures for 2024. Should these numbers hold true, MWG will set new records for both revenue and profit, surpassing the previous peak achieved in 2021.

Wife of DIC Corp’s Chairman of the Board of Directors sells almost all of her held DIG shares.

The wife of DIC Corp’s Chairman is consistently divesting her stake in the company, amidst the stock price of DIG reaching a five-month high.