Profit-taking pressure continued to weigh on today’s trading as most stocks remained in the red. While both VIC and VNM turned negative, a timely rotation into mid-cap stocks helped offset losses, allowing the VN-Index to narrowly close in positive territory despite a broader decline.

Yesterday’s strong gains in VIC and VHM prompted a swift reversal today, with large sell-side transactions adding to the pressure. VIC closed 1.55% lower, a moderate adjustment following its previous day’s surge. VHM fell by 1.21%, giving back about half of yesterday’s gains, a relatively modest decline after rallying nearly 14% in just 10 consecutive sessions.

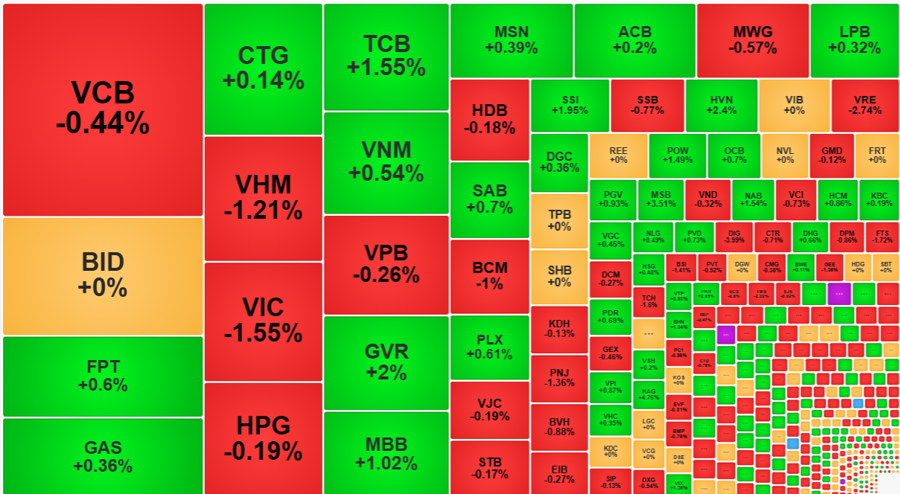

The VN30 basket ended balanced with 13 gainers and 13 losers, resulting in a meager 0.1% gain for the index. This outcome was favorable, but the difference lay in the strength of mid-cap blue-chips: GVR rose 2%, SSI by 1.95%, POW by 1.49%, TCB by 1.55%, and MBB by 1.02%. Among these, only TCB ranked among the top 10 in market capitalization, with GVR and MBB in the top 15.

Even though the strongest stocks in this basket had limited market caps, their impact on the index’s balance was positive. The group of decliners also lacked large-cap stocks, aside from VHM and VIC. VRE decreased by 2.74%, but its market cap is relatively low (ranking 28th in the VN-Index). Meanwhile, HPG, VPB, and VCB also closed in negative territory but with minor losses.

It wasn’t just the mid-cap blue-chips in the VN30 basket that stood out today; the HoSE mid-cap basket also displayed similar strength. Several stocks within this group attracted significant buying interest and posted solid gains, even though the representative index rose a mere 0.06%. Leading the pack were MSB, up 3.51% with a turnover of VND 187 billion; VIX, up 1.26% with a turnover of VND 431.6 billion; HAG, up 4.76% with a turnover of VND 301.6 billion; DBC, up 1.25% with a turnover of VND 182.2 billion; and NKG, up 1.38% with a turnover of VND 168.6 billion. Additionally, HCM, HSG, PDR, and DGC, although rising less than 1%, witnessed impressive liquidity, each recording transactions worth hundreds of billions of dong. Overall, the mid-cap basket’s liquidity surged 24% from the previous day, contrasting the VN30’s 14% decline and the Smallcap’s 5% drop. While the entire HoSE floor witnessed an absolute increase in trading value of approximately VND 429 billion compared to the previous session, the mid-cap basket alone contributed an additional VND 1,383 billion.

The market remains characterized by divergence, with a group of resilient stocks seemingly “immune” to index movements. Indeed, when the VN-Index fell to its intraday low today, losing around 3.7 points, there were still 113 gainers versus 254 losers. By the end of the session, a recovery attempt improved the breadth to 168 gainers versus 225 losers. One reason for the continued robust activity in certain stocks is the narrow range of index fluctuations. While the major movers vary daily, the VN-Index has been confined to a tight range of just a few points. This marks the fifth consecutive session of such narrow sideways movement, with no signs of a “collapse” under selling pressure. Instead, rebounds have consistently emerged as bottom fishers step in to push prices higher towards the end of the day.

Today, while there were quite a few decliners (225), only 64 stocks fell by more than 1%, and they accounted for about 20% of the total matched value on HoSE. Moreover, only 15 of these stocks recorded transactions exceeding VND 10 billion. The most significant sell-side transactions were concentrated in a handful of stocks: DIG, VHM, VRE, VIC, FTS, PNJ, and TCH, each recording transactions of over VND 100 billion.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.