Illustration

Oil Down 2%

Oil prices fell by around 2% on Tuesday as concerns about slowing economic growth in the US and China could curb energy demand.

Brent crude oil fell by $1.88, or 2.3%, to settle at $79.55 a barrel, while US West Texas Intermediate (WTI) crude fell by $1.89, or 2.4%, to settle at $75.53.

In the US, consumer confidence for August rose to its highest level in six months, but Americans are becoming more concerned about the labor market after the unemployment rate for August surged to a near three-year high of 4.3%.

The rise in unemployment will fuel expectations that the Federal Reserve will cut interest rates next month. Lower interest rates could boost economic growth and oil demand.

Meanwhile, in Germany, the economy contracted in the second quarter of 2024.

Gold Up as Dollar Weakens

Gold prices rose on Tuesday as the dollar weakened ahead of inflation data, which could provide insights into the scope of the expected interest rate cut by the Federal Reserve next month.

Spot gold was up 0.3% at $2,524.94 per ounce, while gold futures for December delivery on the COMEX fell 0.1% to $2,552.90.

The dollar index fell 0.3%, making gold more attractive to holders of other currencies.

Investors are now awaiting the Personal Consumption Expenditures (PCE) data, a key indicator of inflation and the Fed’s preferred measure for policy planning, which is expected to be released on Friday.

Gold bars have remained above $2,500 an ounce and are heading towards their best year since 2020, thanks to investors’ optimism about an imminent US rate cut and persistent concerns about conflicts in the Middle East.

Iron Ore Near 3-Week High

Iron ore futures prices rose to their highest level in almost three weeks on Tuesday, boosted by increased buying demand from Chinese steelmakers ahead of the upcoming peak demand season.

The January iron ore contract on the Dalian Commodity Exchange (DCE) ended the session 3.34% higher at CNY 758 ($106.38) per ton, the highest since August 7.

The September iron ore contract on the Singapore Exchange rose 1.5% to $101.75 per ton, the highest since August 9.

Some Chinese steel mills have planned to continue production after maintenance, raising expectations that ore demand will soon pass its trough.

Copper Near 6-Week High

Copper prices rose to their highest level in almost six weeks, buoyed by strong buying expectations of an imminent US rate cut, a weaker dollar, and signs of improving demand in China.

The three-month copper contract on the London Metal Exchange (LME) ended the session 1.6% higher at $9,433 per ton, after touching $9,453 at its highest since July 18.

A rate cut by the Federal Reserve would boost growth and demand in the US but would also put pressure on the country’s currency, making metals priced in dollars cheaper for holders of other currencies. The Fed meets on September 17-18.

Robusta Coffee Hits 16-Year High

Robusta coffee futures prices rose to their highest level in at least 16 years as global supply tightened, while Arabica coffee hit a two-and-a-half-year high.

November robusta coffee ended the session up by $131, or 2.8%, at $4,846 per ton after reaching a peak of $4,952, the highest since January 2008.

“Low exports from Asia have highlighted the scarcity of supply,” said Laleska Moda, a coffee analyst at brokerage Hedgepoint Global Markets. “Exports from Vietnam have been near historical lows for several months.”

December Arabica coffee rose by 2.2% to $2,552.5 per lb after reaching a two-and-a-half-year high of $2,594.5.

Rubber Rises

Rubber prices on the Japanese market rose for the fifth consecutive session due to concerns about persistent wet weather in Thailand and improved economic data in China.

The January rubber contract on the Osaka Stock Exchange (OSE) closed up 6.1 yen, or 1.72%, at 360 yen ($2.49) per kg.

The January rubber contract on the Shanghai Futures Exchange (SHFE) rose by 120 yuan, or 0.73%, to close at 16,500 yuan ($2,316.05) per ton.

Industrial profits in China grew faster in July, driven by high-tech manufacturing, even as sluggish domestic demand weighed on the recovery of the world’s second-largest economy.

Corn, Soybeans, and Wheat Gain

Corn, soybean, and wheat futures prices on the Chicago Board of Trade rose on Tuesday as hot weather affected the Midwest US, and a weekly report from the US Department of Agriculture showed crop conditions were worse than the previous week.

Corn ended the session up 6-1/4 cents at $3.92-3/4 per bushel, while soybeans rose 5-3/4 cents to $9.86-1/2.

Wheat prices also gained, rising by 10-1/2 cents to $5.35-1/2 per bushel.

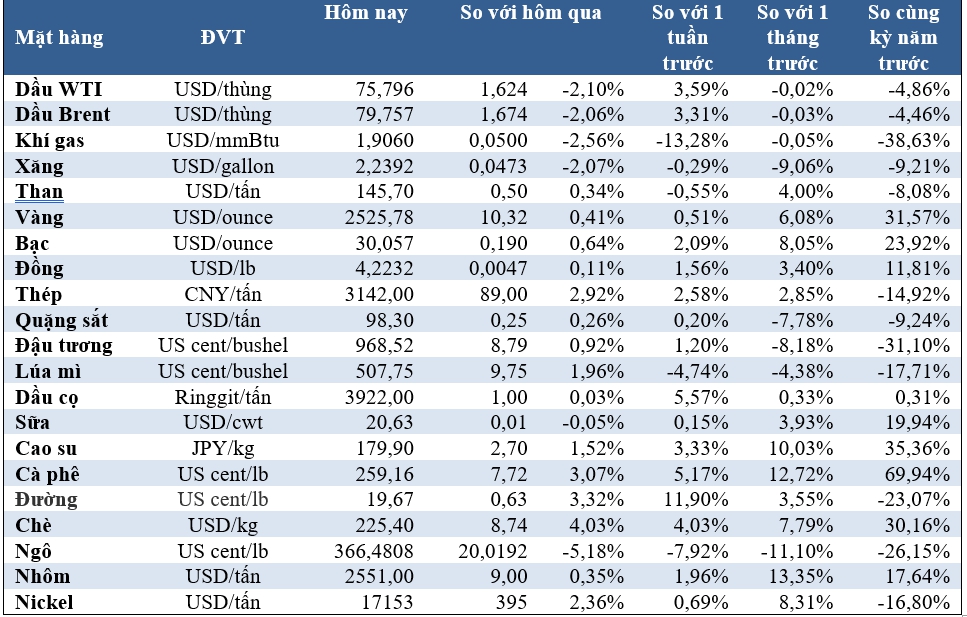

Key Commodity Prices as of August 28:

The Golden Fever of Mini Lucky Wealth to Experience Gold Accumulation

Understanding the increasing demand of the younger generation for investment and wealth accumulation, PNJ introduces the Mini Gold Line – Thanh Loc Dai Phat, a meaningful gold gift that inspires young people to experience wealth accumulation.