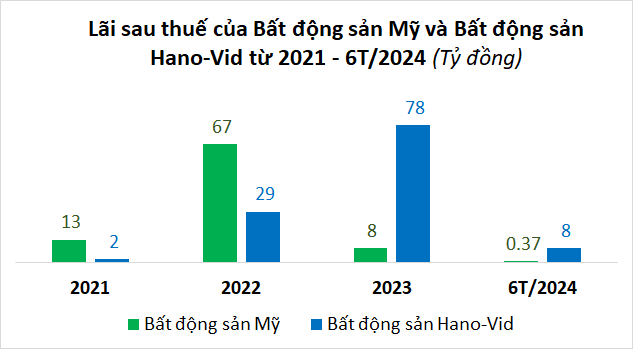

According to the financial report for the first six months of 2024 submitted to the Hanoi Stock Exchange (HNX), Hano-Vid Real Estate’s profit after tax decreased by 81% compared to the same period last year, amounting to nearly 8 billion VND.

My Real Estate reported a meager profit after tax of just over 374 million VND, a staggering 99.7% decline from the previous year’s figure of nearly 109 billion VND.

Source: Author’s Compilation

|

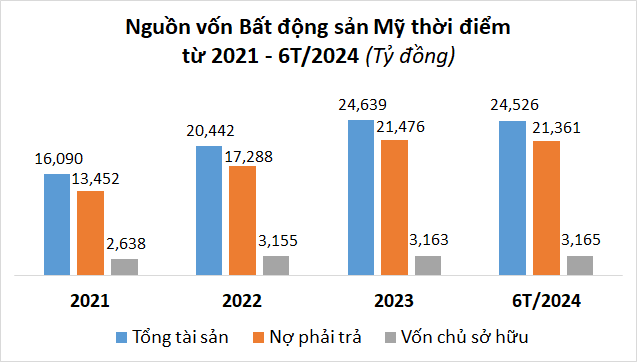

With slim profits in the first half of this year, the company’s equity as of June 30, 2024, decreased by 3% year-on-year to nearly 3,165 billion VND.

The debt-to-equity ratio increased from 6.25 to 6.75 times, corresponding to 21,361 billion VND in payables. Of this, bond debt amounted to nearly 7.8 trillion VND, a 2% decrease compared to the previous year. During the first half, the company paid nearly 608 billion VND in interest for 89 bond lots that matured.

According to HNX data, My Real Estate currently has a total of 116 bond lots in circulation, issued from April 2020 to December 2021, with a total issuance value of over 7,972 billion VND. As the company has repurchased a portion of the bonds, the current outstanding value stands at nearly 7,772 billion VND.

Of these, 110 bond lots have a five-year maturity, with the majority maturing in August 2025, and a 10.2% annual interest rate. MSB Vietnam Maritime Commercial Joint Stock Bank serves as the depository for these bonds. The remaining six lots have a seven-year maturity, maturing in 2028, with a 10% annual interest rate, and are deposited with the Vietnam Securities Depository and Clearing Corporation.

Source: Author’s Compilation

|

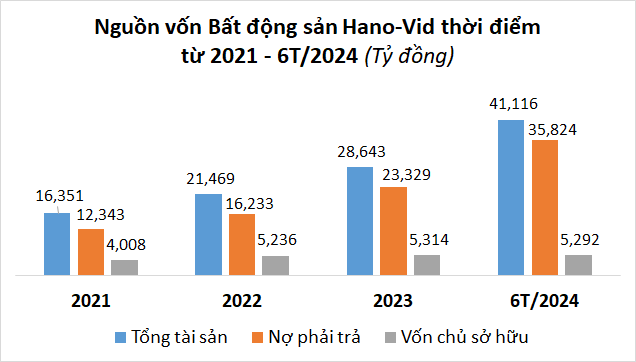

As of the end of June, Hano-Vid Real Estate’s total assets amounted to nearly 41,116 billion VND, a 44% increase compared to the previous year. Payables increased by nearly 54% to over 35,824 billion VND, while bond debt decreased slightly by almost 1% to over 9,500 billion VND.

Hano-Vid Real Estate has 182 bond lots in circulation, with a total issuance value of nearly 9,655 billion VND and an outstanding value of over 9,500 billion VND.

Of these, 180 lots were issued from July to August 2020, with MSB as the depository, and the remaining two lots were issued in February 2022, with the Vietnam Securities Depository and Clearing Corporation as the depository. These 182 lots have maturities ranging from five to seven years and interest rates from 10.2% to 10.5% per annum.

Source: Author’s Compilation

|

It is worth noting that Hano-Vid and My Real Estate are two of the three investors in a joint venture for the Tra Quang Nam urban area project in Phu My town, Phu My district, Binh Dinh province. The project spans over 27 hectares, with a total investment of more than 1,457 billion VND. The capital contribution structure of the joint venture includes 77 billion VND from Hano-Vid, 77 billion VND from My Real Estate, and 66 billion VND from Nam Quang Infrastructure Investment and Development Joint Stock Company. The project is scheduled for completion between June 2021 and June 2027.

Established on December 1, 2010, Hano-Vid is headquartered at 430 Cau Am, Van Phuc Ward, Ha Dong District, Hanoi, with its primary business being real estate consulting, brokerage, and auctioneering. According to HNX, the company currently has a chartered capital of over 3,544 billion VND, and Mr. Nguyen The Dat serves as the General Director and legal representative.

My Real Estate (formerly known as VID Winter Real Estate Joint Stock Company) was once chaired by Ms. Nguyen Thi Nguyet Huong, who also chaired ROX Group (previously TNG Holdings Vietnam) and held a capital contribution. However, following the name change, the company increased its charter capital from 240 billion to 2,571 billion VND. The current Chairwoman and legal representative is Ms. Vu Thuy Duyen (born in 1994).

Most recently, in May 2024, the joint venture between Oleco-NQ Company Limited and My Real Estate was the sole investor to submit documents for the project “New Urban Area in the West of the Administrative Center of Giang Rieng district,” with a total investment of nearly 393 billion VND on an area of nearly 10 hectares.

In addition to this project, in April 2023, the same joint venture was the only investor to submit documents for the “Urban Area No. 1A” project in Ba Xuyen, Song Cong City, Thai Nguyen province. This project entailed an investment of nearly 834 billion VND across 30.6 hectares.

In relation to the ROX Group, in mid-August 2024, Long Van Real Estate Investment Company, a member of the group, announced some progress in the implementation of the nearly 2.5 trillion VND Van Long 2 urban area project in Binh Dinh province.

Shape of the urban area of nearly 2.500 billion VND in Binh Dinh of ROX Group

Astonishingly high price for old and dilapidated apartment buildings reaching nearly 200 million VND/m2, rivaling the most luxurious condominiums in Hanoi

Old collective apartments with prices starting from 100 million VND/m2 are usually the first-floor units that can be used for commercial purposes, while the upper-floor units are priced at 60-80 million VND/m2 for residential purposes.