Vietnam’s stock market experienced another volatile trading session on August 27, with VIC stock, belonging to Vingroup, stealing the spotlight as it surged to a high of VND 1,280.56, a 0.54-point increase. However, foreign investors sold a net value of nearly VND 260 billion, continuing a five-day streak of net selling.

In contrast, securities companies’ proprietary trading bought a net value of VND 381 billion across all three exchanges.

On the HoSE, securities firms’ proprietary trading bought a net value of VND 375 billion, with VND 259 billion bought on the matching order channel and VND 115 billion on the negotiated trading channel.

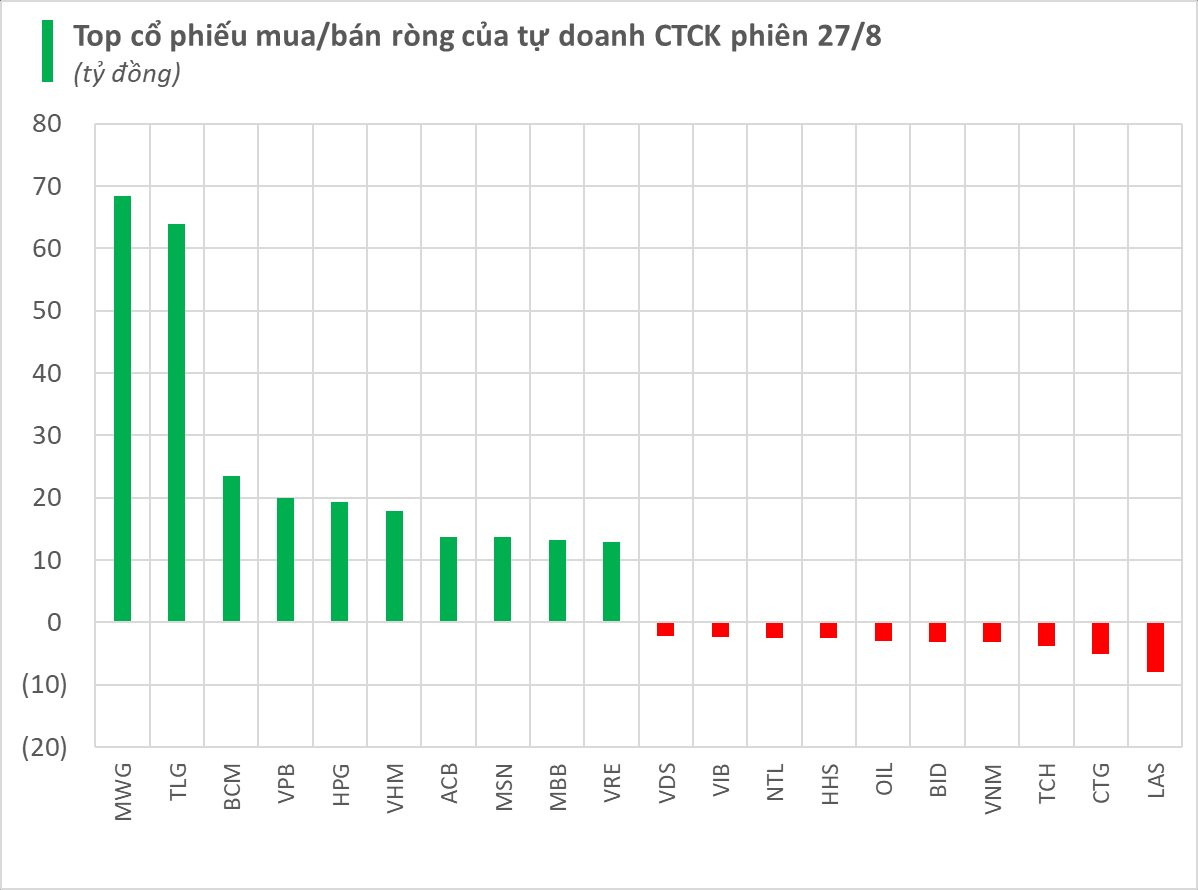

Specifically, securities companies bought the most MWG and TLG stocks, with values of VND 68 billion and VND 64 billion, respectively. Additionally, they bought BCM, VPB, HPG, and VHM stocks during this session.

On the other hand, they sold CTG and TCH stocks the most, with net selling values of VND 5 billion and VND 4 billion, respectively. VNM, BID, and HHS stocks were also among those sold during this session.

On the HNX, securities firms’ proprietary trading bought a net value of nearly VND 1 billion, with IDC stock being the most purchased at VND 9 billion, while LAS stock experienced net selling of nearly VND 8 billion.

On the UPCoM, securities firms’ proprietary trading bought a net value of VND 6 billion, mainly purchasing MCH (VND 5 billion) and BCR (VND 2 billion) stocks, while offloading OIL stock worth VND 3 billion.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”

Stocks rally as bank shares change hands at record levels

The VN-Index experienced its biggest drop of the year today (31/1), closing down over 15 points. Trading volume surged due to profit-taking pressure, mainly focused on the banking sector. SHB saw a record high turnover with over 127 million shares changing hands.