The State Bank of Vietnam set the daily reference exchange rate at 24,224 VND per USD on August 27, down 30 VND from the previous day.

On August 27, the State Bank of Vietnam maintained the buying and selling rates of USD at 23,400 VND/USD and 25,450 VND/USD, respectively.

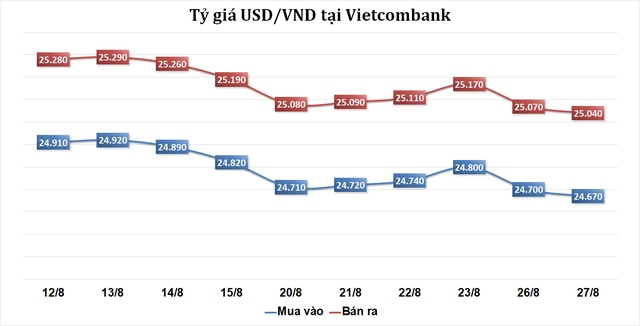

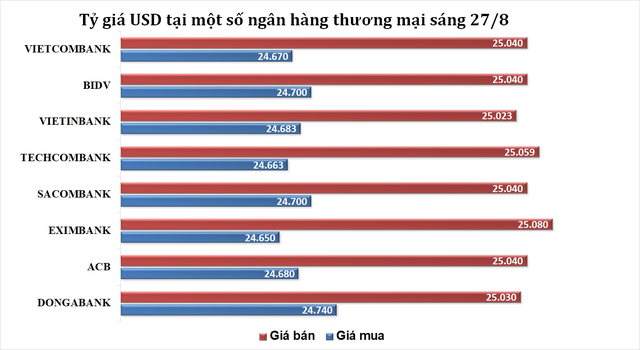

Meanwhile, commercial banks adjusted their buying and selling rates downward, with a decrease of 30 to 90 VND compared to the previous session.

Specifically, as of 9 am, the lowest buying rate was recorded at 24,650 VND/USD (down 48 VND), while the highest buying rate was 24,740 VND/USD (down 50 VND). For selling rates, the lowest rate was 25,023 VND/USD (down 37 VND), and the highest rate stood at 25,080 VND/USD (down 100 VND).

The US Dollar Index (DXY), which measures the greenback’s value against a basket of six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stood at 100.827 points, up 0.007 points from the opening of the session.

The US dollar edged higher, while major currencies in the basket remained relatively stable as market concerns over tensions in the Middle East tempered investors’ optimism about an expected interest rate cut by the US Federal Reserve.

Geopolitical risks in the Middle East have dampened the initial currency movements, despite fears of an escalating conflict after a major missile exchange between Israel and Hezbollah over the weekend.

Rodrigo Catril, a senior forex strategist at National Australia Bank, commented, “The market is taking a bit of a pause and waiting for some key data releases.”

The Federal Reserve is likely to cut interest rates in September after Chairman Jerome Powell signaled his support for such a move during his speech at the annual symposium in Jackson Hole last Friday.

Mary Daly, President of the Federal Reserve Bank of San Francisco, also indicated a high probability of a 25-basis-point rate cut by the Fed next month.

The Fed’s aggressive rate hike cycle and expectations of further increases have been a significant driver of the US dollar’s strength over the past two years, putting pressure on other currencies, particularly the Japanese yen.

David Chao, Invesco’s Asia-Pacific (excluding Japan) global market strategist, stated, “The question now is not whether the Fed will cut rates in September but by how much.”

Market expectations are almost certain that the Fed will cut interest rates next month, with forecasts suggesting a reduction of around 100 basis points by the end of the year.

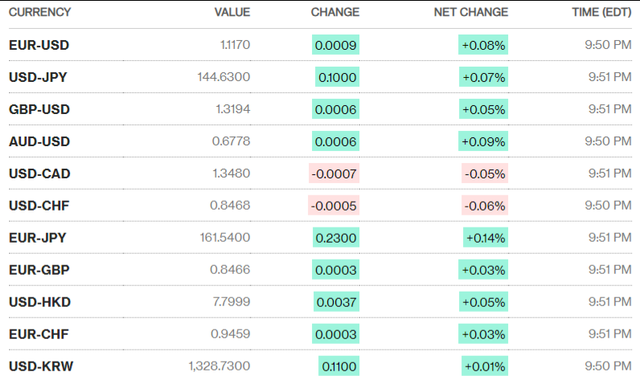

In Asia, the yen weakened by 0.07% to 144.63 yen per dollar after strengthening to a three-week high of 143.45 yen per dollar in the previous session.

The euro rose 0.08% to $1.1170.

Similarly, the British pound traded at $1.3194, up 0.05%.

Elsewhere, the Australian dollar climbed 0.09% to $0.6778, not far from Friday’s one-month high of $0.67985.

The New Zealand dollar advanced 0.13% to $0.6212, also close to Friday’s seven-month peak of $0.6236.

Source: CafeF

Chinese citizens flock to buy 280 tons of gold, realizing real estate and stocks are no longer a good investment channel

Regardless of the global decline in demand for gold, the purchasing power of Chinese citizens has propelled the price of gold to surpass the $2,000 per ounce threshold in 2023.