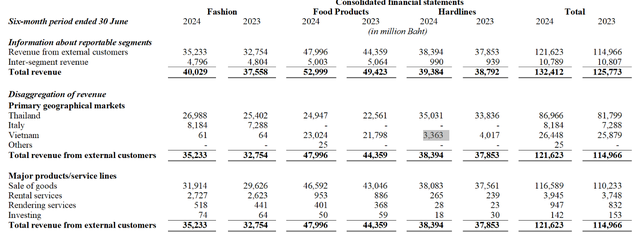

In a recent development, Central Retail, a leading Thai retail company with a significant presence in Vietnam, released its financial report for the first half of 2024. The report revealed that the company’s operations in Vietnam generated over 26.5 billion baht in revenue, roughly equating to more than 19.3 trillion VND. This figure marks a 3% increase compared to the same period last year.

The food sector contributed significantly to Central Retail’s revenue in Vietnam, accounting for 23 billion baht (approximately 16.8 trillion VND).

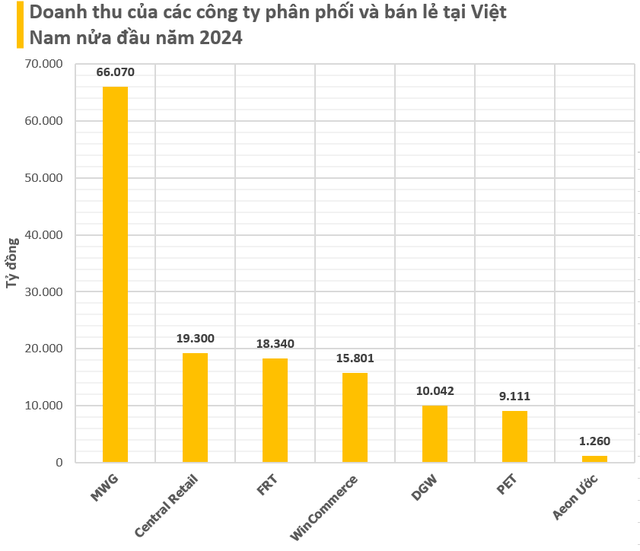

In the context of the Vietnamese retail market, Central Retail Vietnam’s revenue trails behind Bach Hoa Xanh (19.49 trillion VND) but surpasses Wincommerce (15.801 trillion VND). When focusing solely on the food sector, Central Retail Vietnam lags far behind Bach Hoa Xanh but remains ahead of Wincommerce.

As of the end of June 2024, Bach Hoa Xanh operated 1,701 stores, Wincommerce had 3,673 stores, while Central Retail boasted over 340 sales outlets, including 77 food retail stores comprising 38 GO! hypermarkets and 39 supermarkets. In addition, they have over 200 non-food retail stores and 39 GO! Malls shopping centers.

Central Retail is a subsidiary of the Central Group, a Thai conglomerate directly managed by the Chirathivat family. The Chirathivat family is currently ranked fourth among the wealthiest families in Thailand, with an estimated fortune of over $12 billion.

The company commenced its operations in Vietnam back in 2012. In 2015, the group acquired the Nguyen Kim electronics supermarket chain and Lanchi Mart, which operated 85 stores across 15 provinces in the country, and has since continuously expanded its presence.

The brands under Central Retail’s management in Vietnam encompass a wide range of sectors. In the food sector, they include Central Food Hall, Tops Market, Tops Daily, Tops Superstore, Tops Online, Family Mart, GO!, Mini go!, and Lan Chi supermarkets.

The fashion segment features shopping centers such as Central, Robinson, Supersports, Central Marketing Group (CMG), and Rinascente. The electronics and home appliances category includes Power Buy, Thai Watsadu, Baan & Beyond, Auto1, vFIX, OfficeMate, B2S, meb e-book, and Nguyen Kim.

Lastly, their real estate management division comprises retail units like Robinson Lifestyle and Tops Plaza in Thailand, as well as the GO! Supermarkets (formerly Big C) in Vietnam.

Brands Managed by Central Retail in Vietnam

Recognizing Vietnam as a key market, Central Retail announced at the beginning of 2024 that it would invest 1.45 billion USD in the country over the next five years. During the period from 2023 to 2027, the company aims to double its number of stores to 600 and establish a presence in 57 out of 63 provinces in Vietnam. Central Retail also aspires to become the leading multi-channel retailer in the food sector and the second-largest player in the real estate and shopping center sector by 2027.

In mid-March 2024, Central Retail received approval from the People’s Committee of Hung Yen province for the detailed planning design at a scale of 1/500 for the GO! Hung Yen Commercial Center project. The planned site for the GO! Hung Yen Commercial Center covers an area of 15,847 m2 in Hien Nam Ward, Hung Yen City. The construction area for the two-story commercial center is over 8,600 m2, with the remaining space allocated for indoor and outdoor parking lots and other auxiliary works.

Central Retail, and Central Group as a whole, continue to expand their footprint in Vietnam. In an article published in the Bangkok Post on March 9, 2023, Wallaya Chirathivat, CEO of Central Pattana, revealed plans to invest in mega-projects over the next five to ten years, with each project spanning over 350,000 m2 and involving an investment of more than 20 billion baht (approximately 14 trillion VND) per project.

“Vietnam is an important market that we want to tap into, although there are many regulations that we have to overcome. Hopefully, we will be able to announce something about Vietnam by the middle of this year.” – Ms. Wallaya Chirathivat stated.

Turning to the performance of Central Retail’s parent company, the enterprise generated 132.4 billion baht in revenue (approximately 96.9 trillion VND) in the first half of the year, reflecting a 5.3% increase compared to the same period last year. The group’s pre-tax profit reached 5.3 billion baht, equivalent to nearly 4 trillion VND.

Masan implements multiple strategies to benefit consumers in 2023.

In the backdrop of the challenging economic landscape in 2023, consumer retail giants like Masan Group have implemented a series of practical strategies to share the hardships and bring tangible benefits to consumers…