Vietnam’s stock market holds immense potential to become a significant source of financial mobilization for the private sector. Speaking of the market’s potential, the market capitalization has increased from 38% to 58% in the last decade, even peaking at 93% in 2021. This indicates a substantial rise in the value of publicly traded companies in the country.

The total market capitalization stands at VND 4,740 trillion ($198 billion), alongside another emerging market for unlisted public companies (UPCOM) amounting to VND 1,036 trillion ($43 billion). However, despite the impressive market capitalization, capital mobilization on the two main exchanges has been modest, averaging VND 37 trillion ($1.5 billion) per year over the past five years, mostly through secondary offerings, outpacing initial public offerings (IPOs). IPO activities were most vibrant in 2017-2018 but subsequently declined. In 2023, only three IPOs were conducted, raising VND 173 billion ($7 million)

Additionally, according to the World Bank, the lack of participation from large institutions, such as social security and insurance companies, constrains capital mobilization for businesses. The Social Security Fund, Vietnam’s largest institutional investor, currently manages a portfolio equivalent to 10% of GDP. The funds under the Social Security’s management are estimated at VND 1,130 trillion ($44 billion) and are expected to grow by up to 15% in the coming decades. Social Security currently covers 32% of Vietnam’s labor force (17.5 million workers) and aims to extend its coverage to 60% by 2030.

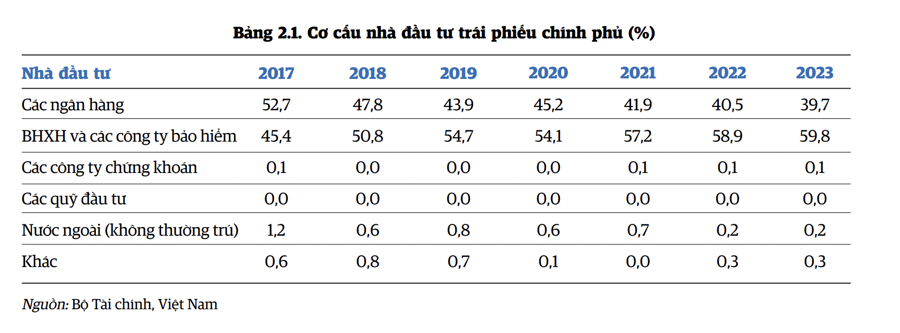

Due to legal restrictions, the Social Security Fund’s assets are primarily focused on government bonds. This near-dominance of government bonds in their investment portfolio not only limits investment returns but also adversely affects the development of the financial sector.

Diversifying the Social Security Fund’s investments is key to accelerating the modernization of Vietnam’s financial system in multiple ways. Firstly, it will help the fund move away from intra-industry investing in the government bond market, thereby reducing market distortion. Secondly, diversifying into corporate securities markets, including stocks and bonds, will aid the development of these markets by diversifying the investor base and bringing relative stability as a long-term investor.

Even if the Social Security Fund does not initially invest directly in these markets and only participates through niche funds, their entry will enhance competition and professionalism in the asset management field. Lastly, if implemented gradually from a small scale, diversification will boost long-term returns for the Social Security Fund’s assets.

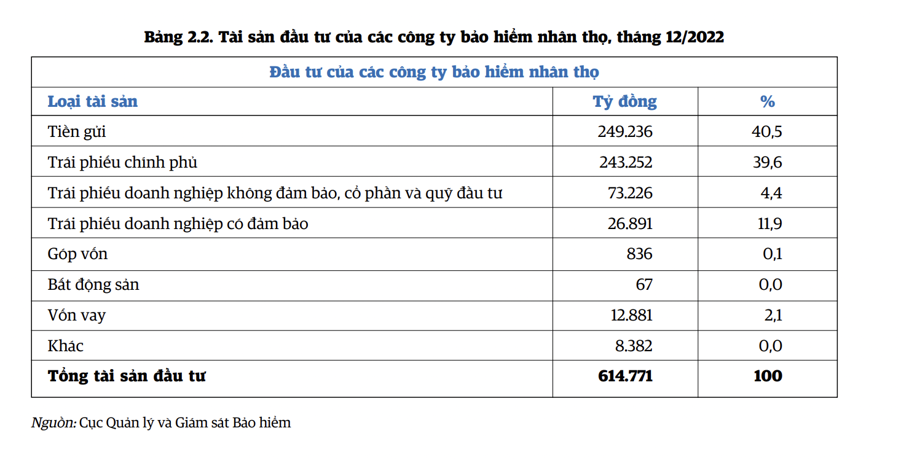

Additionally, insurance companies, particularly life insurance companies, can significantly impact the capital market as they need to invest in long-term instruments to match their long-term liabilities.

As of December 2023, life insurance companies held total assets of VND 786 trillion ($31 billion), with an impressive average growth rate of 20% over the past five years. With a value equivalent to 8% of GDP, they are the second-largest group of domestic institutional investors in Vietnam.

While they have the potential to promote the development of capital markets, life insurance companies’ investments are still largely focused on government bonds and bank deposits.

Insurance companies are encouraged to diversify into the corporate sector, as investing in short-term instruments and government bonds carries risks and yields limited returns. Addressing the issues in the corporate securities market will gradually build trust with insurance companies, encouraging them to diversify their investments and fostering the healthy development of the corporate securities market.

Therefore, according to the World Bank, sensible reforms, if implemented cautiously, can unlock a substantial additional long-term capital mobilization channel for the corporate sector in Vietnam. Even a modest allocation of the Social Security Fund’s investments into corporate securities would mean an additional $20 billion for the corporate sector by 2030. The cumulative additional profits could reach $4 billion by 2030.

Similarly, a modest reallocation of life insurance companies’ investments into corporate securities could attract an additional $15 billion by 2030. Privately managed investment and pension funds could contribute around $14 billion if they grow healthily.

Concurrently, an upgrade to emerging market status by MSCI and FTSE Russell would result in a net inflow of $5 billion into Vietnam’s stock market, as global emerging market portfolios would be reallocated to Vietnam following the upgrade. Inflows could reach $25 billion by 2030 if robust reforms continue and the global investment environment remains favorable.

Overall, this means that the capital markets alone could provide approximately $87 billion to the corporate sector by the end of the decade.

Invest more than 12,000 trillion in stocks and deposits, an insurance company earns trillions in 2023

By the end of 2023, PVI’s total value of financial investments is over 12,158 billion Vietnamese dong. Out of this, bank deposits account for over 8,500 billion Vietnamese dong. In the past year, the insurance company recorded financial investment operating revenue of 1,330 billion Vietnamese dong, a 41.2% increase compared to 2022.

Once a formidable competitor in the stock market, the total market capitalization of the entire real estate industry is now less than the combined market capitalization of three banks.

If you combine the market cap of Vietcombank and BIDV, along with the market cap of Vietinbank (which is approximately 960 trillion VND), it already surpasses the market cap of the top 30 largest real estate enterprises (which is around 788 trillion VND).