Illustrative image

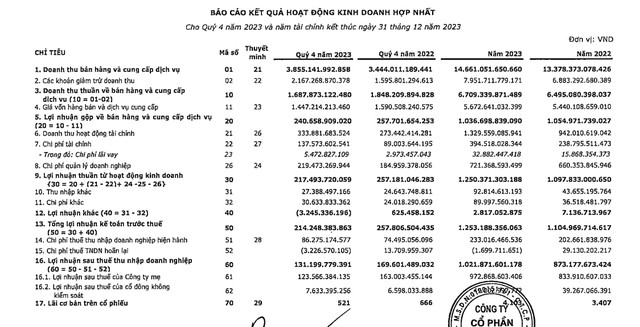

PVI Joint Stock Company (PVI) has recently announced its financial report for the fourth quarter of 2023 with a consolidated after-tax profit of VND 131.2 billion, a decrease of 22.6% compared to the fourth quarter of 2022. However, the full-year net profit in 2023 still increased by 17%, reaching nearly VND 1,022 billion.

In 2023, PVI’s original insurance premium revenue reached VND 11,002 billion, a growth of 9.7% compared to 2022; reinsurance premium revenue reached VND 2,564 billion, a growth of 37.4% compared to the previous year. However, due to significant reductions (mainly reinsurance exit fees), PVI’s net revenue in 2023 only slightly increased by 3.3% to VND 6,709 billion.

Meanwhile, the service cost (mainly compensation and provisions) increased by 4.3% to VND 5,673 billion. As a result, PVI’s gross profit in 2023 decreased by 1.7% to VND 1,037 billion.

Source: PVI Financial Statements

The profit growth driver of PVI in 2023 comes from financial activities, with revenue reaching VND 1,330 billion, an increase of VND 388 billion, equivalent to a 41.2% increase compared to 2022. In which, interest income and loan interest reached VND 789.4 billion (an 87% increase), income from bond trading and valuable papers reached VND 298.1 billion (a 0.5% increase), income from stock trading and dividends brought to PVI nearly VND 130 billion (a 13% decrease).

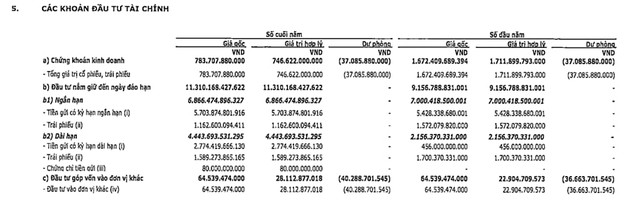

Financial activity revenue grew strongly in the context of PVI pushing for a restructuring of investment portfolio towards reducing stock and bond holdings while significantly increasing bank deposits, especially long-term deposits.

Specifically, the total value of PVI’s financial investments at the end of 2023 was over VND 12,158 billion, an increase of 6% compared to the beginning of the year. In which, trading securities decreased from VND 1,672 billion to VND 784 billion; bonds held until maturity decreased from VND 3,272 billion to VND 2,752 billion; short-term deposits increased from VND 5,428 billion to VND 5,704 billion; long-term deposits and long-term deposit certificates increased from VND 456 billion at the beginning of the year to VND 2,854 billion.

Source: PVI Financial Statements

Thanks to these changes, after deducting expenses, PVI’s financial operating profit reached VND 935 billion, an increase of VND 232 billion, equivalent to a 33% increase compared to 2022.

According to the company’s explanation, with the advantage of cash flow in the early months of 2023, PVI took advantage of a relatively large investment capital with preferential interest rates, along with a reasonable investment portfolio arrangement, making quick and timely decisions against market fluctuations, ensuring high profitability in investment activities for the whole year of 2023.

As of December 31, 2023, PVI’s total assets reached VND 26,946 billion, an increase of 3.1% compared to the end of 2022 and ranked second among listed insurance companies.