Real Estate Business Debt Increases

According to Ms. Nguyen Hoai An, Senior Director of CBRE Hanoi, the supply of apartments in Hanoi and Ho Chi Minh City is moving in opposite directions. In Hanoi, the supply of apartments in the first half of 2024 reached its highest level in the past five years. The supply of newly launched apartments in the second quarter of 2024 in Hanoi increased nearly fourfold compared to the previous quarter, reaching approximately 8,500 units. Hanoi’s apartment supply is mainly focused on the luxury segment, accounting for 70%. The total number of apartments launched in the first half of the year reached nearly 11,000 units.

In the second quarter of 2024, most of the new supply continued to concentrate in the west of Hanoi, mainly from the Lumi Hanoi (phase 1) and Imperia Sola Park projects.

Meanwhile, the apartment supply in Ho Chi Minh City remains scarce, with nearly 2,000 new units launched. Only 500 new apartments were launched in the first quarter.

According to a report by the State Bank of Vietnam (SBV), one of the main areas of credit growth in the past has been real estate lending, which has slowed down significantly. Both enterprise and household borrowing demands have decreased. Despite high property prices, actual transactions are not abundant, mainly because property prices are much higher than people’s income. This trend persists due to economic difficulties and no signs of income recovery.

|

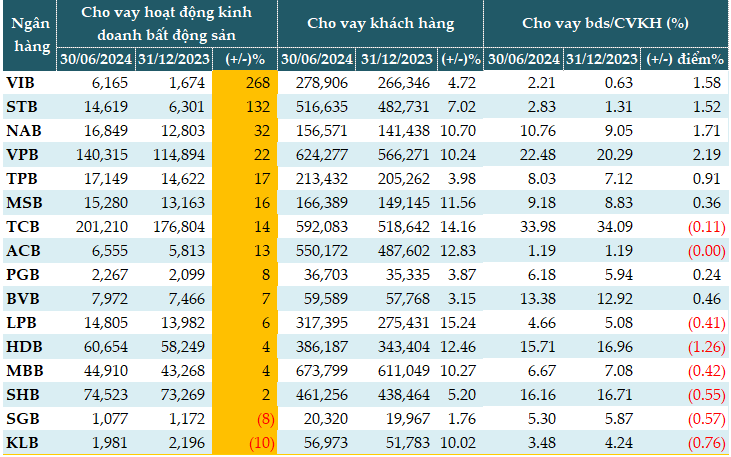

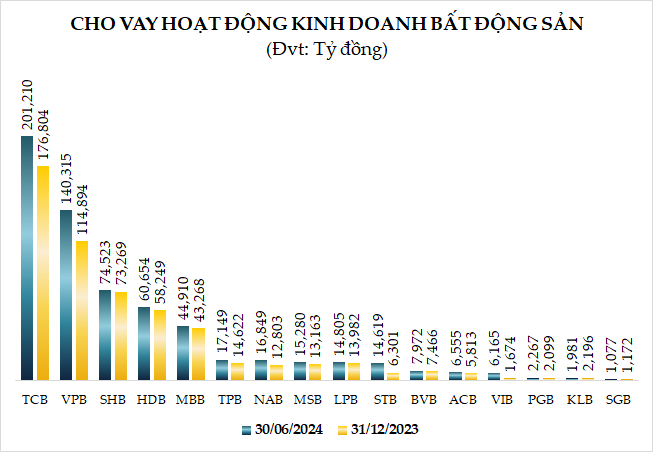

Real Estate Business Lending as of June 30, 2024 (in trillion VND)

Source: VietstockFinance

|

According to VietstockFinance data from 16 banks with lending explanations, as of June 30, 2024, 14 out of 16 banks increased lending to real estate businesses compared to the beginning of the year. The total outstanding loans for real estate business activities of the 16 banks at the end of the second quarter were VND 626,332 billion, up 14% from the beginning of the year.

Techcombank (TCB) leads the system with VND 201,210 billion in real estate business lending, up 14% from the beginning of the year. This is followed by VPBank (VPB) with VND 140,315 billion, up 22% from the beginning of the year. In addition, VPBank also has VND 85,836 billion in personal loans for buying houses, up nearly 1% from the beginning of the year.

SGB and KLB are the two banks that decreased real estate business lending by -8% (VND 1,077 billion) and -10% (VND 1,981 billion), respectively.

Source: VietstockFinance

|

Prof. Nguyen Huu Huan, Senior Lecturer at the University of Economics Ho Chi Minh City, commented that the strong growth in real estate credit is mainly due to debt restructuring. When bonds mature, real estate businesses have to borrow from banks to repay bond debts, causing an increase in real estate credit.

However, the real estate market is showing signs of recovery, albeit very slowly, mainly in the North and not much in the South.

More Solutions Needed to Boost Credit into Real Estate

According to Mr. Nguyen Quanh Huy, CEO of the Faculty of Finance and Banking, Nguyen Trai University, in general, the number of apartments supplied to the market and consumed in the second quarter of both markets increased sharply compared to the first quarter of 2024. Most projects are financed by banks for both investors and apartment buyers. Accordingly, credit for the real estate sector in the second quarter increased slightly compared to the first quarter.

From now until the end of 2024, Ho Chi Minh City is expected to have more than 8,000 new apartments for sale, and Hanoi will have nearly 10,000 new apartments. Thus, the overall supply in the last six months continues to increase compared to the first half. However, nearly 70% of the supply is high-end commercial apartments, priced from VND 4 billion per unit and above. Apartments under VND 3 billion are not abundant. This is also a challenge for both developers in selling and people with real needs to access good projects to buy affordable apartments, as the rate of real estate price increase is outpacing income growth for the majority of the population.

According to Mr. Huy, adjusting the product structure, designing smart apartments with flexible utilities, and reducing the total price per apartment will be solutions to help supply and demand meet. In addition, with the positive support of banks, such as a maximum loan term of up to 30 years and reasonable interest rates, will also help buyers access capital when purchasing, helping the real estate market recover and credit grow in the remaining months of 2024.

At the same time, the whole system focuses on implementing the project of 1 million social housing units, with the supply of social housing from now until the end of the year, will help people with real needs access affordable housing with prices suitable for their actual income.

|

According to the Ministry of Construction, the goal for 2024 is to strive to complete 130,000 social housing units out of the target of 1 million units. This means that nearly 100,000 units must be completed by the end of 2024. The Ministry of Construction has also set a goal to complete the projects that have been started on schedule in 2024. This is a significant pressure on progress, requiring the involvement of ministries, branches, and local authorities. |

Mr. Huy believes that the target of 100,000 units may not be achieved, but with the determination and efforts of the relevant agencies, the real estate-related policies that took effect on August 1, 2024, will result in many social housing projects being approved for construction or sale, contributing to the market with more products priced below VND 3 billion to serve the majority of the population.

Mr. Nguyen Duc Len, Deputy Director of the State Bank of Vietnam, Ho Chi Minh City Branch, assessed that favorable factors in terms of mechanisms and policies, such as low-interest rates, the ability to meet capital demands of credit institutions, preferential credit packages for social housing, the Real Estate Law, the Housing Law, and the Real Estate Business Law, which took effect early on, along with specific actions through the activities of the task forces to remove difficulties for the market, and the positive changes mentioned above, will be the basis and driving force to promote the real estate market to maintain its positive aspects, creating conditions for recovery and growth in the coming time.

VPBank strengthens its system in 2023, laying the foundation for sustainable growth

By 2023, VPBank has made significant strides in expanding its customer base and scaling up its operations. The bank has managed to make progress amidst challenging macroeconomic conditions, focusing its resources on strengthening its system and building momentum for sustainable growth in 2024 and beyond.