Illustration

Manulife Vietnam Limited Company (Manulife) recently announced its semi-annual financial report for 2024 with a pre-tax profit of VND 2,127 billion, a 12.6% decrease compared to the same period last year.

Despite the decline in profits, Manulife remains the most profitable life insurance company in the first half of 2024, surpassing industry giants such as Bao Viet Life Insurance (VND 776 billion) and Prudential (VND 1,092 billion), as well as Dai-ichi Life (VND 1,362 billion).

In the first six months, Manulife’s insurance business reported a loss of VND 1,329 billion, a stark contrast to the VND 1,302 billion profit in the same period last year. This was due to a significant 24% drop in revenue while expenses remained almost unchanged.

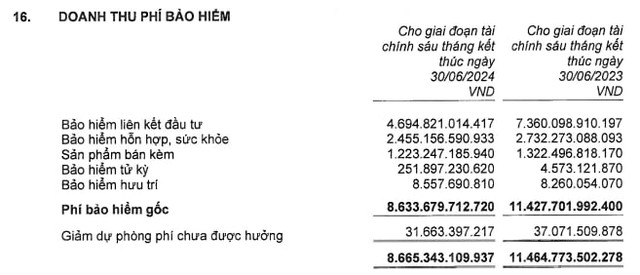

Specifically, Manulife recorded original insurance premium revenue of VND 8,634 billion, a 24.4% decrease year-on-year. This includes a significant drop in revenue from key segments such as investment-linked insurance and mixed insurance, as well as health insurance.

Source: Manulife Vietnam’s Financial Statements

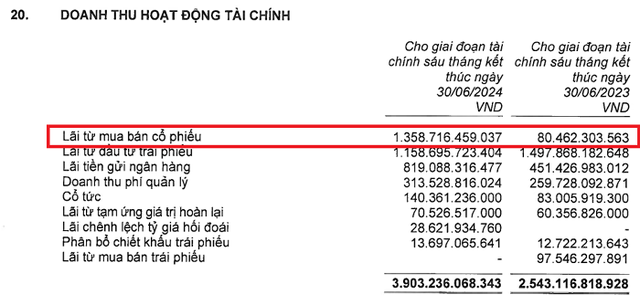

The financial segment, which has been the main pillar supporting Manulife’s profits, continued to perform well with a net profit of VND 3,142 billion, an increase of over 40% compared to the first half of 2023. The company’s financial revenue reached more than VND 3,903 billion, a 53.5% increase, mainly due to gains from buying and selling stocks, which were nearly 17 times higher than the previous year (VND 1,359 billion), and an 81.7% increase in bank deposit interest (VND 819 billion).

As of the end of June, Manulife’s financial investment portfolio stood at VND 106,422 billion, a 9.6% increase from the beginning of the year and accounting for 83.6% of total assets. Short-term financial investments increased by 29.6% to VND 38,251 billion, while long-term financial investments rose by 0.9% to VND 68,171 billion.

Breaking down the short-term investment portfolio, Manulife held listed and UPCoM stocks worth nearly VND 10,407 billion. Additionally, the company had short-term deposits of over VND 24,261 billion and VND 1,353 billion in corporate bonds.

In terms of long-term investments, the largest components were government bonds, government-guaranteed bonds, and local government bonds, totaling VND 57,288 billion. The company also held VND 10,328 billion in corporate bonds.

In addition to the profits from the financial segment, Manulife also recorded a gain of VND 2,555 billion from other business activities, a 64.7% increase year-on-year. According to the report notes, the profit increase in this segment was due to allocated profits and other income derived from the contract owner account value.

During the first half of the year, Manulife proactively reduced its sales and business expenses to VND 849 billion and VND 1,392 billion, respectively. In particular, the company’s agent incentive and support costs decreased by nearly half to VND 368 billion, while competition and conference expenses decreased by 65.4% to VND 112 billion.

The proactive cost-cutting measures, along with increased profits from the financial and other business segments, helped Manulife maintain its leading position in the life insurance industry during the first half of 2024, despite challenges in the insurance business. However, due to significant losses in 2021, Manulife still reported a cumulative loss of VND 778 billion as of June 30, 2024.

As of June 30, 2024, Manulife’s total assets amounted to VND 127,300 billion, a 7.3% increase compared to the end of 2023. The company currently ranks third in the life insurance industry in terms of asset size, following Prudential and Bao Viet Life Insurance.

Manulife’s chartered capital stands at VND 22,220 billion, the highest in the industry, and exceeds its owner’s equity (VND 21,855 billion).

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.