While the market is fluctuating, HBC shares of Hoa Binh Construction Group Joint Stock Company are trading brightly, at one point hitting the maximum limit. As of 10:30 a.m., HBC’s market price reached VND 5,260 per share, equivalent to an increase of more than 6%.

The trading volume of this stock is also very vibrant, with more than 3 million shares changing hands in the morning session, double the average matching volume of the last 10 sessions.

Despite a slight recovery from the bottom, HBC’s market price has lost more than 35% since the decision to forcibly delist from HOSE was made, and is still hovering near a 9-year low. Accordingly, market capitalization also decreased significantly to VND 1,800 billion.

The stock broke out strongly after news that Le Viet Hung, the older brother of HBC’s Chairman of the Board, Le Viet Hai, and also a Senior Advisor of Hoa Binh Construction, had successfully purchased 500,000 HBC shares on August 26.

After the transaction, Mr. Hung’s ownership ratio at HBC increased from 0.25% to 0.39%, equivalent to nearly 1.4 million shares. Temporarily calculated at the market price at that time, Mr. Hung spent about VND 3 billion to complete the purchase of additional shares.

Regarding the forced delisting from HOSE, Hoa Binh Construction said that from September 10, more than 347 million HBC shares will be transferred by the Vietnam Securities Depository and Clearing Corporation (VSDC) from HoSE to UPCoM for registration and securities custody.

At the same time, the enterprise also committed to continue to seriously fulfill its information disclosure obligations in accordance with regulations, ensuring transparency and protecting the interests of shareholders. The floor transfer is expected to be completed in August 2024.

Previously, HBC received a decision to forcibly delist from HoSE from September 6, with the last trading date being September 5. The reason is that Hoa Binh Construction has a total accumulated loss exceeding the chartered capital actually contributed, based on the audited financial statements for the year 2023.

In an interview with the press, Mr. Le Viet Hai – Chairman of the Company, stated that the floor transfer does not affect the basic rights and interests of shareholders. After a period of many upheavals, Hoa Binh is gradually improving its financial indicators and expects that in the next two years, HBC shares will grow well and are determined to relist on HoSE as soon as possible.

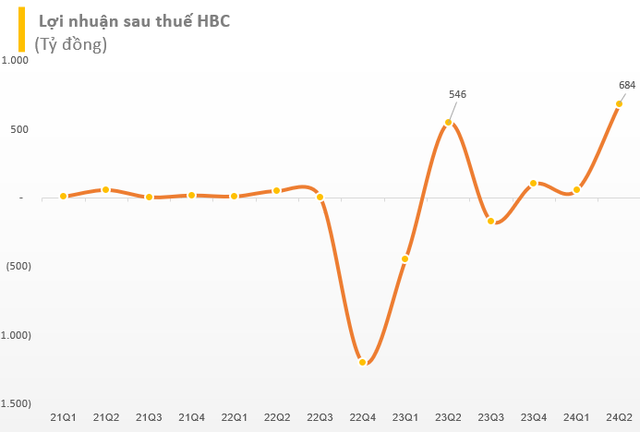

In terms of business results, in the second quarter of 2024, this construction enterprise reported an after-tax profit of VND 684 billion, a significant improvement compared to a loss of more than VND 268 billion in the same period in 2023. The after-tax profit of the Parent Company reached more than VND 682 billion – the highest record in a quarter that the enterprise has achieved since its operation.

For the first six months of 2024, HBC recorded net revenue of VND 3,811 billion, down 10% over the same period last year. Profit after tax soared to VND 741 billion (same period loss of VND 713 billion). Thanks to the above results, HBC has exceeded 71% of the profit target set for the whole of 2024.

In terms of capital, Hoa Binh Construction is still making a cumulative loss of up to VND 2,498 billion as of the second quarter of 2024. Owner’s equity reached VND 1,567 billion, a significant improvement compared to the figure of VND 93 billion at the beginning of the year. Financial borrowings were recorded at VND 4,485 billion, nearly three times the owner’s equity.

Nearly 8,000 billion pre-tax profits in the first two months of the year for Petrovietnam.

During the first two months of the year, Petrovietnam (PVN) – the Vietnam Oil and Gas Group, has reported that its financial targets have been exceeded by 16-26% compared to the plan, showing significant growth compared to the same period in 2023.

Vietnam’s Top Corporation Generates Nearly $6 Billion in Revenue in Just 2 Months, Continues to Thrive After Setting a Series of Records in 2023

At the recent spring meeting of representative state-owned enterprises on March 3, Mr. Le Manh Hung, Chairman of the Board of Directors of Vietnam Oil and Gas Group (Petrovietnam), stated that most of Petrovietnam’s production targets for the first two months of the year have been completed, exceeding the 2-month plan by 5-30%.