Change of Ownership

Cotton Corporation Bông Bạch Tuyết (UPCoM: BBT) was formerly known as Cobovina Bach Tuyet Factory, established in 1960. In 1997, the company transitioned to a joint-stock model, with 30% state capital. In 2004, BBT increased its capital to over 68 billion VND and listed over 6.8 million shares on the HOSE stock exchange.

However, due to difficulties in production and business operations resulting in losses, the company had to halt its manufacturing activities from 2007 to August 2009. Consequently, it was delisted from the stock exchange as it no longer met the profitability requirements set by the State Securities Commission of Vietnam (SSC).

After a decade, in 2018, more than 6.8 million BBT shares returned to UPCoM with an initial price of only 2,300 VND/share. At this time, Dệt may Gia Định (Giditex) held a 30% stake in the company.

BBT once held up to 95% of the market share in the production and trading of medical cotton and cotton-based products. However, the two-year hiatus in manufacturing created opportunities for other businesses to step up and capture market share. Before returning to UPCoM, BBT’s market share in the industry fluctuated between 20-30%.

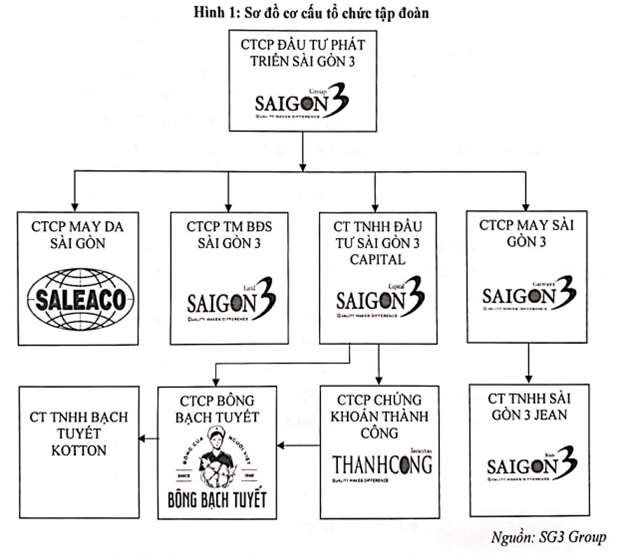

Following a capital increase in 2020 to 98 billion VND, through its subsidiaries, Saigon 3 Capital Investment (holding 40%) and TCI (9.5%), SGI’s equity interest in BBT increased from 16.07% to 47.31%, and its voting rights rose from 20.28% to 50.24%.

2019 also marked a transition in personnel, initiating a new cycle of leadership at BBT. Mr. Nguyen Khanh Linh assumed the role of Chairman of the Board, replacing Mr. Doan Van Son. The position of CEO also changed hands, from Ms. Vo Thi Bich Thuy to Mr. Pham Xuan Dong, and then to Mr. Nguyen Khanh Linh in 2021.

|

Ms. Lan Anh has been the Director of Saigon 3 Capital Investment since April 2023. She also serves as the Chief Financial Officer of Thanh Cong Securities (a subsidiary owned 57.76% by Saigon 3 Capital Investment, HOSE: TCI) since May 2023. She holds the position of Chief Supervisor at SGI since 2019 and at May Sai Gon 3 (a subsidiary of SGI) since 2018. Additionally, she is the Chief Financial Officer and Deputy General Director of Saigon 3 Jean (another SGI subsidiary) since 2019. Mr. Nguyen Khanh Linh is currently the Chairman of the Board of SGI; Chairman of the Board of Ho Chi Minh City Medical Import-Export Joint Stock Company (Yteco, UPCoM: YTC) since 2020; Chairman of the Members’ Council of Thanh Cong Fund Management since 2022; and Chairman of the Board of several other companies, including TCI, May Da Sai Gon, etc. |

Ms. Thuy can be considered one of the few remaining “original” members of BBT, having worked for the brand since 1992. She has held various positions, including accountant, import-export specialist, sales manager, and assistant to the General Director, before becoming a Member of the Board of Directors and General Director of BBT in 2012.

Mr. Doan Van Son returned to the position of Chairman of the Board once more before resigning in August 2022, with Ms. Pham Viet Lan Anh taking his place. Mr. Son was also the last remaining member of the old BBT team to leave the company when he stepped down as a Member of the Board of Directors in April 2023.

The vacancy left by Mr. Son was filled by Ms. Ngo Thi Thu Trang. Around the same time, Giditex completely divested its holdings by selling over 3.4 million BBT shares through order matching transactions on the exchange.

At the 2024 Annual General Meeting of Shareholders, Ms. Pham Viet Lan Anh was re-elected as Chairman of the Board for the term 2024-2029. Mr. Nguyen Khanh Linh retained his position as Vice Chairman, and Ms. Ngo Thi Thu Trang remained as a Member of the Board of Directors. These individuals were all nominated by Saigon 3 Capital Investment (SGI holds 100% capital).

Ms. Pham Viet Lan Anh and Mr. Nguyen Khanh Linh

|

Benefits Derived from the SGI Ecosystem

Since joining the SGI ecosystem in 2020, BBT has officially adopted a new brand identity, coinciding with an increase in its charter capital to 98 billion VND after 16 years of stagnation. The company raised nearly 55 billion VND (by selling 2.96 million shares at a price of 18,500 VND/share) in a private placement to Saigon 3 Capital Investment.

The proceeds from this placement were allocated as follows: nearly 36 billion VND for the purchase of raw materials, 12 billion VND to repay suppliers, 2 billion VND for marketing and brand positioning, and 4 billion VND to supplement the company’s operating cash flow.

In addition to providing loans to BBT to supplement its working capital, in 2021, SGI and Saigon 3 Capital Investment became guarantors for a 5 million USD loan from Financing for Healthier Lives, DAC. The loan has a term of 5 years and a floating interest rate plus a margin of 5.8%. BBT has mortgaged the machinery and equipment purchased with this loan.

Another advantage may stem from the role of Mr. Nguyen Khanh Linh, who currently serves as the Chairman of the Board of YTC – a company engaged in the import and export of pharmaceuticals, raw materials, and medical equipment.

YTC has experience in bidding for ETC projects to supply products to hospitals and is also expanding into the large-scale retail market, including chains like Long Chau, Pharmacity, and An Khang.

BBT adopted a new brand identity in 2020 – Source: BBT

|

SGI was established in August 2018 with a charter capital of 1 billion VND, operating in the financial services support sector. About three months later, SGI decided to conduct a private placement of nearly 70 million shares to acquire May Sai Gon 3’s 95 shareholders, at a swap ratio of 1:1 (1 May Sai Gon 3 share for 1 SGI share).

SGI subsequently became the parent company of May Sai Gon 3 and several other companies, including Thuong Mai Bat Dong San Sai Gon 3 (SG3 Land), Thuong Mai Dich Vu Tu Van Dau Tu Sai Gon 3 (renamed to Saigon 3 Capital Investment in 2020), May Da Sai Gon, Sai Gon 3 Jean (SG3 Jean), and Thanh Cong Securities.

From 2021 to the present, the major shareholders of SGI have included: Mr. Nguyen Quoc Viet (20.23%), Mr. Pham Xuan Hong (5.27%), CTCP Dau Tu Hung Phuc (18.48%), and Ms. Nguyen Ngoc Diep holding 3.65%.

Can the SGI ecosystem help revive the “nostalgic brand” Bông Bạch Tuyết to its former glory?

|

Surviving on Financial Activities and Escaping Accumulated Losses after More Than a Decade

Up to the present, Bông Bạch Tuyết’s main source of revenue still comes from its medical products made from cotton – a strength that has kept this familiar brand afloat in the market for decades.

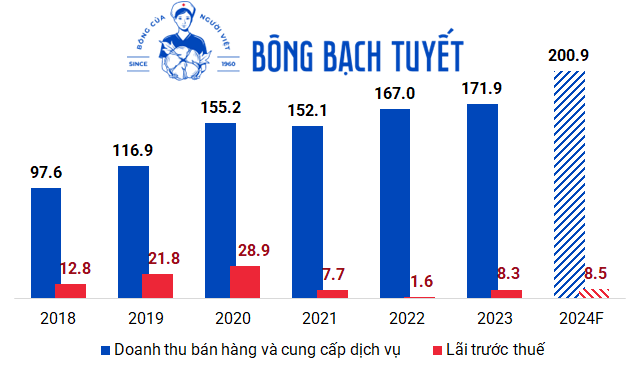

Since joining SGI four years ago, BBT’s revenue has continued its upward trend (except for a slight dip in 2021), but profits have declined. In 2022, profits stood at only 1 billion VND and recovered only in 2023.

Last year, BBT’s revenue reached nearly 153 billion VND, a slight increase compared to the previous year. Lower production costs helped improve the gross profit margin to 33%, but this figure is not exceptionally high compared to the brand’s heyday. For instance, in 2020 and the period from 2013 to 2016, the gross profit margin was at least 40%, and from 2017 to 2019, it exceeded 35%.

It’s not entirely accurate to say that BBT is “surviving” on financial activities, as the money spent on sales and management exceeded the gross profit. Notably, sales expenses have been on the rise in the last three years, increasing from 17 billion VND to 27 billion VND.

Income from financial activities in the last two years has surged, earning 15 billion VND and 17 billion VND, respectively, mainly from interest on loans, which has helped BBT maintain profitability.

| Financial Activities and Sales Expenses of BBT from 2004 to 2023 |

In 2023, BBT recorded a net profit of 7 billion VND, nearly five times higher than the previous year. However, the company had to allocate 5.1 billion VND for additional tax payments and penalties following a tax inspection for the period from 2015 to 2017. BBT used nearly 1.5 billion VND to offset accumulated losses, officially eliminating them after more than a decade.

BBT achieved a record profit of 26 billion VND in 2020, a year in which there was almost no income or expenses from financial activities.

| Profit after Tax of BBT from 2004 to 2023 |

In the last four years, the “nostalgic brand” has invested heavily in purchasing and constructing fixed assets, spending tens to hundreds of billions of VND, a significant increase compared to the previous period. In 2020, 2021, 2022, and 2023, the respective amounts invested were 23 billion VND, 19 billion VND, 20 billion VND, and 14 billion VND.

As of the end of 2023, BBT’s total assets amounted to nearly 295 billion VND, nearly half of which was in short-term receivables of 123 billion VND. Notably, May Da Sai Gon (a subsidiary of SGI) borrowed 90 billion VND for a period of 12 months at an interest rate of 13%/year to supplement its working capital, without providing any collateral.

BBT has also started to leverage financial leverage since joining SGI. In 2021, BBT’s borrowings exceeded 144 billion VND, while in the years before 2020, the borrowings were very low or almost non-existent. This debt has been maintained in subsequent years, dropping to 115 billion VND at the end of 2023.

BBT still accounts for 9 billion VND received from Dia Oc Tan Phu – a joint venture between BBT (holding 26%) and Dau Tu PDG. Dia Oc Tan Phu is the investor in the No. 1 Nguyen Van Sang Housing Project, which has been temporarily suspended since 2017, despite prior approval from the Ho Chi Minh City People’s Committee.

The land plot of the No. 1 Nguyen Van Sang Housing Project has been used as a parking lot for several years – Photo: Tu Kinh

|

Profit Target Remains Flat

In 2024, Bông Bạch Tuyết sets its sights on a revenue target of 200 billion VND, the highest in the company’s history, representing a 16% increase compared to the previous year. However, this figure does not account for deductions, which have amounted to over 10% of revenue in recent years. The company aims to maintain its pre-tax profit at 8.5 billion VND.

BBT plans to deposit and lend 80 billion VND, down from 130 billion VND in 2023, earning interest income of 10.5 billion VND, while expecting to spend 11.5 billion VND on interest expenses.

|

Revenue and Pre-tax Profit of BBT from 2018 to 2024 (in billion VND)

Source: Author’s compilation

|

The strategic products of the Bông Bạch Tuyết brand will continue to be makeup remover pads and dry cleansing towels. Additionally, the company plans to develop premium skincare products.

BBT intends to introduce wet makeup remover pads infused with skincare ingredients and baby cotton swabs with spoon, twisted, and round tips. The company will also develop hospital-grade gauze products.

The company

Foreign investors sell nearly 300 billion VND in the final trading session of the week, while strongly accumulating a real estate stock in the opposite direction.

In a fierce market session, foreign trading is a negative factor with net selling across all three exchanges.