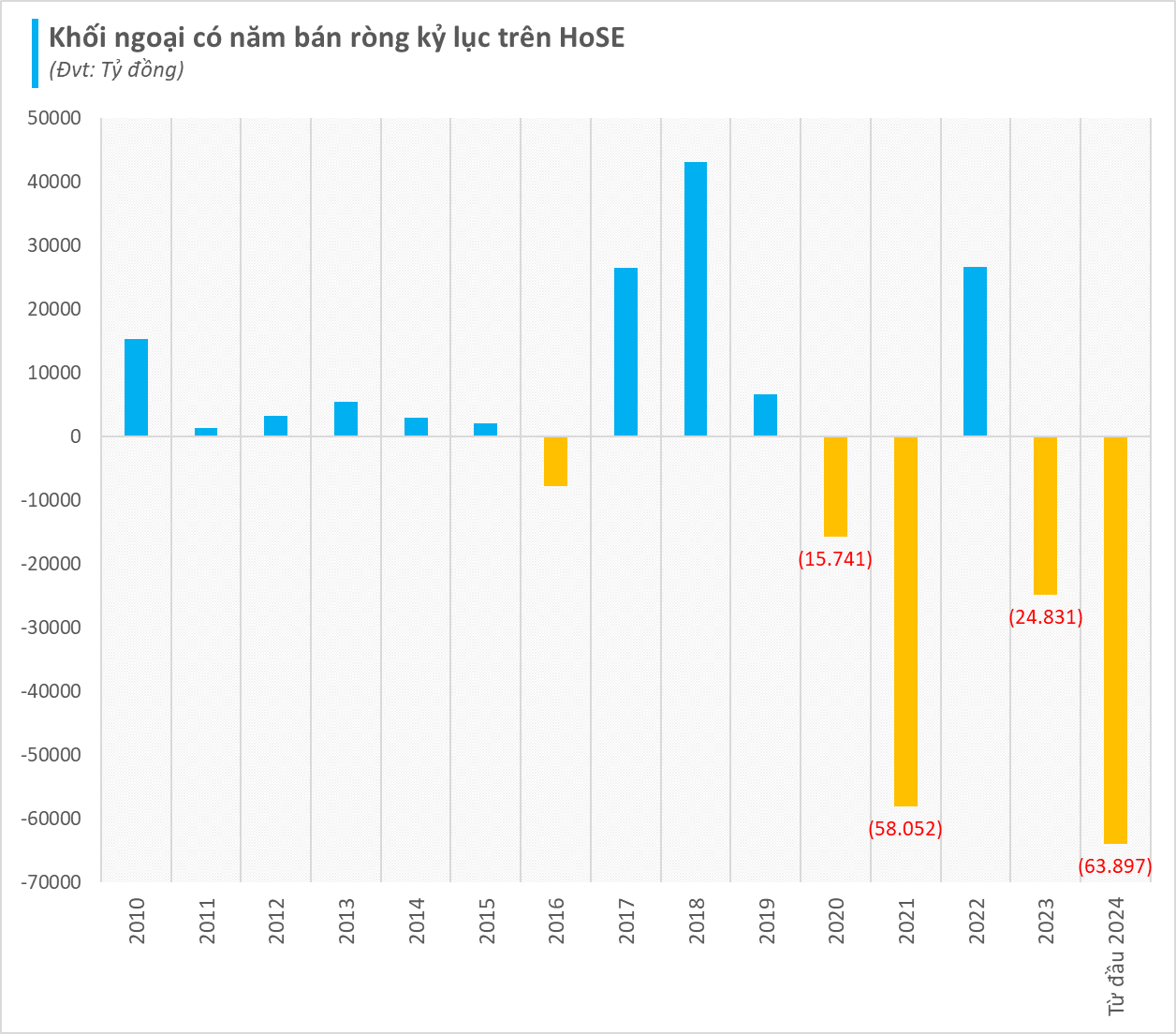

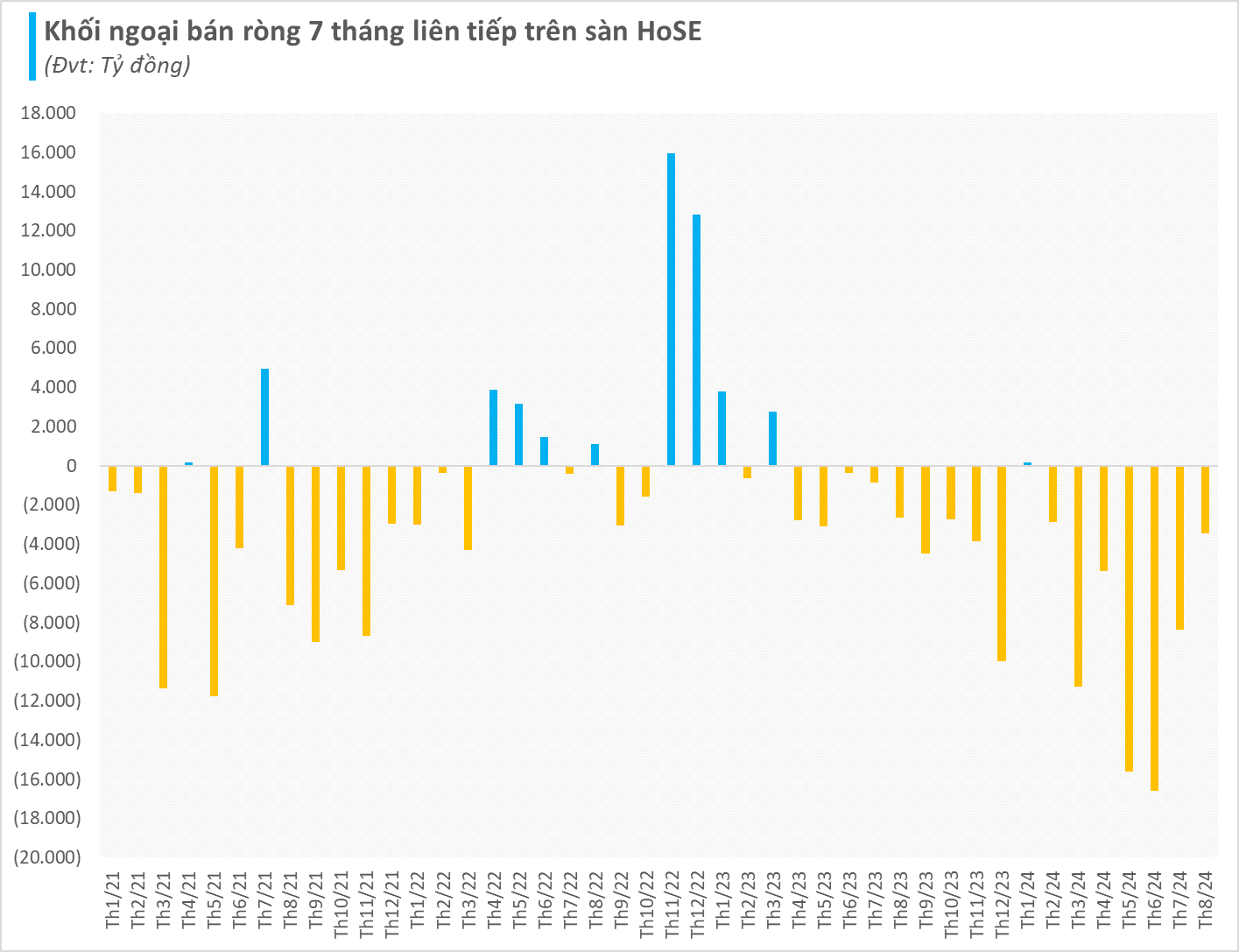

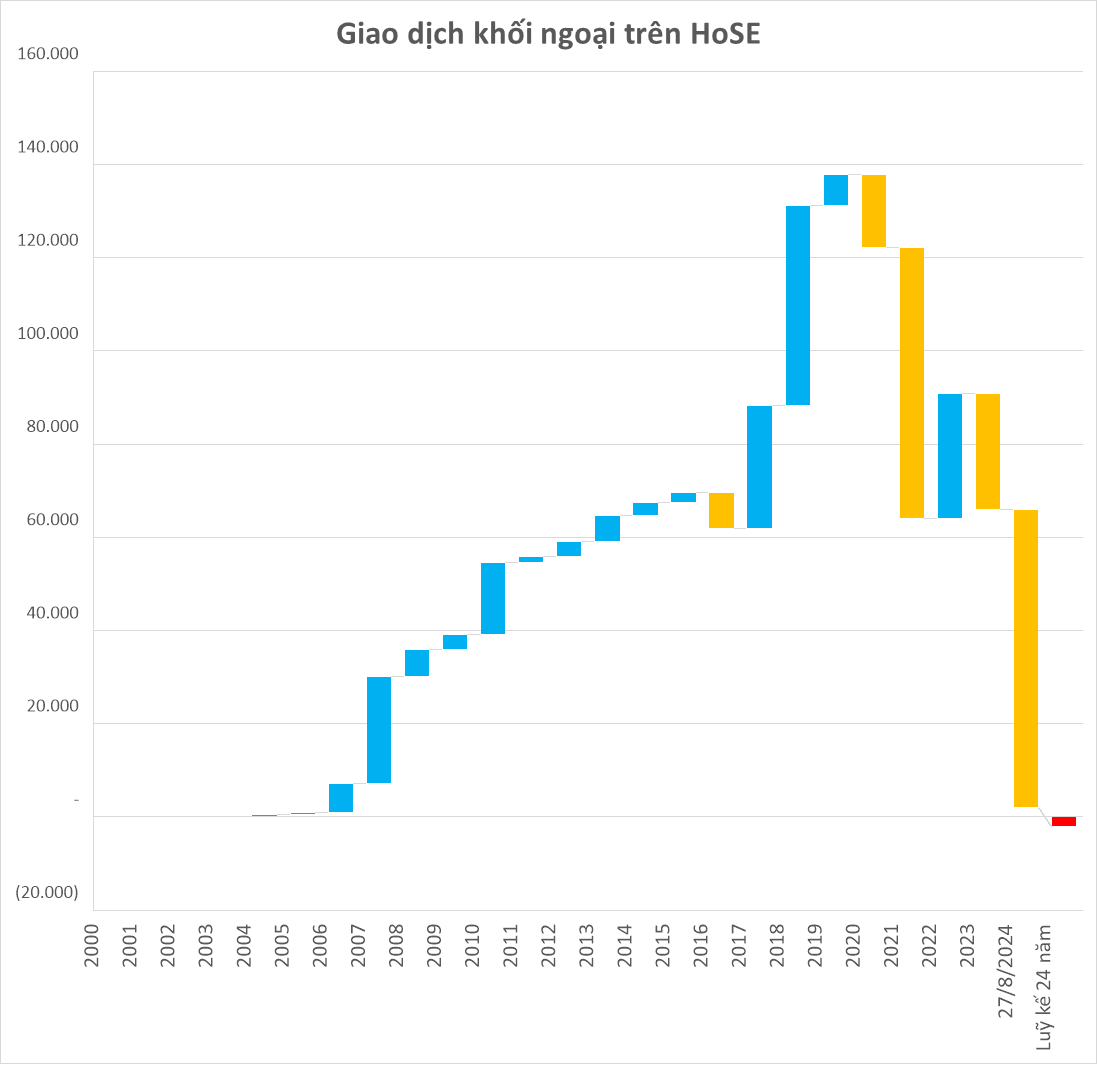

The Vietnamese stock market continues to face strong net selling pressure from foreign investors. Barring any surprises, it is highly likely that foreign investors will net sell for the seventh consecutive month on HoSE. Cumulative net selling from the beginning of 2024 has reached approximately VND 64,000 billion, equivalent to USD 2.6 billion, setting a record high since the inception of the Vietnamese stock market in 1998.

Looking at the broader picture, foreign investors have recorded net selling for 16 out of the last 17 months (except for a sudden net purchase in January 2024). On a positive note, the selling intensity seems to have cooled down, but there are still thousands of billions of Vietnamese dong worth of stocks being net sold each month.

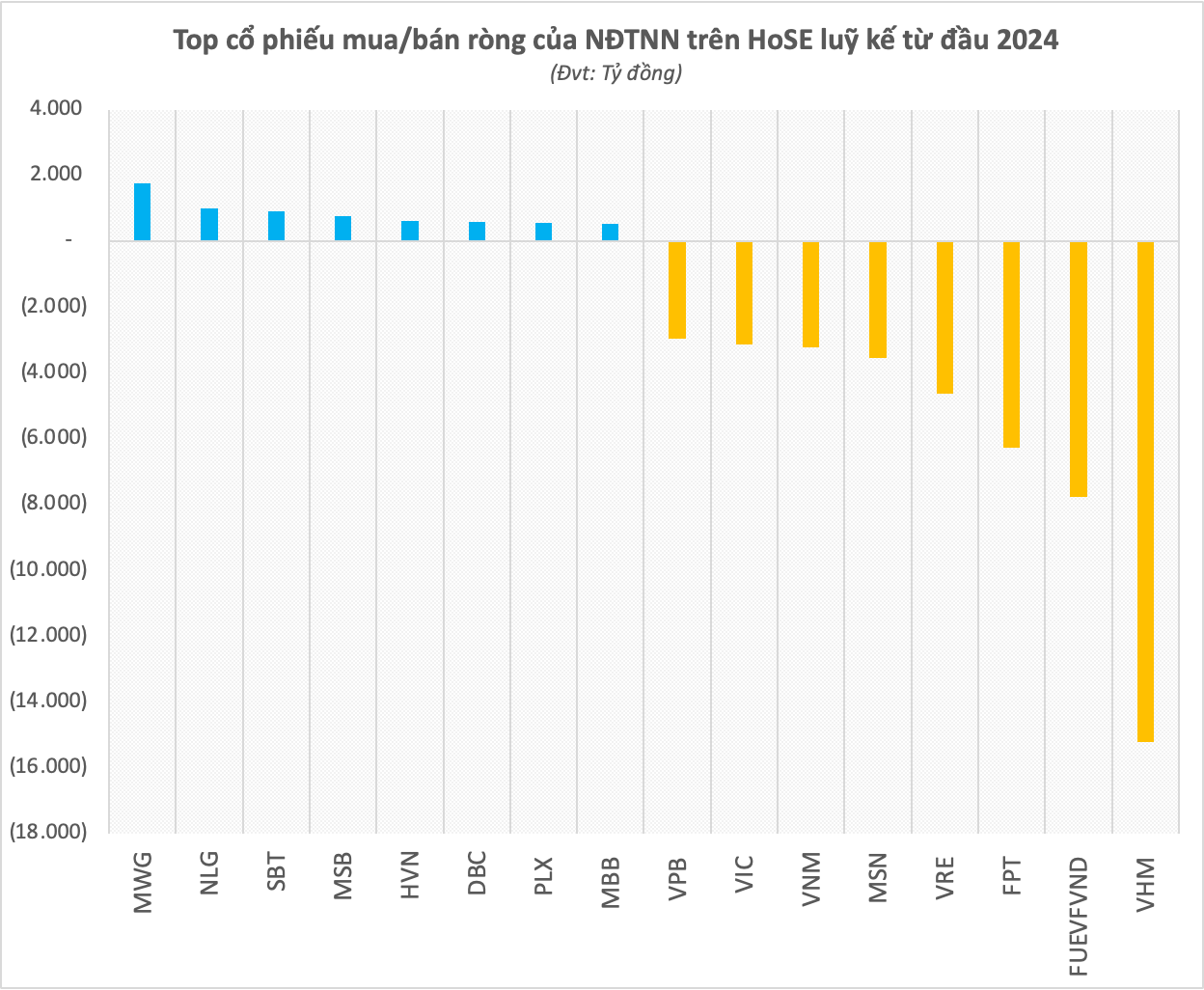

The net selling pressure from foreign investors is widespread, mainly through the order-matching channel. However, when looking at individual stocks, there are some notable differences. VHM stock witnessed the largest net selling, with a net sell-off of more than VND 15,200 billion, which partly caused a correction in the stock price. VHM even dipped below the COVID-19 pandemic low at one point before recovering in early August. In terms of external factors, the real estate market is still facing challenges, and the business performance of Vinhomes is not expected to rebound strongly yet, reducing its appeal to foreign investors.

FUEVFVND fund certificates also made it to the top of the net sell list in the first eight months, with a value of nearly VND 7,800 billion. While it used to be a magnet for foreign capital, the DCVFM VNDiamond ETF (FUEVFVND) managed by Dragon Capital has been experiencing unprecedented net outflows, with net outflows exceeding VND 9,000 billion. This outflow is partly influenced by the selling activities of Thai investors due to the new tax policy that took effect in early 2024.

Additionally, FPT was net sold at nearly VND 6,300 billion. However, unlike the aforementioned stocks, the leading technology stock has maintained a steady upward trend since the beginning of the year. The net selling by foreign investors is likely profit-taking after a long period of holding. Meanwhile, stocks such as VRE, MSN, VNM, and VIC recorded net selling values of over VND 3,000 billion in the eight-month period.

On the other hand, buying momentum has been weak, with no stock recording a net buy value of VND 2,000 billion in the first eight months. MWG was the stock with the strongest net buying, with a value of nearly VND 1,800 billion. After a sharp sell-off last year, foreign capital has returned to this retail stock, and its share price has also increased significantly to a two-year high.

Decoding the “foreign net sell” chorus

In reality, foreign investors had a period of continuously injecting capital into Vietnamese stocks through order-matching and negotiated trading on the stock exchange. The cumulative net buy value reached nearly VND 140,000 billion at the end of 2019. However, foreign capital started to reverse its trend in 2020, with net selling intensity becoming overwhelming, resulting in the complete elimination of the net buy position that had persisted for two decades. Since the inception of the Vietnamese stock market in 2000, the cumulative net buy value of foreign investors has turned negative at VND 2,000 billion. It is important to emphasize that this figure only accounts for HoSE and includes negotiated and order-matched transactions on the exchange, excluding off-exchange transactions, IPO subscriptions, etc.

The net selling trend also indicates a certain level of caution among foreign investors towards the Vietnamese stock market. The story of upgrading the stock market to attract foreign capital remains just an expectation. In reality, the market has been stagnant for many years, with the VN-Index fluctuating between 1,200 and 1,300 points, and market capitalization failing to break out significantly. Long-standing ETFs and active funds in the market have also witnessed unprecedented net outflows, amounting to thousands of billions of dong. Other factors, such as interest rate differentials and exchange rate pressures, also contribute to the outflow of capital from emerging and frontier markets, including Vietnam.

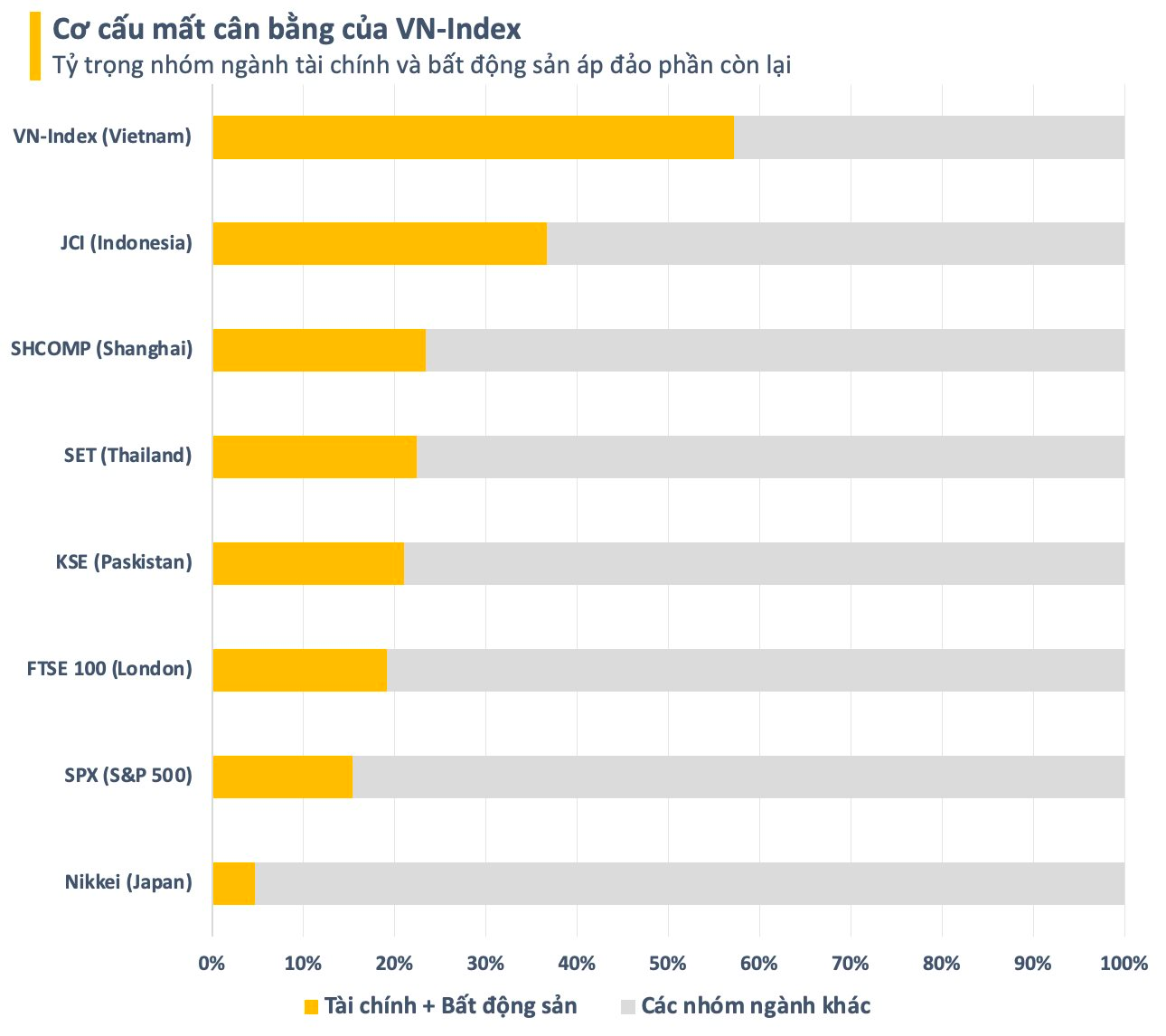

Above all, the “accumulation” moves by foreign investors are mostly opportunistic, taking advantage of bottom-fishing when valuations drop after sharp market declines. In contrast, prolonged net selling stems from the lack of high-quality stocks in the Vietnamese stock market that meet the stringent criteria of foreign investors. Businesses in “hot trend” sectors such as technology, retail, healthcare, and energy, which are typically favored by foreign capital, are not abundantly represented in the market. The market structure is skewed towards the financial and real estate sectors.

The lack of quality stocks not only affects the operations of ETFs, as their reference indices tend to overlap, but it also makes it challenging for active funds to construct a diverse portfolio. Overall, these issues will continue to hinder the inflow of foreign capital into the Vietnamese stock market in the future.

Where is the turning point?

In general, reversing the foreign capital flow back into the Vietnamese stock market is not a simple task and is unlikely to happen in the short term. A positive sign is that while foreign investors have been net selling on the stock exchange, their capital has not entirely withdrawn from the market. Foreign capital is still quietly flowing into the market through private placement deals and off-exchange transactions via VSD. The buying momentum is not widespread but is concentrated in enterprises with high growth potential and unique investment stories.

The upcoming launch of the KRX system will provide the necessary infrastructure to implement the central counterparty (CCP) model, addressing one of the critical bottlenecks for the market upgrade regarding the pre-funding requirement. Most recently, the Ministry of Finance and the State Securities Commission announced a draft amendment related to allowing foreign institutional investors to purchase securities without the need for pre-funding (Non-Prefunding Solution – NPS) and the roadmap for English language disclosure.

According to SSI Securities Corporation (SSI Research), the circular is expected to be implemented in the fourth quarter of this year. FTSE Russell could give a positive assessment in the September 2024 ranking and decide to upgrade Vietnam in September 2025.

Upgrading to an emerging market will help attract capital from ETFs, potentially reaching USD 1.6 billion, excluding active funds. It will also improve market quality and attract investments from professional foreign institutional investors.

“The transition from a frontier to an emerging market is not just a change in name but a qualitative shift, and the capital inflow will mostly come from professional foreign institutional investors. In other words, this is about achieving the goal of developing the investor base.

Upgrading to an emerging market will provide a good opportunity for the Vietnamese stock market to gain attention from MSCI, as the list of potential candidates for an emerging market upgrade is quite limited,” SSI Research stated.