On August 26, Ha Tay Pharmaceutical received a public offering registration dossier for DHT shares from ASKA Pharmaceutical. Specifically, ASKA registered to purchase 9,000 DHT shares, equivalent to 0.011% of the Company’s charter capital, to increase its ownership from 34.99% to a maximum of 35.001%. According to the Enterprise Law, with an ownership ratio of over 35% in a joint-stock company, the group of shareholders or that shareholder has the right to veto special decisions of the company.

If successful, ASKA Pharmaceutical will also continue to hold the position of the largest shareholder of DHT. Ranking second is Le Viet Linh, Member of the Board of Directors and Deputy General Director, holding 7.06%, followed by Le Van Lo, Chairman of the Board of Directors of DHT, with 6.25% capital.

Source: VietstockFinance

|

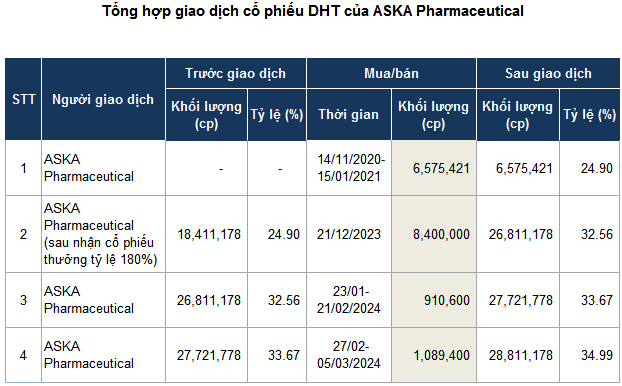

The foreign shareholder began accumulating DHT shares in 2020, with ASKA purchasing a total of 6.6 million shares (including 5.3 million shares offered privately at VND 70,000 per share and 1.3 million shares traded outside the system), holding 24.9% of DHT‘s charter capital. The number of shares that ASKA traded outside the system were transferred by Le Anh Trung, Vice Chairman of the Board of Directors and Deputy General Director (nearly 500,000 shares), and his wife, Nguyen Thi Minh Hau (over 800,000 shares).

By the end of 2023, ASKA had further increased its ownership in DHT to 26.8 million shares, or 32.56% of capital, after completing the private purchase of 8.4 million shares at VND 21,500 per share. In the first two months of 2024, the Japanese shareholder acquired an additional 2 million shares through transactions on the stock exchange, raising its ownership in DHT to 34.99%.

ASKA is a pharmaceutical company with a 100-year history, headquartered in Tokyo, Japan. The company’s business sectors include: manufacturing, trading, exporting, and importing pharmaceuticals, medicines, and medical equipment. In April 2020, ASKA established an international business division to boost growth and development through foreign market operations.

Commenting on the partnership with ASKA, Le Xuan Tham, Member of the Board of Directors of DHT, shared at the 2020 Extraordinary General Meeting of Shareholders: “ASKA is Japan’s top hormone-producing pharmaceutical company, and partnering with them will bring many advantages to DHT. The partner is also a top-17 Japanese pharmaceutical manufacturer with four factories in Iwaki City, Fukushima Prefecture, one of which has achieved PIC/S standards. At the same time, ASKA has committed to supporting DHT in designing, training, and guiding the operation of the Hataphar high-tech pharmaceutical factory.”

The proceeds from the private placement contributed to the Hataphar high-tech pharmaceutical factory project (with a total expected investment of VND 1,350 billion). DHT raised the remaining nearly VND 1,000 billion from other sources.

The new factory, with EU-GMP standards, specializes in producing synthetic drugs, hormone drugs, and herbal medicines. The synthetic drug group includes specialized lines such as cardiovascular, digestive, and diabetic drugs. For herbal medicines, the output is 700 million units per year.

| Business results of DHT from 2006 to 2023 |

Looking back at DHT‘s business results from 2020 to 2023, the presence of the Japanese strategic shareholder has not had a significant impact, as the company is in the investment phase of building a new factory. After peaking at VND 2,042 billion in revenue in 2019, the Company has not been able to reach that level again. Moreover, net profit has not increased significantly, remaining below VND 100 billion in the past three years (2021-2023).

| DHT’s business results for the first half of 2024 |

DHT closed the first half of 2024 with over VND 999 billion in net revenue, down 4% compared to the same period last year. Meanwhile, management expenses increased sharply by 44% to over VND 49 billion, causing net profit to decrease by 35%, reaching over VND 33 billion.

In 2024, DHT sets a target of VND 1,769 billion in total revenue and VND 78.5 billion in pre-tax profit, down 8% and 20%, respectively, compared to the 2023 performance. DHT noted that the profit plan was built on the assumption that depreciation expenses and research and development expenses for the Hataphar CNC factory project would not be recorded in 2024. In case these expenses are recognized, the profit target will be adjusted accordingly.

Compared to the full-year targets, the Company achieved 57% of the revenue target and 54% of the profit plan in the first six months.

Profit from Sugarcane, Durian, and Leafy Vegetables with the Lunar New Year approaching

Good news for farmers in the Mekong Delta provinces as the prices of sugarcane, durian, and vegetables… have skyrocketed during the days leading up to the Lunar New Year, providing them with attractive sources of income.