The stock market remains in a tug-of-war, trading within a narrow range. The index closed slightly higher on August 28, gaining 0.88 points to reach 1,281. Trading volume remained low, with a value of over VND 16,300 billion on the HOSE.

Looking ahead to the next trading session, most securities companies believe that the market is balanced and will soon establish an upward trend in the short term. Investors are advised to take advantage of this adjustment to restructure their portfolios.

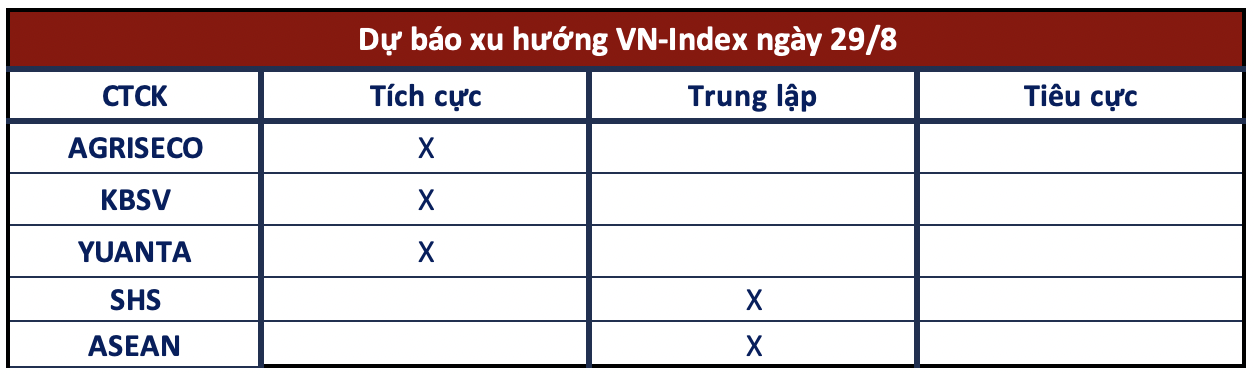

Uptrend Dominates

Agriseco Securities

Technically, the VN-Index retracted its upward momentum with trading volume exceeding the 20-session average. Many real estate stocks have retested support levels during this volatile period. This could be a process of shaking off weak hands during the recovery phase. Going forward, the VN-Index is expected to fluctuate and form a balanced region around the 1,280 (+-10) point mark. Investors are advised to maintain their current holdings and prioritize buying large-cap stocks, as the VN30 is offering a discounted entry point during these short-term fluctuations.

KBSV Securities

The tug-of-war trend persisted in the session, with increased trading volume, but buying pressure slightly outweighed selling pressure as dip buyers continuously supported prices amid large sell-offs. Although the risk of strong fluctuations remains, with the short-term uptrend intact, the VN-Index is highly likely to successfully conquer the nearby resistance level. Investors are advised to gradually buy back trading positions as the VN-Index or target stocks adjust towards nearby support levels.

Yuanta Securities

The market is expected to continue its upward momentum in the next session, with the VN-Index likely to retest the 1,290-point threshold. Additionally, the market remains in a volatile phase, leaning towards positivity, and the VN-Index could soon surpass the 1,290-point level within the next 1–2 sessions. Meanwhile, banking and securities stocks have cooled down in the last three trading sessions, while the real estate group (VNReal) may still experience adjustments in the next session, but the short-term risk in these three sectors remains low, and there is still room for further gains.

Capitalize on Fluctuations to Restructure Portfolios

SHS Securities

In a positive scenario, the VN-Index may face pressure to fluctuate and adjust during the session, hovering around the 1,270-point – 1,275-point range, which corresponds to the 5-10 session average. It may then retest the 1,300-point region next week with the rotating support of large-cap stocks. In a less optimistic scenario, the VN-Index may face adjustment pressure towards the 1,250-point – 1,260-point range, corresponding to the highest price of 2023 and the price gap of the trading session on 19/08/2024. The positive sign is that the adjustment pressure remains relatively normal for many stocks, while several stocks are taking turns recovering after strong adjustment pressure.

Asean Securities

The process of accumulation and base-building after the previous uptrend is still going well, although profit-taking and pre-holiday caution have made transactions more cautious. Positively, large-cap stocks continue to play a role in taking turns supporting the market. The market tends to continue narrowing, creating fluctuations to shake off short-term money.

Although there are still concerns about potential risks from a possible recession in the US economy in the short and medium term, Asean remains very positive about the medium and long-term prospects of the domestic market. Investors should maintain a stable proportion of stocks with solid business foundations and good profit prospects. Short-term fluctuations will provide opportunities to restructure portfolios.

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.