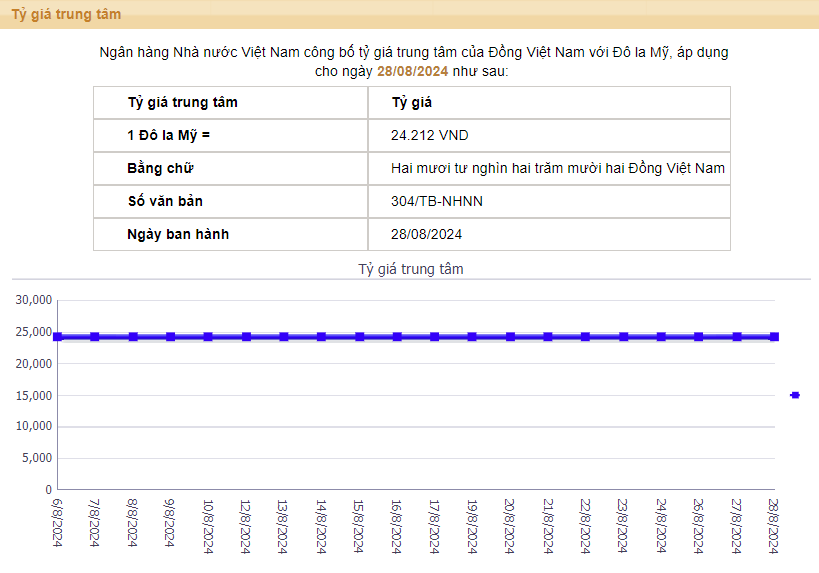

USD/VND Exchange Rate Update

Source: SBV

With a +/- 5% margin, the ceiling and floor exchange rates applied by banks for today’s session are 25,422 VND/USD and 23,001 VND/USD, respectively.

This morning, the State Bank of Vietnam’s Trading Centre maintained its buying and selling rates at 23,400 – 25,372 VND/USD, keeping the buying rate unchanged from the previous session while lowering the selling rate by 13 dongs.

Following a similar trend, many banks adjusted their buying and selling rates for the greenback, with changes ranging from 10 to 45 dongs compared to the same period yesterday (August 27).

| USD Exchange Rates | Buying | Selling |

| Vietcombank | 24,630 | 25,000 |

| VietinBank | 24,660 | 25,000 |

| BIDV | 24,660 | 25,000 |

| Techcombank | 24,648 | 25,039 |

| Eximbank | 24,630 | 25,060 |

Specifically, at 9:50 am this morning, Vietcombank listed the buying and selling rates for the greenback at 24,630 – 25,000 VND/USD, a decrease of 10 dongs for both rates compared to the previous session.

BIDV listed its buying and selling rates at 24,660 – 25,000 VND/USD, a reduction of 40 dongs for each rate from the previous day.

Techcombank’s exchange rates stood at 24,648 – 25,039 VND/USD, marking a decrease of 44 dongs for both buying and selling rates compared to yesterday.

Eximbank maintained its buying rate at 24,630 VND/USD while keeping the selling rate unchanged from the previous day at 25,060 VND/USD.

According to our survey, NCB offered the lowest buying rate at 24,520 VND/USD, while OCB quoted the highest buying rate at 24,790 VND/USD. In terms of selling rates, HSBC offered the lowest rate at 24,938 VND/USD, while Saigonbank quoted the highest rate at 25,380 VND/USD.

In the unofficial market, the USD/VND exchange rate in Hanoi was traded at 25,130 – 25,190 VND/USD, a decrease of 40 dongs for buying and 50 dongs for selling compared to the previous session.

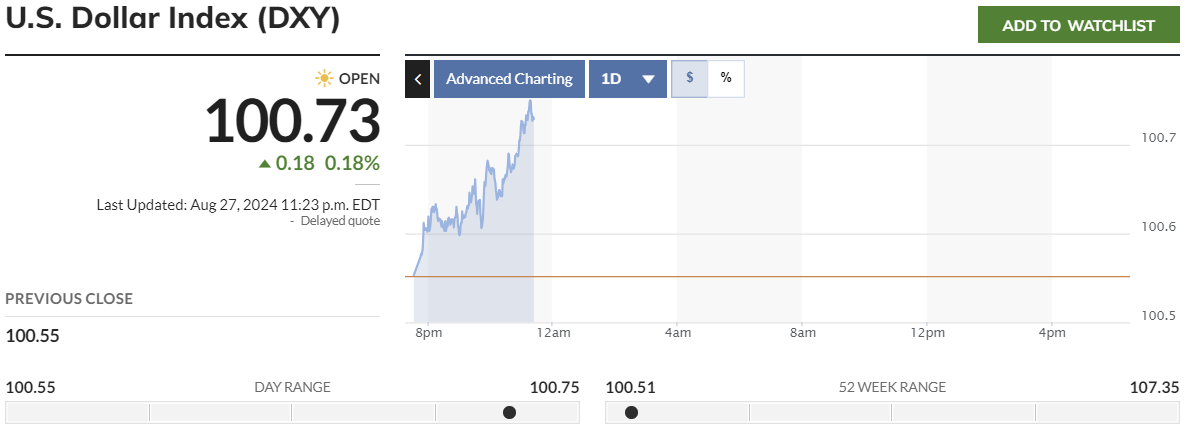

At the same time, in the global market, the US Dollar Index (DXY), which measures the strength of the US dollar against a basket of major currencies, stood at 100.73 points, reflecting an increase of 0.18% from the previous session.

Source: MarketWatch

The DXY index recovered in the last trading session after dipping to nearly its lowest level since July 2023, as the prospects of interest rate cuts by the US Federal Reserve continued to weigh on the greenback.

Market expectations are split, with about a one-third chance of a 50-basis-point rate cut in September, and over 100 basis points in total easing anticipated for the year.

These expectations have been reinforced by dovish statements from Fed officials, who have warned about growing risks to the labor market while signaling confidence that inflation will return to the 2% target.

Investors are now awaiting upcoming data releases on unemployment benefit claims and the PCE price index later this week to gain further insights into the interest rate trajectory.

4 Factors Putting Pressure on USD/VND Exchange Rate in Q1/2024

With the currency exchange rate fluctuating in the first few weeks of 2024, Mr. Ngo Dang Khoa, Director of Foreign Exchange, Capital Markets and Securities Services at HSBC Vietnam, highlights four factors putting pressure on the USD/VND exchange rate in Q1/2024…