|

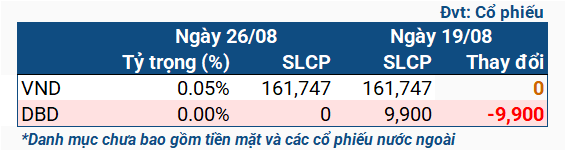

iShares ETF Equity Changes from 08/19/2024 to 08/26/2024

|

In detail, the Fund sold all 9,900 DBD shares that were still held in its portfolio. The only remaining Vietnamese stock in iShares ETF’s portfolio is VND, with 161,747 shares. Total asset value as of August 26 was just under $227 million, down from $231 million recorded on August 19.

iShares ETF has been aggressively selling off Vietnamese stocks since June 11, 2024, when asset management giant BlackRock announced that the ETF would cease trading and no longer accept creation or buyback orders after market close on March 31, 2025. The announcement also emphasized that the timeline could change.

Following the fund closure announcement, BlackRock surprisingly hit an impressive milestone: Q2 assets hit a record $10.65 trillion. This achievement was backed by strong equity market performance and significant inflows into the company’s ETFs.

Chau An

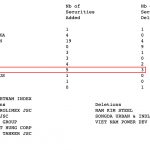

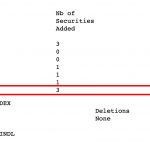

MSCI Welcomes 5 Vietnamese Stocks to Frontier Markets Small Cap Index

During the Q1 2024 review, which took place on the morning of February 13, 2024, a total of 41 stocks were added and 21 stocks were removed from the MSCI Frontier Markets Small Cap Index. Vietnam contributed 5 new stocks, while 3 stocks went in the opposite direction.

BlackRock’s Bitcoin spot ETF trading volume exceeds $1.1 billion

As BlackRock continues to lead the way in cryptocurrency investing, the Spot Bitcoin ETF is expected to further grow in popularity and assets under management. With BlackRock’s track record of delivering innovative investment solutions, investors can trust that they are in capable hands as they navigate the evolving landscape of digital currencies.