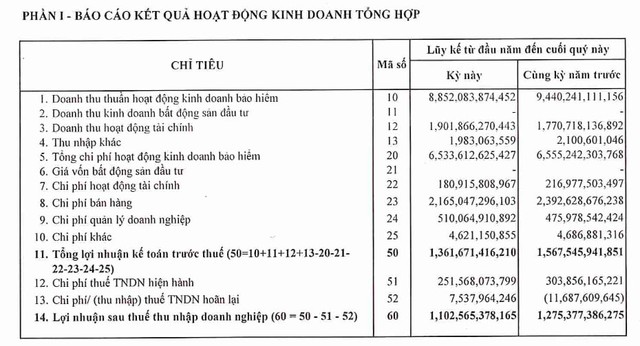

Dai-ichi Life Vietnam, a leading life insurance company in the country, has released its financial report for the first half of 2024, revealing a pre-tax profit of VND 1,362 billion, a 13% decrease compared to the same period in 2023. Despite this, Dai-ichi still ranks among the top profitable insurance companies, second only to Manulife and outperforming industry giants like Bao Viet Life Insurance and Prudential.

The company’s post-tax profit also witnessed a similar decline of over 13%, amounting to VND 1,103 billion. Nevertheless, Dai-ichi’s retained earnings as of June stand at an impressive VND 10,742 billion, the highest in the company’s history and among the top figures in the Vietnamese life insurance industry.

Source: Dai-ichi Life Vietnam’s Semi-Annual Financial Statement

During the first six months of the year, Dai-ichi’s gross profit from its insurance business decreased by nearly 20% year-on-year to VND 2,318 billion. This was primarily due to a 6% drop in net insurance revenue to over VND 8,800 billion, while operating expenses related to the insurance business remained relatively unchanged at over VND 6,500 billion.

The financial segment provided a boost to Dai-ichi’s overall profits, with a nearly 11% increase in revenue to VND 1,721 billion. This was driven by a 7% rise in financial investment income to nearly VND 1,902 billion, coupled with a nearly 17% reduction in financial expenses, which amounted to approximately VND 181 billion.

Dai-ichi attributed its sales expenses for the first half of the year to VND 2,165 billion, a 9.5% decrease year-on-year, while its administrative expenses increased by over 7% to VND 510 billion.

After accounting for these expenses, the company’s net profit from business operations stood at over VND 1,364 billion, reflecting a 13% decline.

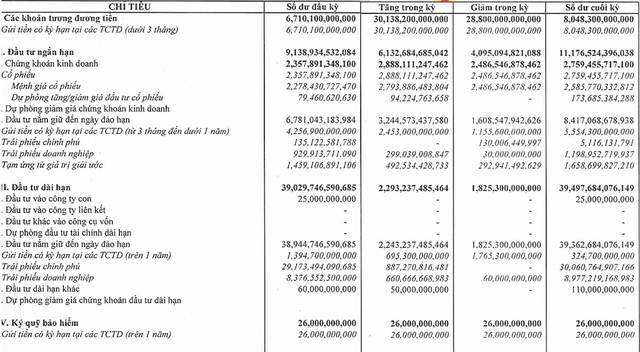

As of the end of June, Dai-ichi’s total assets amounted to VND 70,954 billion, a 6.4% increase from the beginning of the year. This includes over VND 8,000 billion in short-term bank deposits (under 3 months) and nearly VND 50,700 billion in financial investments.

Source: Dai-ichi Life Vietnam’s Semi-Annual Financial Statement

In terms of short-term financial investments, Dai-ichi held stocks worth over VND 2,759 billion as of the end of the second quarter, an increase of approximately VND 400 billion from the beginning of the year. Additionally, the insurance company also had over VND 5,550 billion in time deposits (3 months to 1 year) and nearly VND 1,200 billion in corporate bonds.

For long-term financial investments, Dai-ichi allocated over VND 30,000 billion to government bonds, nearly VND 9,000 billion to corporate bonds, and VND 325 billion in long-term deposits (over 1 year).

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.