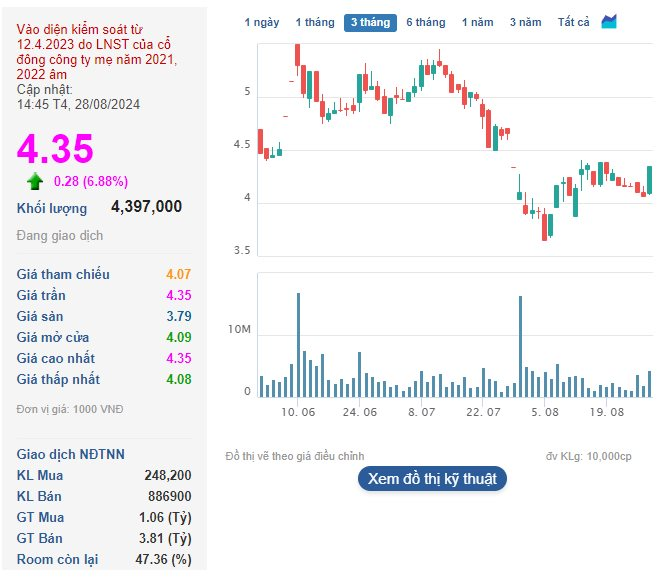

HNG shares of Hoang Anh Gia Lai International Agriculture Joint Stock Company skyrocketed in the August 28 session, marking the second gain in ten trading sessions (including two sessions with unchanged prices). The share price surged by 6.88% to VND 4,350 per share, with a trading volume of nearly 4.4 million units.

Prior to this surge, HNG shares had plunged to their lowest level since the beginning of the year, reaching VND 3,650 per share on August 5. However, the share price has since rebounded significantly, boosting the company’s market capitalization to over VND 4,822 billion.

HNG shares surge in the August 28 session. (Source: Cafef)

Similarly, shares of Hoang Anh Gia Lai Joint Stock Company (HAG) also witnessed explosive trading on the same day. By the end of the August 28 session, HAG shares climbed by 4.76% to VND 11,000 per share, with a trading volume of more than 27.3 million units—a ninefold increase compared to the previous session.

Notably, HAG shares have been on an upward trajectory recently, with seven out of ten sessions ending in gains, resulting in a nearly 10% increase in share price. The company’s market capitalization has surged to nearly VND 11,632 billion.

HAG shares surge by 4.76% with a significant increase in trading volume. (Source: Cafef)

The upward momentum of HAG shares coincides with news that on August 15, Ms. Doan Hoang Anh, daughter of the Chairman of the Board of Directors, Mr. Doan Nguyen Duc, registered to purchase 2 million HAG shares. The transaction will be executed through order matching on the exchange from August 20 to September 18, 2024, with the aim of increasing her ownership.

As of the registration date, Ms. Hoang Anh held 11 million HAG shares, representing a 1.04% ownership stake. If this transaction is successful, her ownership will increase to 13 million shares, equivalent to a 1.23% stake.

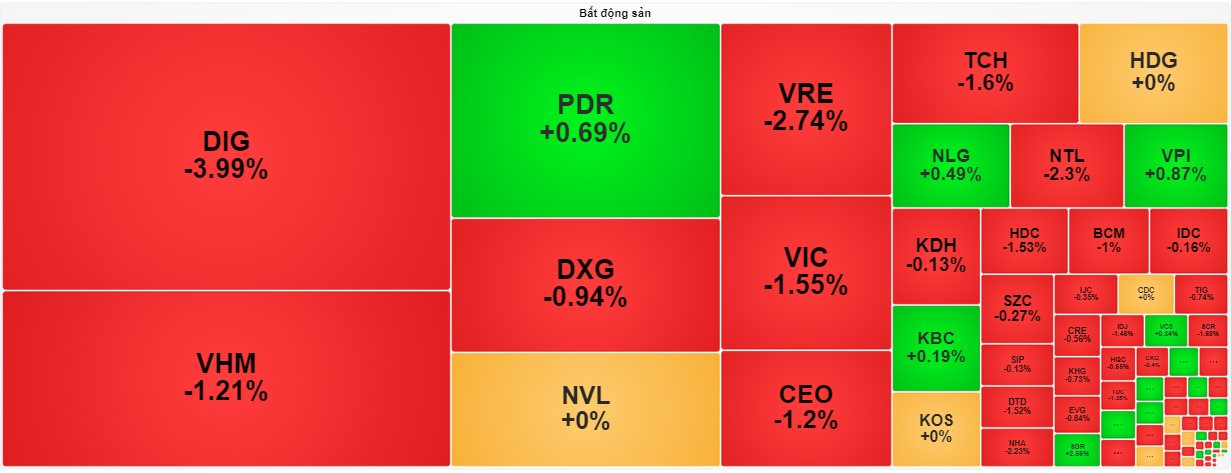

Real Estate Stocks Take a Hit

In the August 28 session, the VN-Index climbed by 0.88 points to 1,281.44, while the HNX-Index and UPCoM-Index dipped by 0.68 points and 0.01 points, respectively. Market liquidity dipped to nearly VND 18,100 billion, with the HoSE exchange accounting for over VND 16,300 billion.

After propping up the VN-Index for several sessions, real estate stocks faced heavy selling pressure, particularly those in the “Vin” family, including VHM, VIC, and VRE.

Real estate stocks witness a sell-off in the August 28 session.

Specifically, real estate stocks took a beating in the session, with the “Vin” family standing out: VHM fell by 1.21%, VIC dropped by 1.55%, and VRE declined by 2.74%. These three stocks, along with VCB, exerted the most significant downward pressure on the VN-Index during the session.

Additionally, a slew of large-cap real estate stocks witnessed price declines: DIG (-3.99%), DXG (-0.84%), CEO (-1.2%), TCH (-1.6%), NTL (-2.3%), BCM (-1%), and HDG (-1.63%), among others.

On a positive note, some real estate stocks managed to stay in the green, recording modest gains of less than 1%: PDR, KBC, NLG, and VPI.

On the buying side, investors actively snapped up shares of GVR, TCB, MBB, FPT, HVN, SSI, VNM, MSB, GAS, and HAG.

Foreign investors extended their net selling streak to six sessions on the HoSE exchange, offloading stocks worth over VND 110 billion. HPG shares of Hoa Phat Group were the most sold, with a net sell value of over VND 178 billion. This was followed by HSG (VND 73.7 billion), VHM (VND 49.61 billion), and MWG (VND 43.3 billion).

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.