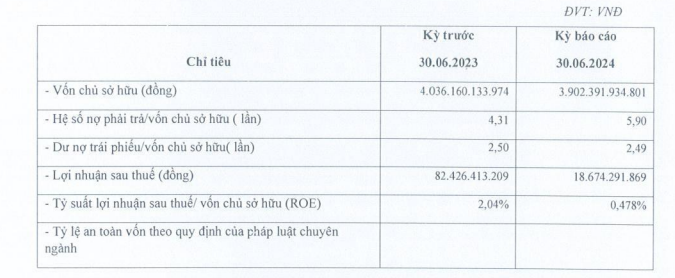

Vietnam Han Trade, Advertising, Construction, and Real Estate Joint Stock Company has released its periodic financial report for the first six months of 2024. For this period, Vietnam Han reported a post-tax profit of nearly VND 19 billion, a 77% decrease compared to the same period last year. The return on equity (ROE) ratio also witnessed a decline, falling from 2% to 0%.

As of June 30, the company’s equity stood at VND 3,902 billion. The debt-to-equity ratio for this period was 5.9, translating to a debt of VND 23,022 billion, a 30% increase compared to the end of 2023. Of this debt, bond debt accounted for VND 9,716 billion, remaining relatively unchanged from December 31, 2023.

Image: CafeF

In its semi-annual bond repayment report, Vietnam Han disclosed that as of June 30, the company was servicing debt for 129 bond lots, with a total issuance value of VND 10,300 billion and a par value of VND 9,736 billion.

Established in 2006, Vietnam Han Trade, Advertising, Construction, and Real Estate Joint Stock Company is known for its role as the investor of Goldmark City, a VND 10,000 billion project spanning 12 hectares at 136 Ho Tung Mau, Bac Tu Liem, Hanoi.

Additionally, the company has been involved in developing several large-scale projects, including the Tam Nong Eco-Urban, Tourism, Resort, and Sports Complex (Dream City) in Phu Tho province, spanning 2,050 hectares with a total investment of USD 1.5 billion. Other notable projects include Skypark Beach Long Dien in Dong Nai (94.8 hectares) and three Vietnam Han Residential Areas in Long Hai, Ba Ria Vung Tau.

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.