Ms. Lan Anh, a Hanoi-based office worker, recently had a terrifying experience. One afternoon, she received a call from someone claiming to be a staff member of the social insurance agency, asking her to update her information on the social insurance app – VssID.

Believing that the caller was a government official, she downloaded an app as instructed and proceeded to update her information. She trusted the professionalism and persuasive manner of the person on the phone and followed their instructions without suspicion.

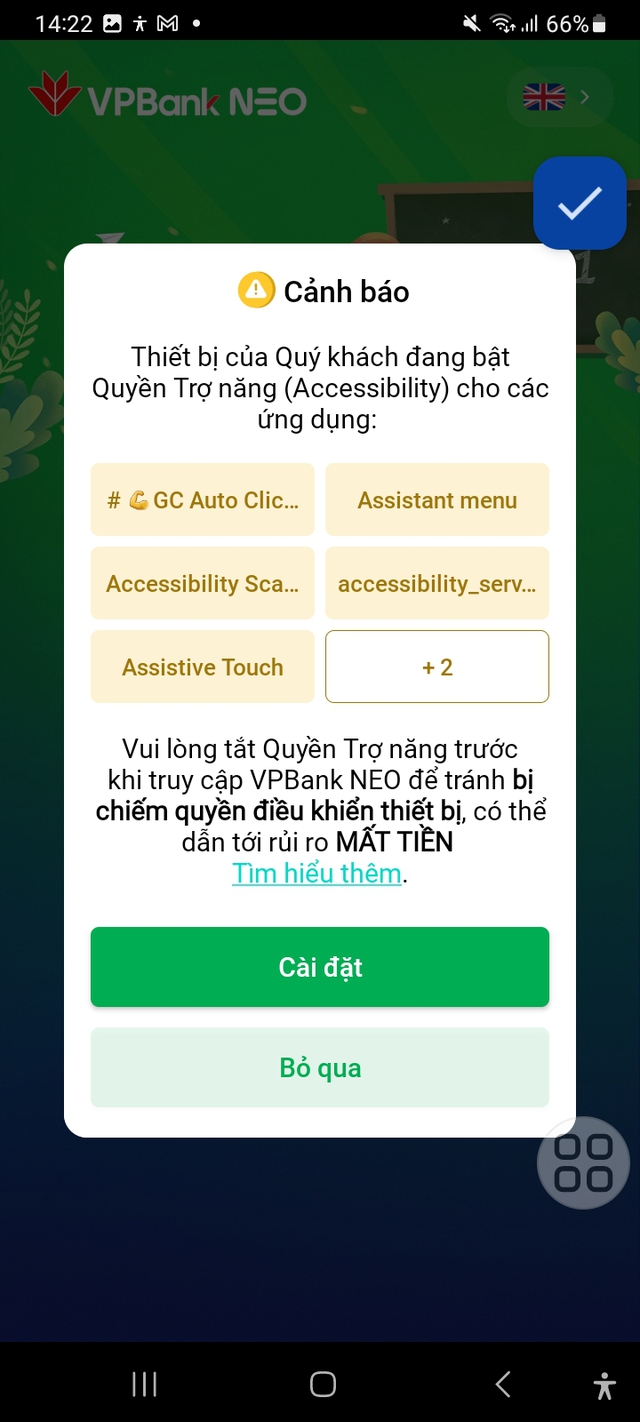

Soon after installing the app, her phone started to act strangely; it became sluggish, and some apps opened automatically. Her access to certain important apps was also restricted. Simultaneously, she received a warning from her banking app, VPBank NEO, that her phone had been granted accessibility permissions, allowing potential hackers to take control of her device. These permissions are a feature on Android devices meant to make the phone more convenient to use, but they can be exploited by malicious actors to record user activities and gain control of the device, enabling them to access banking apps and transfer money.

Frightened, Ms. Lan Anh immediately locked her account through the VPBank NEO app and contacted the bank’s customer support for further assistance. Fortunately, although the scammers had gained control of her phone, the bank’s security measures detected the breach and prevented any unauthorized access to her account until she revoked the accessibility permissions.

The Hotspot of Online Scams

In 2023, the Vietnam Information Security Portal recorded nearly 16,000 reports of online scams, with a total loss of approximately 8,000-10,000 billion VND. Of these scams, 73% were conducted through messages and calls on social media and mobile phones.

According to the Global Technology Council, Vietnam is among the top 10 hotspots for cybercrime globally, and the scams are becoming increasingly sophisticated and complex.

In addition to scams such as deepfake video calls, impersonation of tax authorities, police, prosecutors, and courts, SIM card locking scams, and fake receipts for counterfeit goods sold on e-commerce platforms, there has been a recent surge in scams involving the installation of fake apps to gain accessibility permissions on phones.

The Police Department of Cyber Security and High-Tech Crime Prevention in Ho Chi Minh City (PA05) has also noted an increase in victims being tricked into installing malware-infected apps, resulting in the loss of funds from their accounts.

This malicious software can automatically collect login information, account balances, and perform banking transactions without the user’s knowledge.

This method can lead to significant financial losses for customers. One of the most notable recent cases involved a customer who lost 26.5 billion VND from their account after installing a suspicious app.

Banks Strengthen Security Measures

The rising trend of scams presents a significant challenge for banks in protecting their customers from potential threats.

According to VPBank’s representative, modern banking apps prioritize not only user-friendliness but also robust security and privacy measures.

VPBank NEO, the bank’s digital banking platform, is one of the few banking apps that meet international security standards and offers a range of advanced security features.

VPBank focuses on security solutions to protect its customers’ accounts.

VPBank NEO can detect apps that have been granted accessibility permissions and may pose a security risk to mobile devices. It alerts users if they are operating in an unsafe or untrusted environment or if there are potential vulnerabilities and exploits. The app then provides instructions on how to revoke accessibility permissions on Android phones. VPBank NEO can only be used on a device that has disabled all accessibility permissions.

Additionally, in compliance with Decision 2345 of the State Bank of Vietnam, VPBank has implemented biometric authentication for certain transactions through VPBank NEO since July 1, 2024. Customers are required to authenticate their identity biometrically when making transfers larger than 10 million VND per transaction or when the daily transaction value exceeds 20 million VND.

International transfers, batch transfers, and initial logins on new devices will also require facial recognition. This added layer of security ensures that only the account holder can perform these transactions, safeguarding the account even if the mobile device is lost or stolen.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Mobile World achieves revenue of VND118,000 trillion: TVs, tablets, and phones all decrease by 10% – 50%, while one product grows in both quantity and revenue.

Mobile World Investment Corporation (MWG) has recently announced its 2023 business results. According to the report, the company’s consolidated revenue reached over 118 trillion Vietnamese dong, equivalent to 89% of the revenue in 2022.