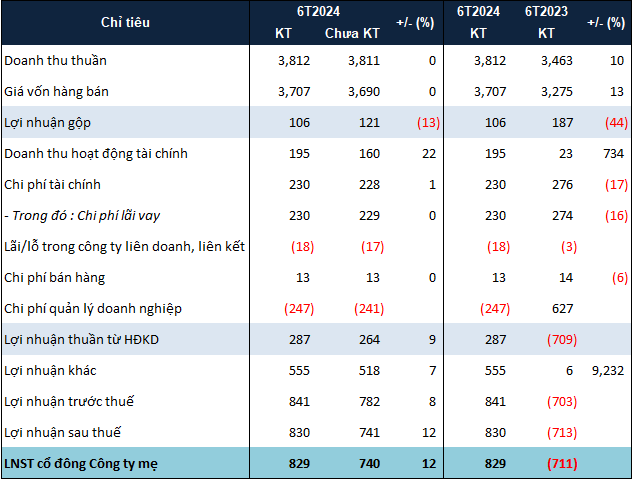

The most significant change in HBC’s audited business results compared to the previously self-prepared financial statements is a 22% increase in financial revenue to VND 195 billion.

Most of the aforementioned difference comes from the profit on installment and late payment sales. Specifically, HBC recognized only VND 29 million in this item in their self-prepared report, but in the audited report, this item reached nearly VND 41 billion.

|

HBC’s 2024 Semi-Annual Audit Adjustments. Unit: Billion VND

Source: VietstockFinance

|

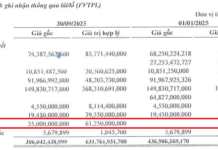

In addition to the business results, HBC’s balance sheet also underwent notable changes, especially in the inventory item. Specifically, the company’s Q2/2023 financial statements recognized inventory as of June 30, 2024, at nearly VND 1,583 billion, but the audited financial statements showed a value of nearly VND 2,347 billion for this item, equivalent to an increase of over 48%.

This increase in inventory is attributed to a 85% surge in work-in-progress expenses compared to pre-audit figures, reaching nearly VND 1,618 billion. Of this, work-in-progress expenses for real estate business activities contributed nearly VND 1,257 billion, including: Pax Residence in Nha Be district, Ho Chi Minh City, at over VND 113 billion; Ascent Lakeside Tower, a commercial and service apartment building on Nguyen Van Linh Street, District 7, at over VND 408 billion; Ascent Plaza, a high-rise apartment building with commercial and service space at 375-377 No Trang Long, Binh Thanh District, at nearly VND 662 billion; and the rest from other projects.

Along with the increase in inventory, the company’s long-term work-in-progress assets decreased significantly by almost 94%, to just over VND 47 billion, due to the exclusion of nearly VND 742 billion in long-term work-in-progress expenses from real estate projects.

Overall, HBC’s total assets increased slightly by 1% after the audit, to nearly VND 15,790 billion. Meanwhile, its liabilities remained almost unchanged at nearly VND 14,128 billion.

Ha Le