In a newly published analysis report, MBS suggests that the possibility of MWG shares of Mobile World Investment Corporation being reinstated to the VNDiamond index in the upcoming October 2024 review is relatively high due to the company’s improved financial performance in the first half of 2024.

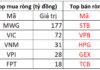

According to MBS, MWG’s current P/E ratio of 46.x meets the criteria, and the company’s FOL ratio, currently at 95.6%, is likely to satisfy the requirement of maintaining an FOL above 95% in the upcoming review.

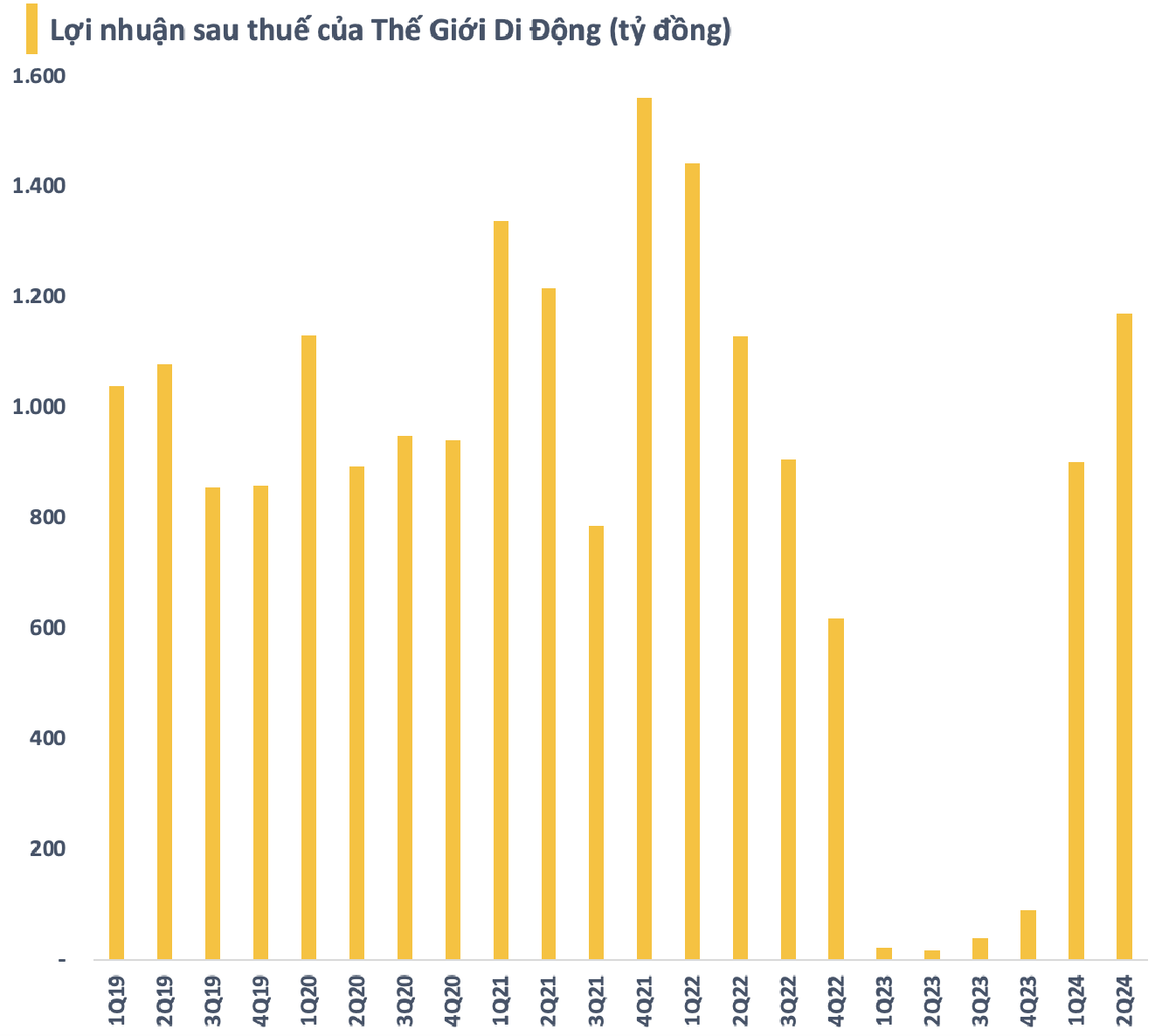

Vietnam’s stock market currently has five ETFs that track the VNDiamond index, including DCVFM VNDIAMOND ETF (FUEVFVND, with a scale of VND 12,000 billion), MAFM VNDIAMOND ETF (FUEMAVND, VND 500 billion), ETF BVFVN DIAMOND (FUEBFVND, VND 54 billion), and ETF KIM GROWTH VN DIAMOND (FUEKIVND, VND 61 billion).

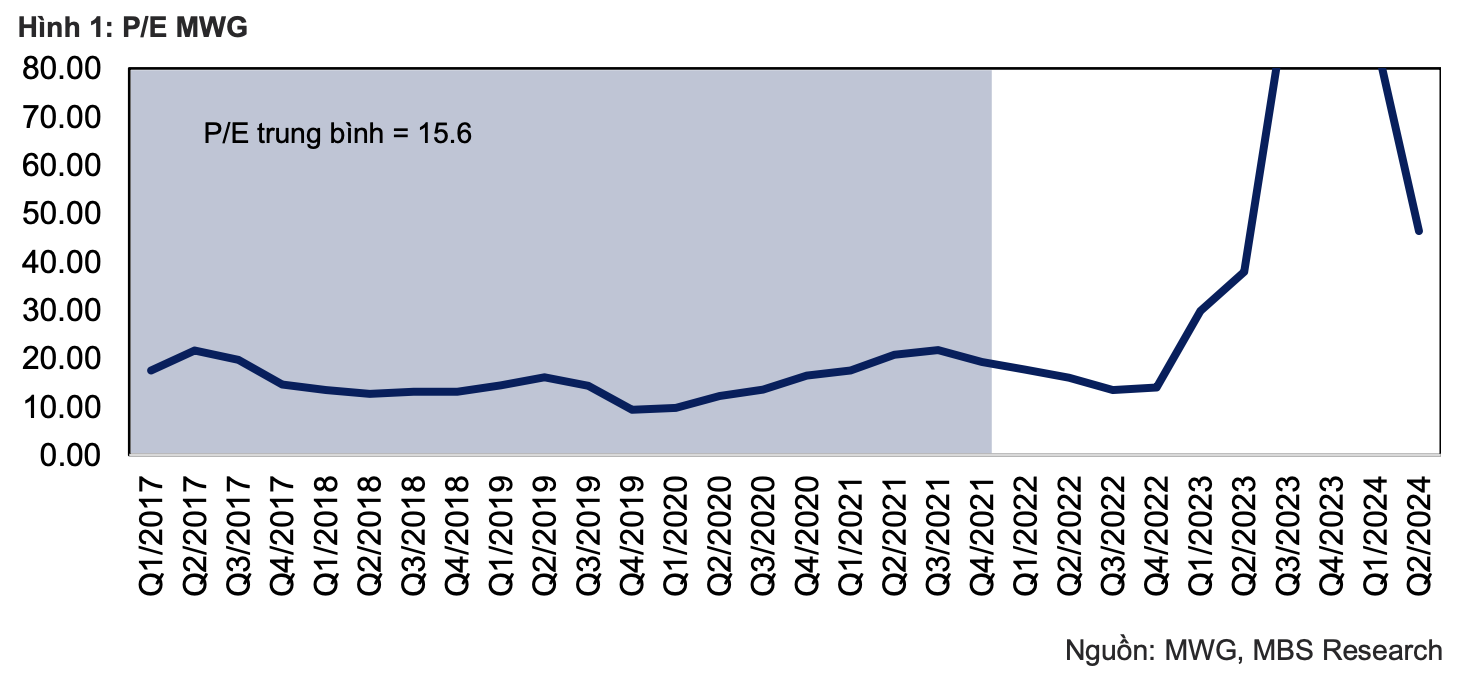

Previously, MWG shares were removed from the index during the April 2024 review, mainly due to not meeting the P/E criteria, as a result of a challenging 2023 that saw the company’s net profit drop by 96% to a record low.

However, MWG has since staged a strong recovery in the first half of 2024, with two consecutive quarters of remarkable growth compared to the same period in 2023. The company’s net profit for the first six months of 2024 stood at VND 2,075 billion, a more than 5,200% increase year-on-year, thus achieving nearly 87% of its full-year plan. This growth was driven by the recovery of the ICT&CE and Bach Hoa Xanh (BHX) segments.

Looking ahead, MBS believes that MWG’s growth prospects for 2024-25 will be driven by BHX, as the segment turns profitable and is ready for rapid store expansion. With a gross profit margin of 25-26%, MBS forecasts BHX to reach 1,787/1,986 stores and net profit of VND 156/317 billion in 2024-25.

Additionally, the TGDĐ&ĐMX store chain is expected to witness a strong recovery in 2024, mainly due to improved selling prices. In 2025, MBS anticipates that MWG will halt store closures and focus on its sales strategy as the demand for ICT-CE recovers. Consequently, MBS expects MWG’s net profit to reach VND 4,571/5,238 billion in 2024-25.