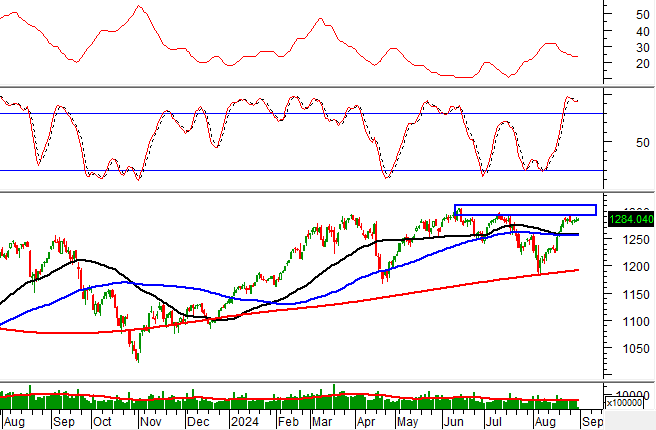

Technical Signals for the VN-Index

In the morning trading session of August 30, 2024, the VN-Index witnessed an increase in points, while volume declined, indicating investors’ cautious sentiment.

Currently, the VN-Index is advancing towards retesting the June 2024 high (equivalent to the 1,290-1,310 point region) as the ADX indicator moves within the gray area (20 < ADX < 25).

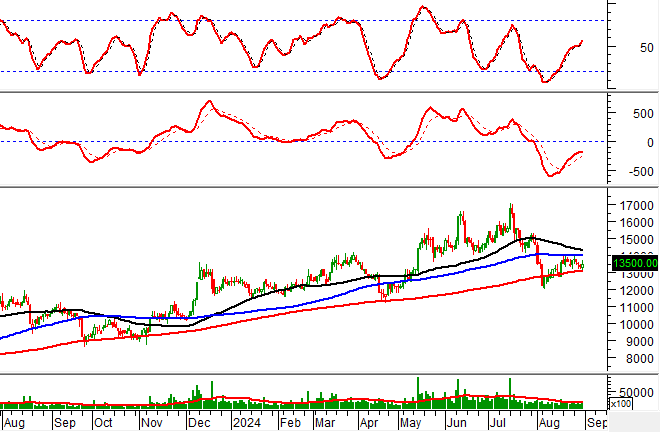

Technical Signals for the HNX-Index

On August 30, 2024, the HNX-Index witnessed a slight decline in points, accompanied by a significant increase in trading volume during the morning session, reflecting investors’ uncertainty.

Additionally, the HNX-Index is testing the group of the 50-day and 100-day SMA while the Stochastic Oscillator indicator has generated a sell signal in the overbought region. If the indicator falls below this support level, the risk of a downward adjustment in the upcoming sessions will increase.

DGC – Duc Giang Chemical Group JSC

During the morning session of August 30, 2024, DGC’s share price increased, and trading volume surpassed the 20-session average, indicating investors’ optimism.

Moreover, the share price rebounded after crossing above the Middle line of the Bollinger Bands, while the MACD indicator continues to rise and previously generated a buy signal, further reinforcing the stock’s current upward trend.

TIG – Thang Long Investment Group JSC

On the morning of August 30, 2024, TIG’s share price increased, and liquidity surpassed the 20-session average, reflecting investors’ optimism.

Additionally, the share price is finding support from the 200-day SMA, and the Stochastic Oscillator indicator continues to rise after previously generating a buy signal, indicating the long-term optimistic outlook remains intact.

Technical Analysis Department, Vietstock Consulting